Victory Capital Management Inc. raised its holdings in Comstock Resources, Inc. (NYSE:CRK - Free Report) by 645.5% in the 1st quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 120,928 shares of the oil and gas producer's stock after purchasing an additional 104,706 shares during the quarter. Victory Capital Management Inc.'s holdings in Comstock Resources were worth $2,460,000 as of its most recent SEC filing.

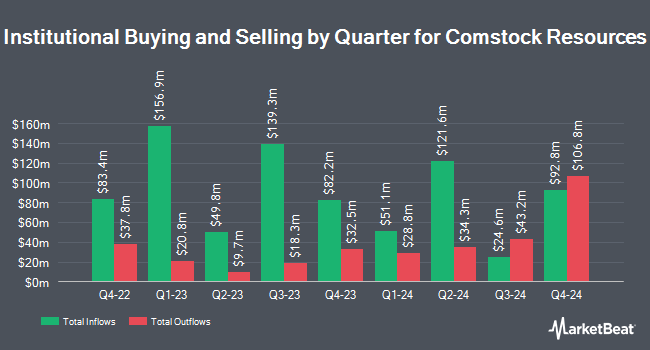

Several other institutional investors have also recently bought and sold shares of the business. Bleakley Financial Group LLC raised its position in shares of Comstock Resources by 6.1% during the first quarter. Bleakley Financial Group LLC now owns 33,893 shares of the oil and gas producer's stock worth $689,000 after acquiring an additional 1,938 shares during the last quarter. Emerald Advisers LLC bought a new stake in shares of Comstock Resources during the first quarter worth $158,000. New York State Common Retirement Fund bought a new stake in shares of Comstock Resources during the first quarter worth $1,815,000. Emerald Mutual Fund Advisers Trust bought a new stake in shares of Comstock Resources during the first quarter worth $52,000. Finally, Nisa Investment Advisors LLC raised its position in shares of Comstock Resources by 129.3% during the first quarter. Nisa Investment Advisors LLC now owns 2,075 shares of the oil and gas producer's stock worth $42,000 after acquiring an additional 1,170 shares during the last quarter. Institutional investors own 36.13% of the company's stock.

Comstock Resources Price Performance

Shares of NYSE CRK traded down $1.07 during mid-day trading on Friday, hitting $16.80. 1,660,265 shares of the stock traded hands, compared to its average volume of 2,426,993. The firm has a 50 day simple moving average of $24.39 and a two-hundred day simple moving average of $21.32. Comstock Resources, Inc. has a twelve month low of $7.74 and a twelve month high of $31.17. The company has a market cap of $4.92 billion, a PE ratio of -70.10 and a beta of 0.37. The company has a debt-to-equity ratio of 1.34, a current ratio of 0.40 and a quick ratio of 0.40.

Comstock Resources (NYSE:CRK - Get Free Report) last posted its quarterly earnings results on Wednesday, July 30th. The oil and gas producer reported $0.13 earnings per share for the quarter, topping analysts' consensus estimates of $0.09 by $0.04. The business had revenue of $470.26 million for the quarter, compared to the consensus estimate of $431.82 million. Comstock Resources had a positive return on equity of 3.69% and a negative net margin of 5.05%. The firm's revenue for the quarter was up 90.5% on a year-over-year basis. During the same period in the prior year, the business earned ($0.20) EPS. As a group, equities research analysts forecast that Comstock Resources, Inc. will post 0.54 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

A number of brokerages recently commented on CRK. Bank of America lifted their price objective on Comstock Resources from $25.00 to $27.00 and gave the stock a "buy" rating in a research note on Friday, May 23rd. Piper Sandler reaffirmed an "underweight" rating and set a $12.00 price objective (up from $6.00) on shares of Comstock Resources in a research report on Tuesday, May 13th. UBS Group reduced their price target on Comstock Resources from $20.00 to $18.00 and set a "sell" rating for the company in a research report on Thursday. Mizuho upped their price objective on Comstock Resources from $22.00 to $24.00 and gave the company a "neutral" rating in a research note on Tuesday, May 13th. Finally, Wolfe Research upgraded Comstock Resources from a "peer perform" rating to an "outperform" rating and set a $34.00 target price on the stock in a research note on Tuesday, June 17th. Five investment analysts have rated the stock with a sell rating, four have issued a hold rating and two have issued a buy rating to the stock. According to MarketBeat, Comstock Resources currently has a consensus rating of "Hold" and a consensus target price of $19.64.

View Our Latest Stock Analysis on CRK

Comstock Resources Company Profile

(

Free Report)

Comstock Resources, Inc, an independent energy company, engages in the acquisition, exploration, development, and production of natural gas and oil properties in the United States. Its assets are located in the Haynesville and Bossier shales located in North Louisiana and East Texas. The company was incorporated in 1919 and is headquartered in Frisco, Texas.

Featured Articles

Before you consider Comstock Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Comstock Resources wasn't on the list.

While Comstock Resources currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.