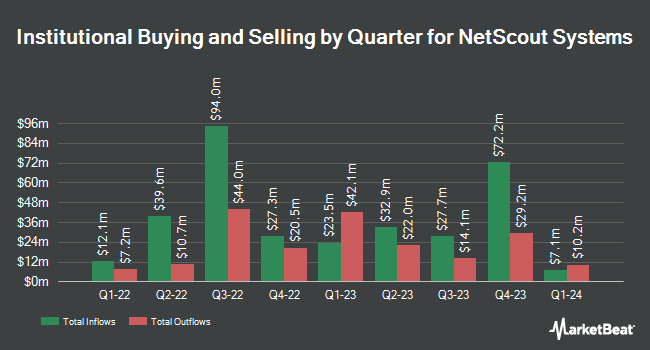

Victory Capital Management Inc. boosted its position in shares of NetScout Systems, Inc. (NASDAQ:NTCT - Free Report) by 141.8% during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 194,631 shares of the technology company's stock after buying an additional 114,124 shares during the period. Victory Capital Management Inc. owned 0.27% of NetScout Systems worth $4,089,000 as of its most recent SEC filing.

Other institutional investors also recently added to or reduced their stakes in the company. American Century Companies Inc. increased its holdings in shares of NetScout Systems by 126.8% in the fourth quarter. American Century Companies Inc. now owns 35,563 shares of the technology company's stock valued at $770,000 after purchasing an additional 19,884 shares during the period. Sei Investments Co. increased its holdings in shares of NetScout Systems by 49.5% in the fourth quarter. Sei Investments Co. now owns 216,865 shares of the technology company's stock valued at $4,697,000 after purchasing an additional 71,815 shares during the period. KLP Kapitalforvaltning AS acquired a new position in shares of NetScout Systems in the fourth quarter valued at approximately $297,000. Vanguard Group Inc. increased its holdings in shares of NetScout Systems by 0.7% in the fourth quarter. Vanguard Group Inc. now owns 9,353,501 shares of the technology company's stock valued at $202,597,000 after purchasing an additional 64,475 shares during the period. Finally, Prudential Financial Inc. increased its holdings in shares of NetScout Systems by 102.9% in the fourth quarter. Prudential Financial Inc. now owns 392,566 shares of the technology company's stock valued at $8,503,000 after purchasing an additional 199,079 shares during the period. Institutional investors and hedge funds own 91.64% of the company's stock.

NetScout Systems Price Performance

Shares of NASDAQ:NTCT traded down $0.04 during trading on Thursday, reaching $21.45. The company had a trading volume of 91,227 shares, compared to its average volume of 498,526. The firm has a market capitalization of $1.55 billion, a price-to-earnings ratio of -4.16 and a beta of 0.65. The stock's fifty day moving average price is $23.39 and its 200 day moving average price is $22.46. NetScout Systems, Inc. has a fifty-two week low of $17.96 and a fifty-two week high of $27.89.

NetScout Systems (NASDAQ:NTCT - Get Free Report) last announced its quarterly earnings data on Thursday, May 8th. The technology company reported $0.52 earnings per share for the quarter, hitting analysts' consensus estimates of $0.52. NetScout Systems had a positive return on equity of 7.37% and a negative net margin of 44.60%. The firm had revenue of $204.99 million for the quarter, compared to analyst estimates of $194.80 million. During the same quarter in the prior year, the company posted $0.55 earnings per share. NetScout Systems's quarterly revenue was up .8% on a year-over-year basis. On average, equities analysts anticipate that NetScout Systems, Inc. will post 1.5 EPS for the current fiscal year.

Insider Buying and Selling

In other NetScout Systems news, COO Michael Szabados sold 7,500 shares of the business's stock in a transaction on Tuesday, May 13th. The stock was sold at an average price of $22.77, for a total transaction of $170,775.00. Following the sale, the chief operating officer directly owned 28,489 shares in the company, valued at approximately $648,694.53. The trade was a 20.84% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, EVP John Downing sold 3,000 shares of the business's stock in a transaction on Thursday, May 29th. The stock was sold at an average price of $23.47, for a total value of $70,410.00. Following the sale, the executive vice president owned 127,352 shares in the company, valued at approximately $2,988,951.44. The trade was a 2.30% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 14,000 shares of company stock valued at $324,660 over the last quarter. Company insiders own 3.71% of the company's stock.

NetScout Systems Company Profile

(

Free Report)

NetScout Systems, Inc provides service assurance and cybersecurity solutions for protect digital business services against disruptions in the United States, Europe, Asia, and internationally. The company offers nGeniusONE management software that enables customers to predict, preempt, and resolve network and service delivery problems, as well as facilitate the optimization and capacity planning of their network infrastructures; and specialized platforms and analytic modules that enable its customers to analyze and troubleshoot traffic in radio access and Wi-Fi networks.

See Also

Before you consider NetScout Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NetScout Systems wasn't on the list.

While NetScout Systems currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.