Victory Capital Management Inc. grew its holdings in shares of Albertsons Companies, Inc. (NYSE:ACI - Free Report) by 45.3% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 78,886 shares of the company's stock after buying an additional 24,590 shares during the quarter. Victory Capital Management Inc.'s holdings in Albertsons Companies were worth $1,735,000 as of its most recent SEC filing.

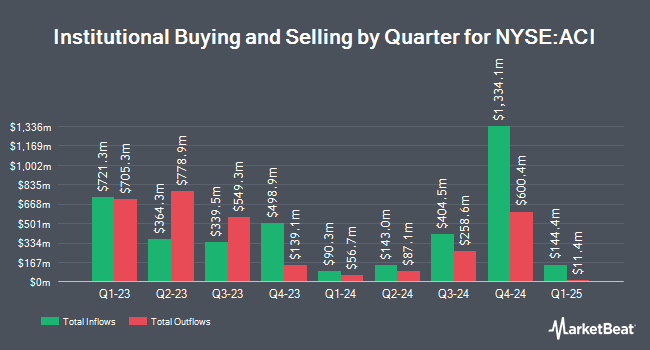

Several other institutional investors and hedge funds also recently made changes to their positions in ACI. WealthCollab LLC grew its position in shares of Albertsons Companies by 446.0% in the 4th quarter. WealthCollab LLC now owns 1,780 shares of the company's stock worth $35,000 after acquiring an additional 1,454 shares in the last quarter. Bessemer Group Inc. acquired a new position in Albertsons Companies during the 1st quarter valued at approximately $40,000. GAMMA Investing LLC boosted its position in Albertsons Companies by 340.1% during the 1st quarter. GAMMA Investing LLC now owns 1,919 shares of the company's stock valued at $42,000 after purchasing an additional 1,483 shares during the period. Fifth Third Bancorp boosted its position in Albertsons Companies by 54.8% during the 1st quarter. Fifth Third Bancorp now owns 2,997 shares of the company's stock valued at $66,000 after purchasing an additional 1,061 shares during the period. Finally, Blue Trust Inc. boosted its position in Albertsons Companies by 100.0% during the 1st quarter. Blue Trust Inc. now owns 3,370 shares of the company's stock valued at $74,000 after purchasing an additional 1,685 shares during the period. 71.35% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity

In other news, EVP Omer Gajial sold 47,303 shares of the company's stock in a transaction dated Wednesday, May 14th. The stock was sold at an average price of $21.46, for a total transaction of $1,015,122.38. Following the completion of the sale, the executive vice president owned 162,569 shares in the company, valued at approximately $3,488,730.74. This represents a 22.54% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Company insiders own 1.35% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research firms recently issued reports on ACI. Royal Bank Of Canada restated an "outperform" rating and set a $23.00 price objective on shares of Albertsons Companies in a research report on Wednesday, April 16th. Roth Capital reaffirmed a "buy" rating and set a $24.00 target price (up previously from $23.00) on shares of Albertsons Companies in a research note on Wednesday, July 16th. Tigress Financial reaffirmed a "buy" rating and set a $28.00 target price on shares of Albertsons Companies in a research note on Tuesday, July 8th. Evercore ISI cut their target price on Albertsons Companies from $23.00 to $22.00 and set an "in-line" rating on the stock in a research note on Thursday, April 17th. Finally, BMO Capital Markets raised Albertsons Companies from a "market perform" rating to an "outperform" rating and lifted their target price for the company from $19.00 to $25.00 in a research note on Wednesday, May 7th. One analyst has rated the stock with a sell rating, four have assigned a hold rating and twelve have given a buy rating to the company. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $24.06.

Get Our Latest Report on Albertsons Companies

Albertsons Companies Stock Up 2.1%

NYSE ACI traded up $0.40 on Friday, reaching $19.62. The stock had a trading volume of 5,468,130 shares, compared to its average volume of 7,114,485. The business has a 50 day moving average price of $21.27 and a 200 day moving average price of $21.22. The company has a current ratio of 0.82, a quick ratio of 0.18 and a debt-to-equity ratio of 2.17. Albertsons Companies, Inc. has a 1 year low of $17.00 and a 1 year high of $23.20. The company has a market capitalization of $10.98 billion, a price-to-earnings ratio of 11.96, a P/E/G ratio of 1.97 and a beta of 0.46.

Albertsons Companies (NYSE:ACI - Get Free Report) last posted its earnings results on Tuesday, July 15th. The company reported $0.55 EPS for the quarter, topping the consensus estimate of $0.54 by $0.01. The firm had revenue of $24.88 billion for the quarter, compared to the consensus estimate of $24.68 billion. Albertsons Companies had a net margin of 1.18% and a return on equity of 37.92%. The business's quarterly revenue was up 2.5% on a year-over-year basis. During the same period in the prior year, the business posted $0.66 earnings per share. On average, analysts forecast that Albertsons Companies, Inc. will post 2.14 EPS for the current fiscal year.

Albertsons Companies Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, August 8th. Stockholders of record on Friday, July 25th will be paid a dividend of $0.15 per share. This represents a $0.60 annualized dividend and a dividend yield of 3.1%. The ex-dividend date is Friday, July 25th. Albertsons Companies's dividend payout ratio is 36.59%.

Albertsons Companies Company Profile

(

Free Report)

Albertsons Companies, Inc, through its subsidiaries, engages in the operation of food and drug stores in the United States. The company's food and drug retail stores offer grocery products, general merchandise, health and beauty care products, pharmacy, fuel, and other items and services. It also manufactures and processes food products for sale in stores.

Further Reading

Before you consider Albertsons Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Albertsons Companies wasn't on the list.

While Albertsons Companies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.