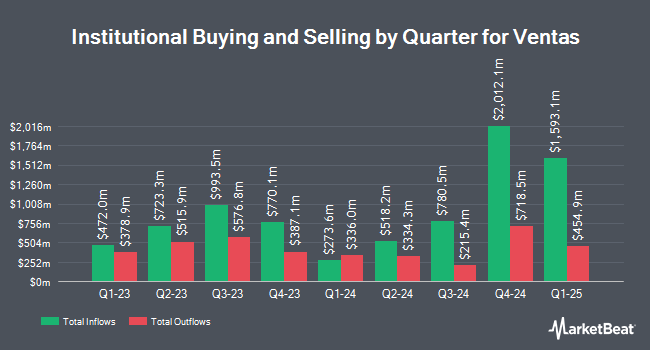

VIRGINIA RETIREMENT SYSTEMS ET Al acquired a new position in shares of Ventas, Inc. (NYSE:VTR - Free Report) in the second quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm acquired 219,970 shares of the real estate investment trust's stock, valued at approximately $13,891,000.

Several other institutional investors have also made changes to their positions in VTR. Spirit of America Management Corp NY raised its position in Ventas by 33.5% in the second quarter. Spirit of America Management Corp NY now owns 15,950 shares of the real estate investment trust's stock worth $1,007,000 after purchasing an additional 4,000 shares in the last quarter. Chevy Chase Trust Holdings LLC raised its holdings in shares of Ventas by 4.0% in the 2nd quarter. Chevy Chase Trust Holdings LLC now owns 238,389 shares of the real estate investment trust's stock worth $15,054,000 after buying an additional 9,114 shares in the last quarter. Easterly Investment Partners LLC bought a new position in shares of Ventas during the 2nd quarter worth approximately $18,991,000. Stratos Wealth Partners LTD. boosted its stake in Ventas by 24.4% in the 2nd quarter. Stratos Wealth Partners LTD. now owns 4,763 shares of the real estate investment trust's stock valued at $301,000 after buying an additional 935 shares in the last quarter. Finally, Nordea Investment Management AB boosted its stake in Ventas by 1,042.6% in the 2nd quarter. Nordea Investment Management AB now owns 386,881 shares of the real estate investment trust's stock valued at $24,064,000 after buying an additional 353,022 shares in the last quarter. 94.18% of the stock is currently owned by institutional investors and hedge funds.

Ventas Stock Performance

Shares of NYSE:VTR opened at $70.65 on Monday. The business has a fifty day moving average of $68.42 and a 200-day moving average of $66.37. The company has a debt-to-equity ratio of 1.13, a quick ratio of 0.68 and a current ratio of 0.68. Ventas, Inc. has a twelve month low of $56.68 and a twelve month high of $71.36. The firm has a market cap of $32.11 billion, a PE ratio of 164.30, a price-to-earnings-growth ratio of 2.60 and a beta of 0.89.

Ventas (NYSE:VTR - Get Free Report) last issued its quarterly earnings data on Wednesday, July 30th. The real estate investment trust reported $0.87 EPS for the quarter, topping analysts' consensus estimates of $0.85 by $0.02. The firm had revenue of $1.42 billion for the quarter, compared to analyst estimates of $1.37 billion. Ventas had a net margin of 3.61% and a return on equity of 1.75%. The company's revenue was up 18.3% on a year-over-year basis. During the same quarter in the prior year, the firm earned $0.80 EPS. Ventas has set its FY 2025 guidance at 3.410-3.46 EPS. On average, equities research analysts predict that Ventas, Inc. will post 3.4 EPS for the current fiscal year.

Ventas Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Thursday, October 16th. Investors of record on Tuesday, September 30th were given a $0.48 dividend. This represents a $1.92 annualized dividend and a yield of 2.7%. The ex-dividend date was Tuesday, September 30th. Ventas's payout ratio is 446.51%.

Analyst Ratings Changes

VTR has been the subject of several recent analyst reports. UBS Group started coverage on Ventas in a research note on Friday, September 19th. They set a "neutral" rating and a $73.00 price objective for the company. JPMorgan Chase & Co. increased their target price on shares of Ventas from $72.00 to $76.00 and gave the stock an "overweight" rating in a research report on Tuesday, August 26th. Cantor Fitzgerald started coverage on shares of Ventas in a report on Wednesday, October 1st. They set an "overweight" rating and a $77.00 price target for the company. Scotiabank boosted their price target on shares of Ventas from $72.00 to $74.00 and gave the company a "sector perform" rating in a research report on Thursday, August 28th. Finally, Evercore ISI upped their price objective on shares of Ventas from $77.00 to $80.00 and gave the stock an "outperform" rating in a research note on Monday, September 15th. One analyst has rated the stock with a Strong Buy rating, ten have given a Buy rating and four have assigned a Hold rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $75.23.

Read Our Latest Research Report on VTR

Insider Buying and Selling

In other news, CEO Peter J. Bulgarelli sold 2,554 shares of Ventas stock in a transaction on Wednesday, October 1st. The stock was sold at an average price of $70.26, for a total value of $179,444.04. Following the completion of the sale, the chief executive officer directly owned 116,488 shares of the company's stock, valued at approximately $8,184,446.88. This trade represents a 2.15% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CEO Debra A. Cafaro sold 10,322 shares of the business's stock in a transaction on Wednesday, October 1st. The stock was sold at an average price of $70.24, for a total value of $725,017.28. Following the sale, the chief executive officer owned 1,145,695 shares of the company's stock, valued at approximately $80,473,616.80. The trade was a 0.89% decrease in their position. The disclosure for this sale can be found here. Insiders sold 69,557 shares of company stock worth $4,771,687 in the last quarter. Insiders own 1.00% of the company's stock.

Ventas Profile

(

Free Report)

Ventas Inc NYSE: VTR is a leading S&P 500 real estate investment trust focused on delivering strong, sustainable shareholder returns by enabling exceptional environments that benefit a large and growing aging population. The Company's growth is fueled by its senior housing communities, which provide valuable services to residents and enable them to thrive in supported environments.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ventas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ventas wasn't on the list.

While Ventas currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.