Villanova Investment Management Co LLC trimmed its position in Janus International Group, Inc. (NYSE:JBI - Free Report) by 65.6% in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 41,446 shares of the company's stock after selling 78,892 shares during the quarter. Villanova Investment Management Co LLC's holdings in Janus International Group were worth $298,000 at the end of the most recent quarter.

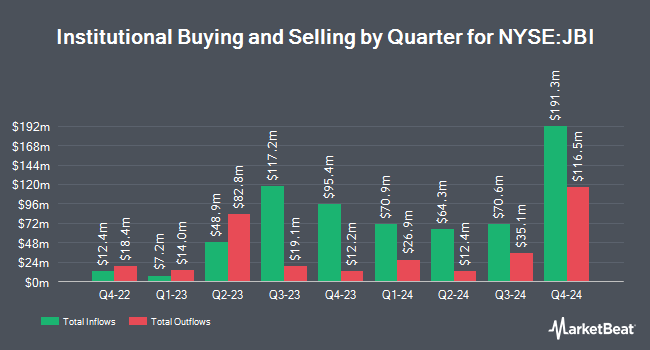

Several other hedge funds and other institutional investors also recently made changes to their positions in JBI. Tower Research Capital LLC TRC boosted its holdings in shares of Janus International Group by 42.9% in the fourth quarter. Tower Research Capital LLC TRC now owns 5,146 shares of the company's stock worth $38,000 after buying an additional 1,544 shares during the period. Price T Rowe Associates Inc. MD boosted its holdings in shares of Janus International Group by 20.5% in the fourth quarter. Price T Rowe Associates Inc. MD now owns 55,809 shares of the company's stock worth $411,000 after buying an additional 9,482 shares during the period. Northern Trust Corp boosted its holdings in shares of Janus International Group by 11.1% in the fourth quarter. Northern Trust Corp now owns 1,351,719 shares of the company's stock worth $9,935,000 after buying an additional 134,525 shares during the period. Comerica Bank boosted its holdings in shares of Janus International Group by 103.4% during the fourth quarter. Comerica Bank now owns 14,241 shares of the company's stock worth $105,000 after purchasing an additional 7,241 shares during the period. Finally, Jane Street Group LLC boosted its holdings in shares of Janus International Group by 17.9% during the fourth quarter. Jane Street Group LLC now owns 86,976 shares of the company's stock worth $639,000 after purchasing an additional 13,220 shares during the period. 88.78% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

JBI has been the subject of several research reports. Jefferies Financial Group raised their price target on shares of Janus International Group from $9.00 to $10.00 and gave the stock a "hold" rating in a report on Wednesday, August 20th. KeyCorp raised their price target on shares of Janus International Group from $10.00 to $12.00 and gave the stock an "overweight" rating in a report on Friday, August 8th. UBS Group raised their price target on shares of Janus International Group from $9.00 to $10.00 and gave the stock a "neutral" rating in a report on Friday, August 8th. Finally, Wall Street Zen upgraded shares of Janus International Group from a "hold" rating to a "buy" rating in a report on Saturday, August 9th. One analyst has rated the stock with a Buy rating and two have issued a Hold rating to the company's stock. According to MarketBeat.com, Janus International Group presently has a consensus rating of "Hold" and a consensus target price of $10.67.

Check Out Our Latest Stock Report on JBI

Janus International Group Stock Performance

Shares of NYSE:JBI traded up $0.08 during trading on Tuesday, reaching $10.25. The stock had a trading volume of 282,178 shares, compared to its average volume of 1,322,977. Janus International Group, Inc. has a 52 week low of $5.99 and a 52 week high of $10.73. The firm has a market capitalization of $1.42 billion, a price-to-earnings ratio of 33.02 and a beta of 1.31. The company has a quick ratio of 2.26, a current ratio of 2.61 and a debt-to-equity ratio of 1.00. The stock has a fifty day simple moving average of $9.61 and a two-hundred day simple moving average of $8.39.

Janus International Group (NYSE:JBI - Get Free Report) last released its quarterly earnings results on Thursday, August 7th. The company reported $0.20 EPS for the quarter, beating analysts' consensus estimates of $0.15 by $0.05. Janus International Group had a net margin of 4.85% and a return on equity of 13.10%. The company had revenue of $228.10 million for the quarter, compared to analyst estimates of $216.99 million. During the same quarter last year, the firm posted $0.21 earnings per share. The company's quarterly revenue was down 8.2% compared to the same quarter last year. Janus International Group has set its FY 2025 guidance at EPS. As a group, analysts anticipate that Janus International Group, Inc. will post 0.54 earnings per share for the current fiscal year.

Janus International Group Profile

(

Free Report)

Janus International Group, Inc manufacturers and supplies turn-key self-storage, and commercial and industrial building solutions in North America and internationally. The company offers roll up and swing doors, hallway systems, relocatable storage moveable additional storage structures units, and other solutions.

Read More

Before you consider Janus International Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Janus International Group wasn't on the list.

While Janus International Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.