Victory Capital Management Inc. decreased its holdings in shares of Impinj, Inc. (NASDAQ:PI - Free Report) by 14.4% during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 17,831 shares of the company's stock after selling 2,994 shares during the period. Victory Capital Management Inc. owned approximately 0.06% of Impinj worth $1,617,000 as of its most recent SEC filing.

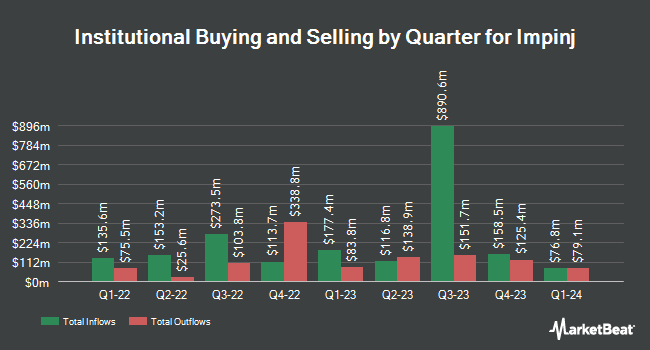

Several other institutional investors have also recently bought and sold shares of the business. Canada Pension Plan Investment Board purchased a new position in shares of Impinj during the 4th quarter valued at $29,000. SBI Securities Co. Ltd. grew its position in Impinj by 75.3% during the first quarter. SBI Securities Co. Ltd. now owns 398 shares of the company's stock worth $36,000 after buying an additional 171 shares in the last quarter. GAMMA Investing LLC raised its holdings in shares of Impinj by 68.7% during the 1st quarter. GAMMA Investing LLC now owns 722 shares of the company's stock valued at $65,000 after buying an additional 294 shares in the last quarter. KBC Group NV raised its holdings in shares of Impinj by 35.0% during the 1st quarter. KBC Group NV now owns 1,227 shares of the company's stock valued at $111,000 after buying an additional 318 shares in the last quarter. Finally, Point72 Asia Singapore Pte. Ltd. purchased a new stake in Impinj during the fourth quarter valued at about $156,000.

Wall Street Analyst Weigh In

A number of equities analysts have issued reports on the stock. Evercore ISI boosted their price objective on shares of Impinj from $99.00 to $117.00 and gave the company an "outperform" rating in a research report on Thursday, April 24th. Needham & Company LLC raised their target price on shares of Impinj from $115.00 to $165.00 and gave the stock a "buy" rating in a research report on Thursday. Susquehanna raised their target price on shares of Impinj from $130.00 to $140.00 and gave the stock a "positive" rating in a research report on Tuesday, July 22nd. Piper Sandler raised their target price on shares of Impinj from $140.00 to $180.00 and gave the stock an "overweight" rating in a research report on Thursday. Finally, Cantor Fitzgerald upped their target price on shares of Impinj from $133.00 to $158.00 and gave the stock an "overweight" rating in a research report on Thursday. One analyst has rated the stock with a sell rating, one has given a hold rating and six have given a buy rating to the company's stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $163.29.

Check Out Our Latest Analysis on PI

Impinj Stock Down 1.1%

Shares of PI traded down $1.66 during trading hours on Friday, hitting $152.92. The company had a trading volume of 1,027,589 shares, compared to its average volume of 564,778. The company has a debt-to-equity ratio of 1.51, a quick ratio of 7.46 and a current ratio of 11.64. Impinj, Inc. has a 52-week low of $60.85 and a 52-week high of $239.88. The stock has a market capitalization of $4.45 billion, a price-to-earnings ratio of 15,307.31 and a beta of 1.74. The firm has a fifty day moving average price of $115.52 and a 200-day moving average price of $104.91.

Impinj (NASDAQ:PI - Get Free Report) last posted its quarterly earnings data on Wednesday, July 30th. The company reported $0.80 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.72 by $0.08. The company had revenue of $97.89 million for the quarter, compared to the consensus estimate of $93.78 million. Impinj had a net margin of 0.18% and a return on equity of 8.14%. The firm's revenue was down 4.5% compared to the same quarter last year. During the same quarter last year, the firm posted $0.83 earnings per share. On average, equities research analysts forecast that Impinj, Inc. will post -0.47 EPS for the current fiscal year.

Impinj Profile

(

Free Report)

Impinj, Inc operates a cloud connectivity platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. Its platform wirelessly connects items and delivers data about the connected items to business and consumer applications. The company's platform comprises endpoint ICs, a miniature radios-on-a-chip that attaches to a host item and includes a number to identify the item.

Featured Stories

Before you consider Impinj, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Impinj wasn't on the list.

While Impinj currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.