Victrix Investment Advisors acquired a new stake in shares of The Charles Schwab Co. (NYSE:SCHW - Free Report) in the 4th quarter, according to its most recent 13F filing with the SEC. The fund acquired 43,889 shares of the financial services provider's stock, valued at approximately $3,248,000. Charles Schwab accounts for 2.3% of Victrix Investment Advisors' portfolio, making the stock its 16th largest holding.

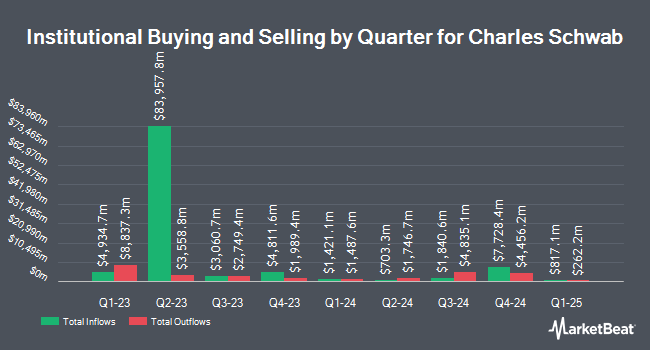

Several other institutional investors and hedge funds have also bought and sold shares of the business. Vident Advisory LLC lifted its stake in Charles Schwab by 46.5% during the 4th quarter. Vident Advisory LLC now owns 47,194 shares of the financial services provider's stock valued at $3,493,000 after acquiring an additional 14,987 shares during the period. Sovereign s Capital Management LLC acquired a new stake in Charles Schwab during the 4th quarter valued at approximately $629,000. Vivaldi Capital Management LP acquired a new stake in Charles Schwab during the 4th quarter valued at approximately $14,846,000. Wimmer Associates 1 LLC acquired a new position in shares of Charles Schwab in the 4th quarter valued at $221,000. Finally, Twinbeech Capital LP acquired a new position in shares of Charles Schwab in the 4th quarter valued at $218,000. 84.38% of the stock is currently owned by institutional investors and hedge funds.

Charles Schwab Price Performance

NYSE:SCHW traded down $1.61 during trading hours on Wednesday, reaching $87.57. 8,579,684 shares of the company were exchanged, compared to its average volume of 9,446,028. The company has a current ratio of 0.47, a quick ratio of 0.47 and a debt-to-equity ratio of 0.59. The stock's 50-day moving average is $79.58 and its 200-day moving average is $78.73. The firm has a market cap of $159.10 billion, a PE ratio of 29.29, a price-to-earnings-growth ratio of 0.99 and a beta of 0.90. The Charles Schwab Co. has a twelve month low of $61.01 and a twelve month high of $89.85.

Charles Schwab (NYSE:SCHW - Get Free Report) last released its earnings results on Thursday, April 17th. The financial services provider reported $1.04 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.01 by $0.03. Charles Schwab had a net margin of 30.31% and a return on equity of 18.20%. The business had revenue of $5.60 billion during the quarter, compared to analyst estimates of $5.46 billion. During the same quarter in the prior year, the firm earned $0.74 earnings per share. On average, sell-side analysts anticipate that The Charles Schwab Co. will post 4.22 earnings per share for the current fiscal year.

Charles Schwab Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, May 23rd. Stockholders of record on Friday, May 9th will be issued a dividend of $0.27 per share. This represents a $1.08 dividend on an annualized basis and a dividend yield of 1.23%. The ex-dividend date of this dividend is Friday, May 9th. Charles Schwab's payout ratio is 32.73%.

Insider Transactions at Charles Schwab

In related news, insider Jonathan M. Craig sold 9,559 shares of the company's stock in a transaction dated Thursday, May 1st. The shares were sold at an average price of $82.00, for a total value of $783,838.00. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, insider Paul V. Woolway sold 9,887 shares of the company's stock in a transaction dated Wednesday, March 5th. The shares were sold at an average price of $75.38, for a total transaction of $745,282.06. Following the completion of the sale, the insider now directly owns 47,931 shares of the company's stock, valued at $3,613,038.78. This represents a 17.10% decrease in their position. The disclosure for this sale can be found here. Insiders sold 38,412 shares of company stock valued at $3,014,797 over the last 90 days. 6.30% of the stock is currently owned by corporate insiders.

Analysts Set New Price Targets

SCHW has been the subject of several analyst reports. JMP Securities reiterated a "market outperform" rating and issued a $94.00 target price on shares of Charles Schwab in a research note on Monday, April 21st. Piper Sandler boosted their target price on shares of Charles Schwab from $74.00 to $80.00 in a research note on Thursday, April 17th. UBS Group boosted their target price on shares of Charles Schwab from $95.00 to $96.00 and gave the company a "buy" rating in a research note on Tuesday, April 22nd. TD Securities boosted their target price on shares of Charles Schwab from $95.00 to $113.00 and gave the company a "buy" rating in a research note on Tuesday. Finally, Morgan Stanley boosted their target price on shares of Charles Schwab from $76.00 to $83.00 and gave the company an "overweight" rating in a research note on Tuesday, May 13th. Two research analysts have rated the stock with a sell rating, three have assigned a hold rating and fourteen have issued a buy rating to the stock. According to data from MarketBeat, Charles Schwab currently has an average rating of "Moderate Buy" and a consensus price target of $89.63.

Check Out Our Latest Analysis on Charles Schwab

Charles Schwab Company Profile

(

Free Report)

The Charles Schwab Corporation, together with its subsidiaries, operates as a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services in the United States and internationally. The company operates in two segments, Investor Services and Advisor Services.

See Also

Before you consider Charles Schwab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Charles Schwab wasn't on the list.

While Charles Schwab currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.