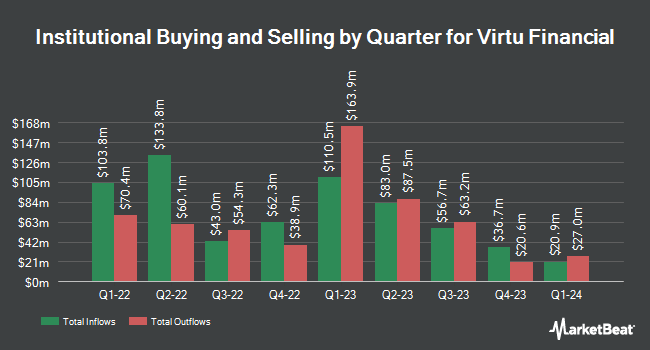

Amundi increased its stake in shares of Virtu Financial, Inc. (NASDAQ:VIRT - Free Report) by 117.6% during the 1st quarter, according to its most recent filing with the SEC. The institutional investor owned 191,879 shares of the financial services provider's stock after acquiring an additional 103,714 shares during the period. Amundi owned approximately 0.12% of Virtu Financial worth $7,176,000 at the end of the most recent reporting period.

Several other large investors also recently bought and sold shares of VIRT. Vanguard Group Inc. raised its stake in shares of Virtu Financial by 1.8% during the first quarter. Vanguard Group Inc. now owns 9,568,548 shares of the financial services provider's stock valued at $364,753,000 after purchasing an additional 165,396 shares during the period. Invesco Ltd. grew its holdings in Virtu Financial by 83.6% during the 1st quarter. Invesco Ltd. now owns 1,473,165 shares of the financial services provider's stock valued at $56,157,000 after purchasing an additional 670,774 shares in the last quarter. Allianz Asset Management GmbH increased its stake in Virtu Financial by 69.5% during the 1st quarter. Allianz Asset Management GmbH now owns 1,063,011 shares of the financial services provider's stock worth $40,522,000 after buying an additional 435,958 shares during the period. Allspring Global Investments Holdings LLC lifted its holdings in Virtu Financial by 11.5% in the 1st quarter. Allspring Global Investments Holdings LLC now owns 930,110 shares of the financial services provider's stock worth $35,856,000 after buying an additional 95,692 shares in the last quarter. Finally, Two Sigma Investments LP boosted its position in Virtu Financial by 9.6% in the 4th quarter. Two Sigma Investments LP now owns 834,400 shares of the financial services provider's stock valued at $29,771,000 after buying an additional 73,304 shares during the last quarter. Institutional investors and hedge funds own 45.78% of the company's stock.

Virtu Financial Stock Performance

Shares of VIRT stock traded down $0.82 on Tuesday, hitting $35.41. 1,308,198 shares of the stock traded hands, compared to its average volume of 969,395. The company's fifty day moving average is $41.97 and its 200 day moving average is $40.46. Virtu Financial, Inc. has a 1-year low of $29.82 and a 1-year high of $45.77. The company has a market capitalization of $5.41 billion, a PE ratio of 10.23, a PEG ratio of 1.14 and a beta of 0.69. The company has a debt-to-equity ratio of 1.11, a current ratio of 0.49 and a quick ratio of 0.49.

Virtu Financial Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Monday, September 15th. Stockholders of record on Monday, September 1st were given a $0.24 dividend. This represents a $0.96 dividend on an annualized basis and a dividend yield of 2.7%. The ex-dividend date was Friday, August 29th. Virtu Financial's dividend payout ratio (DPR) is presently 21.82%.

Insider Activity at Virtu Financial

In other news, COO Brett Fairclough sold 90,701 shares of Virtu Financial stock in a transaction dated Thursday, August 7th. The shares were sold at an average price of $42.40, for a total value of $3,845,722.40. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Company insiders own 47.20% of the company's stock.

Analyst Ratings Changes

VIRT has been the subject of several recent analyst reports. Wall Street Zen downgraded Virtu Financial from a "buy" rating to a "hold" rating in a research note on Saturday, May 24th. UBS Group restated a "neutral" rating and set a $45.00 price objective (up previously from $40.00) on shares of Virtu Financial in a research note on Monday, August 4th. Morgan Stanley upped their target price on Virtu Financial from $31.00 to $35.00 and gave the company an "underweight" rating in a research report on Tuesday, July 15th. Finally, Piper Sandler increased their target price on Virtu Financial from $44.00 to $48.00 and gave the company an "overweight" rating in a research note on Tuesday, July 15th. Two analysts have rated the stock with a Buy rating, five have issued a Hold rating and one has assigned a Sell rating to the company's stock. Based on data from MarketBeat, the stock presently has an average rating of "Hold" and an average target price of $39.75.

View Our Latest Report on VIRT

Virtu Financial Company Profile

(

Free Report)

Virtu Financial, Inc operates as a financial services company in the United States, Asia Pacific, Canada, EMEA, Ireland, and internationally. The company operates through two segments, Market Making and Execution Services. Its product includes offerings in execution, liquidity sourcing, analytics and broker-neutral, capital markets, and multi-dealer platforms in workflow technology.

Read More

Before you consider Virtu Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Virtu Financial wasn't on the list.

While Virtu Financial currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.