Vident Advisory LLC grew its holdings in BHP Group Limited Sponsored ADR (NYSE:BHP - Free Report) by 58.0% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 44,946 shares of the mining company's stock after purchasing an additional 16,491 shares during the quarter. Vident Advisory LLC's holdings in BHP Group were worth $2,182,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

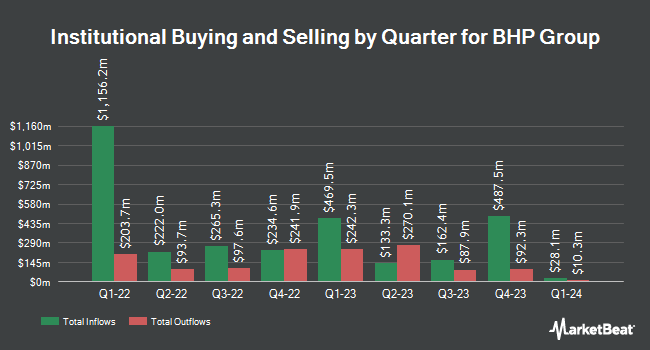

A number of other hedge funds and other institutional investors also recently made changes to their positions in the business. Driehaus Capital Management LLC lifted its stake in shares of BHP Group by 53.1% in the 1st quarter. Driehaus Capital Management LLC now owns 23,840 shares of the mining company's stock valued at $1,157,000 after purchasing an additional 8,268 shares during the period. Synovus Financial Corp lifted its stake in shares of BHP Group by 198.7% in the 1st quarter. Synovus Financial Corp now owns 23,905 shares of the mining company's stock valued at $1,160,000 after purchasing an additional 15,903 shares during the period. ICONIQ Capital LLC lifted its stake in shares of BHP Group by 132.5% in the 1st quarter. ICONIQ Capital LLC now owns 18,211 shares of the mining company's stock valued at $884,000 after purchasing an additional 10,377 shares during the period. Smartleaf Asset Management LLC lifted its stake in shares of BHP Group by 78.7% in the 1st quarter. Smartleaf Asset Management LLC now owns 9,841 shares of the mining company's stock valued at $481,000 after purchasing an additional 4,333 shares during the period. Finally, Kestra Advisory Services LLC raised its stake in BHP Group by 5.8% during the 1st quarter. Kestra Advisory Services LLC now owns 62,324 shares of the mining company's stock worth $3,025,000 after buying an additional 3,425 shares during the period. 3.79% of the stock is owned by institutional investors and hedge funds.

BHP Group Stock Down 2.0%

Shares of BHP Group stock traded down $1.13 on Friday, hitting $54.42. The company had a trading volume of 3,269,889 shares, compared to its average volume of 2,551,148. The stock has a market capitalization of $138.00 billion, a price-to-earnings ratio of 12.37 and a beta of 0.81. BHP Group Limited Sponsored ADR has a 1 year low of $39.73 and a 1 year high of $63.21. The stock has a 50 day moving average of $52.84 and a 200-day moving average of $49.99. The company has a debt-to-equity ratio of 0.43, a quick ratio of 1.11 and a current ratio of 1.46.

BHP Group Increases Dividend

The firm also recently declared a semi-annual dividend, which will be paid on Thursday, September 25th. Investors of record on Friday, September 5th will be given a dividend of $1.185 per share. The ex-dividend date of this dividend is Friday, September 5th. This is a positive change from BHP Group's previous semi-annual dividend of $1.00. This represents a dividend yield of 441.0%. BHP Group's dividend payout ratio (DPR) is 53.86%.

Wall Street Analysts Forecast Growth

A number of research firms recently weighed in on BHP. Argus downgraded BHP Group from a "buy" rating to a "hold" rating in a research note on Friday, June 13th. Berenberg Bank reaffirmed a "sell" rating and set a $44.00 price target on shares of BHP Group in a research note on Thursday, July 24th. Sanford C. Bernstein downgraded BHP Group from an "outperform" rating to a "market perform" rating in a research note on Monday, May 19th. Citigroup reissued a "neutral" rating on shares of BHP Group in a report on Wednesday, August 20th. Finally, Macquarie downgraded BHP Group from an "outperform" rating to a "neutral" rating in a research note on Friday, July 18th. One analyst has rated the stock with a Strong Buy rating, six have assigned a Hold rating and one has given a Sell rating to the company's stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Hold" and an average price target of $48.50.

Read Our Latest Report on BHP

BHP Group Profile

(

Free Report)

BHP Group Limited operates as a resources company in Australia, Europe, China, Japan, India, South Korea, the rest of Asia, North America, South America, and internationally. The company operates through Copper, Iron Ore, and Coal segments. It engages in the mining of copper, uranium, gold, zinc, lead, molybdenum, silver, iron ore, cobalt, and metallurgical and energy coal.

See Also

Before you consider BHP Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BHP Group wasn't on the list.

While BHP Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.