Victory Capital Management Inc. reduced its position in Ocular Therapeutix, Inc. (NASDAQ:OCUL - Free Report) by 76.6% during the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 16,150 shares of the biopharmaceutical company's stock after selling 52,721 shares during the period. Victory Capital Management Inc.'s holdings in Ocular Therapeutix were worth $118,000 at the end of the most recent quarter.

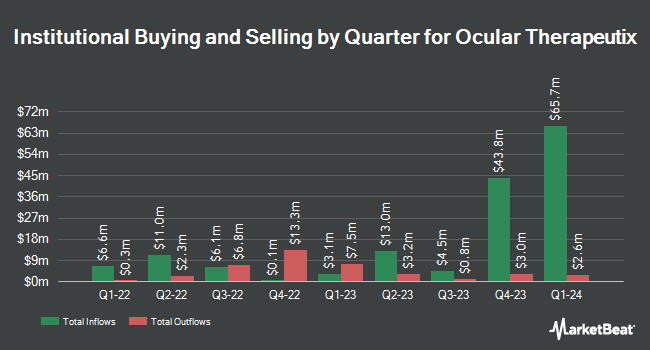

Other hedge funds have also made changes to their positions in the company. Sei Investments Co. lifted its position in shares of Ocular Therapeutix by 19.3% in the 4th quarter. Sei Investments Co. now owns 27,742 shares of the biopharmaceutical company's stock worth $237,000 after acquiring an additional 4,496 shares during the period. KLP Kapitalforvaltning AS bought a new stake in shares of Ocular Therapeutix during the fourth quarter worth $149,000. Vanguard Group Inc. grew its stake in Ocular Therapeutix by 1.2% in the fourth quarter. Vanguard Group Inc. now owns 8,483,913 shares of the biopharmaceutical company's stock valued at $72,453,000 after acquiring an additional 99,730 shares during the period. JPMorgan Chase & Co. lifted its holdings in shares of Ocular Therapeutix by 123.6% in the fourth quarter. JPMorgan Chase & Co. now owns 189,295 shares of the biopharmaceutical company's stock valued at $1,617,000 after purchasing an additional 104,650 shares in the last quarter. Finally, Wellington Management Group LLP raised its holdings in Ocular Therapeutix by 1.0% during the fourth quarter. Wellington Management Group LLP now owns 467,352 shares of the biopharmaceutical company's stock worth $3,991,000 after acquiring an additional 4,488 shares in the last quarter. Institutional investors and hedge funds own 59.21% of the company's stock.

Ocular Therapeutix Trading Down 3.5%

Shares of Ocular Therapeutix stock traded down $0.44 during trading on Thursday, reaching $12.06. 1,490,090 shares of the stock were exchanged, compared to its average volume of 1,778,889. The company has a quick ratio of 10.14, a current ratio of 10.22 and a debt-to-equity ratio of 0.26. Ocular Therapeutix, Inc. has a 1 year low of $5.78 and a 1 year high of $12.65. The stock's fifty day moving average is $10.00 and its 200 day moving average is $8.32. The firm has a market cap of $1.92 billion, a price-to-earnings ratio of -9.45 and a beta of 1.49.

Ocular Therapeutix (NASDAQ:OCUL - Get Free Report) last announced its quarterly earnings data on Tuesday, August 5th. The biopharmaceutical company reported ($0.39) earnings per share for the quarter, missing analysts' consensus estimates of ($0.35) by ($0.04). The firm had revenue of $13.46 million during the quarter, compared to analysts' expectations of $13.12 million. Ocular Therapeutix had a negative return on equity of 71.62% and a negative net margin of 382.51%. Ocular Therapeutix's revenue was down 17.7% on a year-over-year basis. During the same quarter in the previous year, the firm earned ($0.26) earnings per share. As a group, equities research analysts expect that Ocular Therapeutix, Inc. will post -0.98 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

Several analysts have issued reports on OCUL shares. HC Wainwright restated a "buy" rating and issued a $15.00 price objective on shares of Ocular Therapeutix in a research note on Thursday, May 29th. Scotiabank reduced their price target on Ocular Therapeutix from $22.00 to $20.00 and set a "sector outperform" rating on the stock in a research report on Wednesday. Finally, Needham & Company LLC increased their price target on Ocular Therapeutix from $14.00 to $15.00 and gave the stock a "buy" rating in a research report on Tuesday. Six investment analysts have rated the stock with a buy rating, According to data from MarketBeat.com, Ocular Therapeutix currently has a consensus rating of "Buy" and a consensus target price of $17.17.

Read Our Latest Stock Report on OCUL

Insiders Place Their Bets

In related news, insider Pravin Dugel sold 21,219 shares of the business's stock in a transaction that occurred on Friday, May 23rd. The shares were sold at an average price of $7.18, for a total value of $152,352.42. Following the completion of the transaction, the insider owned 3,499,099 shares of the company's stock, valued at $25,123,530.82. The trade was a 0.60% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Insiders sold 29,079 shares of company stock worth $208,739 over the last quarter. Insiders own 2.30% of the company's stock.

Ocular Therapeutix Company Profile

(

Free Report)

Ocular Therapeutix, Inc, a biopharmaceutical company, focuses on the formulation, development, and commercialization of therapies for diseases and conditions of the eye using its bioresorbable hydrogel-based formulation technology in the United States. The company markets DEXTENZA, a dexamethasone ophthalmic insert to treat post-surgical ocular inflammation and pain following ophthalmic surgery, as well as allergic conjunctivitis.

Recommended Stories

Before you consider Ocular Therapeutix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ocular Therapeutix wasn't on the list.

While Ocular Therapeutix currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.