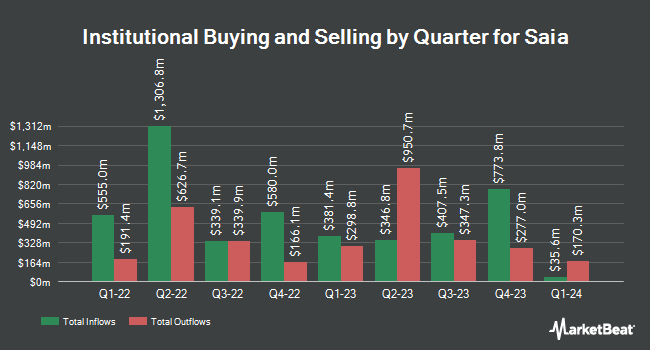

Victory Capital Management Inc. reduced its holdings in shares of Saia, Inc. (NASDAQ:SAIA - Free Report) by 97.3% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 4,923 shares of the transportation company's stock after selling 177,675 shares during the quarter. Victory Capital Management Inc.'s holdings in Saia were worth $1,720,000 at the end of the most recent quarter.

A number of other institutional investors also recently modified their holdings of SAIA. Mitsubishi UFJ Asset Management Co. Ltd. lifted its stake in Saia by 172.7% in the 4th quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 60 shares of the transportation company's stock worth $28,000 after purchasing an additional 38 shares in the last quarter. Golden State Wealth Management LLC increased its holdings in shares of Saia by 127.0% in the 1st quarter. Golden State Wealth Management LLC now owns 84 shares of the transportation company's stock worth $29,000 after buying an additional 47 shares during the last quarter. Huntington National Bank increased its holdings in shares of Saia by 291.7% in the 4th quarter. Huntington National Bank now owns 94 shares of the transportation company's stock worth $43,000 after buying an additional 70 shares during the last quarter. NBC Securities Inc. bought a new position in shares of Saia in the 1st quarter worth $43,000. Finally, Brown Brothers Harriman & Co. bought a new position in shares of Saia in the 4th quarter worth $64,000.

Saia Trading Down 3.0%

Shares of SAIA traded down $9.15 during trading hours on Friday, reaching $293.09. 599,252 shares of the company traded hands, compared to its average volume of 709,307. The company's fifty day moving average price is $281.54 and its two-hundred day moving average price is $343.57. The company has a market capitalization of $7.81 billion, a price-to-earnings ratio of 27.06, a price-to-earnings-growth ratio of 13.94 and a beta of 1.99. The company has a quick ratio of 1.43, a current ratio of 1.49 and a debt-to-equity ratio of 0.13. Saia, Inc. has a 12 month low of $229.12 and a 12 month high of $624.55.

Saia (NASDAQ:SAIA - Get Free Report) last announced its earnings results on Friday, July 25th. The transportation company reported $2.67 earnings per share for the quarter, beating analysts' consensus estimates of $2.39 by $0.28. The firm had revenue of $817.12 million for the quarter, compared to analyst estimates of $826.59 million. Saia had a net margin of 8.96% and a return on equity of 12.42%. The company's revenue for the quarter was down .7% compared to the same quarter last year. During the same quarter in the previous year, the firm posted $3.83 EPS. Equities research analysts predict that Saia, Inc. will post 15.46 earnings per share for the current fiscal year.

Analyst Ratings Changes

A number of equities analysts have recently commented on SAIA shares. BMO Capital Markets lowered shares of Saia from an "outperform" rating to a "market perform" rating and decreased their price target for the stock from $455.00 to $285.00 in a report on Friday, April 25th. Benchmark increased their price target on shares of Saia from $325.00 to $360.00 and gave the stock a "buy" rating in a report on Monday, July 28th. Deutsche Bank Aktiengesellschaft lowered shares of Saia from a "buy" rating to a "hold" rating and set a $273.00 price target on the stock. in a report on Thursday, May 1st. Wall Street Zen upgraded shares of Saia to a "sell" rating in a research report on Tuesday, May 13th. Finally, Raymond James Financial set a $310.00 price objective on Saia and gave the stock an "outperform" rating in a report on Monday, April 28th. One investment analyst has rated the stock with a sell rating, ten have issued a hold rating, nine have assigned a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, Saia currently has an average rating of "Hold" and an average target price of $347.16.

View Our Latest Analysis on SAIA

Saia Profile

(

Free Report)

Saia, Inc, together with its subsidiaries, operates as a transportation company in North America. The company provides less-than-truckload services for shipments between 100 and 10,000 pounds; and other value-added services, including non-asset truckload, expedited, and logistics services. It also offers other value-added services, including non-asset truckload, expedited, and logistics services.

Featured Stories

Before you consider Saia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Saia wasn't on the list.

While Saia currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.