Villanova Investment Management Co LLC decreased its position in ACI Worldwide, Inc. (NASDAQ:ACIW - Free Report) by 74.5% during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 5,497 shares of the technology company's stock after selling 16,035 shares during the period. Villanova Investment Management Co LLC's holdings in ACI Worldwide were worth $301,000 at the end of the most recent quarter.

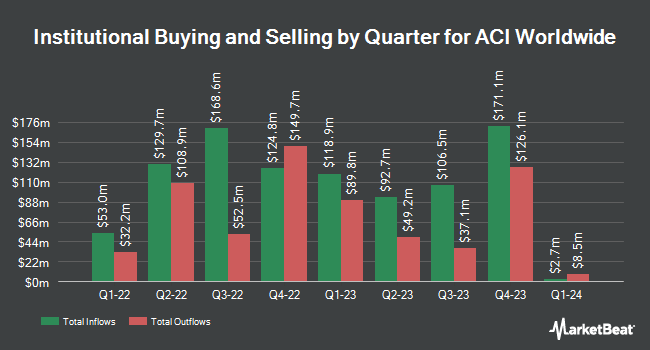

Several other hedge funds and other institutional investors have also made changes to their positions in ACIW. Bank of America Corp DE boosted its holdings in ACI Worldwide by 267.7% during the fourth quarter. Bank of America Corp DE now owns 563,335 shares of the technology company's stock worth $29,243,000 after buying an additional 410,142 shares in the last quarter. Cetera Investment Advisers acquired a new position in shares of ACI Worldwide in the fourth quarter valued at approximately $318,000. Deutsche Bank AG raised its position in shares of ACI Worldwide by 129.2% in the fourth quarter. Deutsche Bank AG now owns 148,305 shares of the technology company's stock valued at $7,699,000 after buying an additional 83,596 shares during the last quarter. Ensign Peak Advisors Inc increased its position in ACI Worldwide by 4.4% during the fourth quarter. Ensign Peak Advisors Inc now owns 39,989 shares of the technology company's stock worth $2,076,000 after purchasing an additional 1,695 shares during the last quarter. Finally, Gotham Asset Management LLC increased its position in ACI Worldwide by 209.8% during the fourth quarter. Gotham Asset Management LLC now owns 49,154 shares of the technology company's stock worth $2,552,000 after purchasing an additional 33,289 shares during the last quarter. Hedge funds and other institutional investors own 94.74% of the company's stock.

Insider Buying and Selling at ACI Worldwide

In other news, Director Janet O. Estep sold 4,500 shares of the firm's stock in a transaction dated Wednesday, June 18th. The shares were sold at an average price of $44.66, for a total transaction of $200,970.00. Following the completion of the transaction, the director owned 77,631 shares in the company, valued at approximately $3,467,000.46. This trade represents a 5.48% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this link. Company insiders own 1.10% of the company's stock.

ACI Worldwide Price Performance

ACI Worldwide stock traded down $0.52 during trading hours on Tuesday, hitting $49.07. 208,583 shares of the company traded hands, compared to its average volume of 762,940. The firm has a market cap of $5.06 billion, a P/E ratio of 20.68 and a beta of 1.07. The company has a quick ratio of 1.48, a current ratio of 1.48 and a debt-to-equity ratio of 0.62. The firm's 50-day simple moving average is $46.46 and its two-hundred day simple moving average is $48.72. ACI Worldwide, Inc. has a 1-year low of $40.45 and a 1-year high of $59.71.

ACI Worldwide (NASDAQ:ACIW - Get Free Report) last released its earnings results on Thursday, August 7th. The technology company reported $0.35 EPS for the quarter, beating the consensus estimate of $0.27 by $0.08. The firm had revenue of $401.26 million for the quarter, compared to analysts' expectations of $380.45 million. ACI Worldwide had a net margin of 14.76% and a return on equity of 19.09%. ACI Worldwide's quarterly revenue was up 7.4% on a year-over-year basis. During the same quarter last year, the company earned $0.47 EPS. ACI Worldwide has set its Q3 2025 guidance at EPS. As a group, analysts forecast that ACI Worldwide, Inc. will post 2 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several equities research analysts have issued reports on the stock. Jefferies Financial Group decreased their price objective on shares of ACI Worldwide from $68.00 to $60.00 and set a "buy" rating for the company in a research note on Tuesday, May 27th. Wall Street Zen downgraded shares of ACI Worldwide from a "strong-buy" rating to a "hold" rating in a research note on Saturday, August 9th. Stephens upgraded shares of ACI Worldwide from an "equal weight" rating to an "overweight" rating and set a $60.00 price objective for the company in a research note on Thursday, July 17th. Finally, Zacks Research downgraded shares of ACI Worldwide from a "strong-buy" rating to a "hold" rating in a research note on Thursday, August 21st. Three investment analysts have rated the stock with a Buy rating and one has given a Hold rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $60.00.

Check Out Our Latest Analysis on ACI Worldwide

About ACI Worldwide

(

Free Report)

ACI Worldwide, Inc, a software company, develops, markets, installs, and supports a range of software products and solutions for facilitating digital payments in the United States and internationally. The company operates in three segments: Banks, Merchants, and Billers. The company offers ACI Acquiring, a solution to process credit, debit, and prepaid card transactions, deliver digital innovation, and fraud prevention; ACI Issuing, a digital payment issuing solution for new payment offering; and ACI Enterprise Payments Platform that provides payment processing and orchestration capabilities for digital payments.

Read More

Before you consider ACI Worldwide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ACI Worldwide wasn't on the list.

While ACI Worldwide currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.