Victory Capital Management Inc. increased its position in shares of UiPath, Inc. (NYSE:PATH - Free Report) by 236.7% during the first quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 171,400 shares of the company's stock after acquiring an additional 120,490 shares during the quarter. Victory Capital Management Inc.'s holdings in UiPath were worth $1,765,000 as of its most recent filing with the SEC.

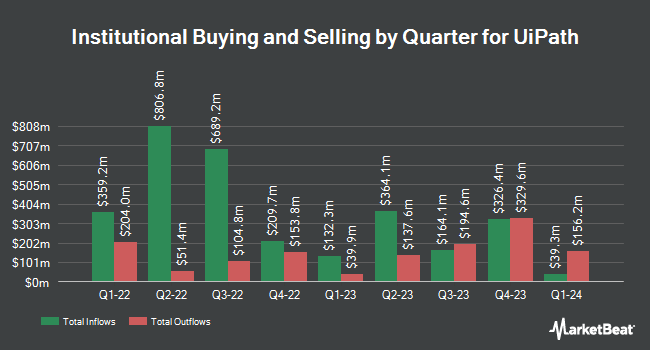

Other hedge funds have also recently bought and sold shares of the company. Clear Creek Financial Management LLC acquired a new position in UiPath during the first quarter valued at approximately $266,000. Invesco Ltd. increased its stake in UiPath by 10.5% during the 4th quarter. Invesco Ltd. now owns 382,800 shares of the company's stock worth $4,865,000 after buying an additional 36,332 shares during the period. Pallas Capital Advisors LLC increased its stake in UiPath by 32.2% during the 1st quarter. Pallas Capital Advisors LLC now owns 84,776 shares of the company's stock worth $873,000 after buying an additional 20,667 shares during the period. Deutsche Bank AG raised its position in shares of UiPath by 280.3% in the 4th quarter. Deutsche Bank AG now owns 1,505,585 shares of the company's stock valued at $19,136,000 after purchasing an additional 1,109,669 shares in the last quarter. Finally, Norges Bank acquired a new position in shares of UiPath in the 4th quarter valued at approximately $71,191,000. Institutional investors and hedge funds own 62.50% of the company's stock.

Insider Buying and Selling at UiPath

In other UiPath news, CEO Daniel Dines sold 45,000 shares of the business's stock in a transaction on Wednesday, July 16th. The shares were sold at an average price of $12.43, for a total transaction of $559,350.00. Following the completion of the transaction, the chief executive officer owned 5,058,376 shares of the company's stock, valued at $62,875,613.68. The trade was a 0.88% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CFO Ashim Gupta sold 56,322 shares of the firm's stock in a transaction on Wednesday, July 2nd. The stock was sold at an average price of $12.72, for a total transaction of $716,415.84. Following the completion of the sale, the chief financial officer owned 859,991 shares in the company, valued at $10,939,085.52. This represents a 6.15% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 831,310 shares of company stock worth $10,428,922 over the last three months. Company insiders own 23.19% of the company's stock.

Analyst Upgrades and Downgrades

A number of brokerages have issued reports on PATH. Truist Financial upped their target price on UiPath from $12.00 to $13.00 and gave the company a "hold" rating in a research report on Friday, May 30th. Evercore ISI lifted their target price on UiPath from $11.00 to $15.00 and gave the stock an "in-line" rating in a research report on Friday, May 30th. Morgan Stanley increased their price target on UiPath from $12.00 to $15.00 and gave the stock an "equal weight" rating in a research report on Monday, June 2nd. Wells Fargo & Company reiterated an "equal weight" rating on shares of UiPath in a research report on Friday, May 30th. Finally, Canaccord Genuity Group set a $16.00 price objective on UiPath and gave the stock a "buy" rating in a research report on Monday, June 2nd. Two equities research analysts have rated the stock with a sell rating, twelve have assigned a hold rating and three have given a buy rating to the company. According to data from MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus price target of $13.83.

Read Our Latest Research Report on PATH

UiPath Stock Down 5.4%

Shares of UiPath stock traded down $0.64 during midday trading on Friday, hitting $11.11. The company's stock had a trading volume of 19,228,927 shares, compared to its average volume of 12,787,786. The firm has a market capitalization of $5.94 billion, a P/E ratio of -92.58, a PEG ratio of 14.55 and a beta of 1.03. The stock has a 50-day simple moving average of $12.63 and a 200-day simple moving average of $12.37. UiPath, Inc. has a 1-year low of $9.38 and a 1-year high of $15.93.

UiPath (NYSE:PATH - Get Free Report) last posted its earnings results on Thursday, May 29th. The company reported $0.11 EPS for the quarter, topping the consensus estimate of $0.10 by $0.01. The firm had revenue of $356.62 million for the quarter, compared to the consensus estimate of $332.17 million. UiPath had a negative net margin of 4.65% and a negative return on equity of 3.05%. The business's quarterly revenue was up 6.4% on a year-over-year basis. During the same period in the prior year, the business posted $0.13 earnings per share. As a group, sell-side analysts predict that UiPath, Inc. will post -0.17 earnings per share for the current year.

About UiPath

(

Free Report)

UiPath Inc provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally. The company offers a suite of interrelated software to build, manage, run, engage, measure, and govern automation within the organization.

Featured Stories

Before you consider UiPath, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UiPath wasn't on the list.

While UiPath currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.