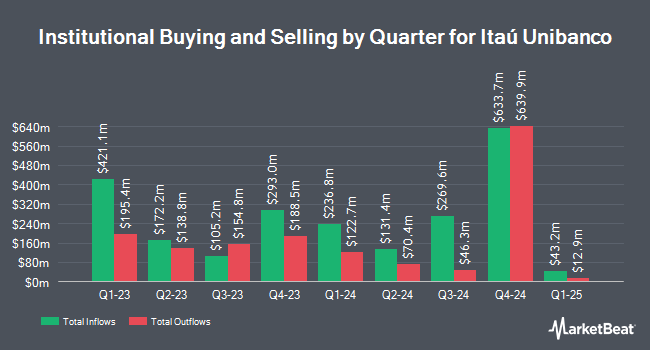

Virtu Financial LLC bought a new stake in Itau Unibanco Holding S.A. (NYSE:ITUB - Free Report) in the 1st quarter, according to its most recent 13F filing with the SEC. The firm bought 260,789 shares of the bank's stock, valued at approximately $1,434,000.

Several other large investors also recently made changes to their positions in the company. Invesco Ltd. lifted its position in Itau Unibanco by 58.8% in the 1st quarter. Invesco Ltd. now owns 585,013 shares of the bank's stock valued at $3,218,000 after acquiring an additional 216,519 shares in the last quarter. Connor Clark & Lunn Investment Management Ltd. lifted its position in Itau Unibanco by 11.5% in the 1st quarter. Connor Clark & Lunn Investment Management Ltd. now owns 866,035 shares of the bank's stock valued at $4,763,000 after acquiring an additional 89,569 shares in the last quarter. Altfest L J & Co. Inc. lifted its position in Itau Unibanco by 67.9% in the 1st quarter. Altfest L J & Co. Inc. now owns 18,534 shares of the bank's stock valued at $102,000 after acquiring an additional 7,494 shares in the last quarter. Vanguard Group Inc. lifted its position in Itau Unibanco by 6.7% in the 1st quarter. Vanguard Group Inc. now owns 24,592,740 shares of the bank's stock valued at $135,260,000 after acquiring an additional 1,549,003 shares in the last quarter. Finally, Natural Investments LLC lifted its position in Itau Unibanco by 9.1% in the 1st quarter. Natural Investments LLC now owns 97,936 shares of the bank's stock valued at $538,000 after acquiring an additional 8,192 shares in the last quarter.

Itau Unibanco Stock Down 0.4%

NYSE ITUB traded down $0.03 during trading hours on Friday, hitting $6.95. The company's stock had a trading volume of 16,280,651 shares, compared to its average volume of 28,605,262. Itau Unibanco Holding S.A. has a 52 week low of $4.42 and a 52 week high of $7.13. The company has a market capitalization of $74.87 billion, a PE ratio of 9.87, a price-to-earnings-growth ratio of 1.08 and a beta of 0.74. The company has a current ratio of 1.59, a quick ratio of 1.59 and a debt-to-equity ratio of 2.39. The company's 50-day simple moving average is $6.59 and its two-hundred day simple moving average is $6.04.

Itau Unibanco (NYSE:ITUB - Get Free Report) last posted its earnings results on Tuesday, August 5th. The bank reported $0.18 EPS for the quarter, hitting the consensus estimate of $0.18. Itau Unibanco had a net margin of 14.05% and a return on equity of 19.48%. The firm had revenue of $7.14 billion for the quarter, compared to analysts' expectations of $44.75 billion. Research analysts anticipate that Itau Unibanco Holding S.A. will post 0.8 EPS for the current fiscal year.

Itau Unibanco Cuts Dividend

The company also recently announced a dividend, which was paid on Friday, August 8th. Shareholders of record on Thursday, July 3rd were given a dividend of $0.0024 per share. The ex-dividend date of this dividend was Wednesday, July 2nd. This represents a dividend yield of 43.0%. Itau Unibanco's dividend payout ratio (DPR) is currently 4.23%.

Wall Street Analysts Forecast Growth

Separately, UBS Group reaffirmed a "neutral" rating on shares of Itau Unibanco in a research report on Thursday, July 10th.

Check Out Our Latest Analysis on Itau Unibanco

About Itau Unibanco

(

Free Report)

Itaú Unibanco Holding SA offers a range of financial products and services to individuals and corporate customers in Brazil and internationally. The company operates through three segments: Retail Banking, Wholesale Banking, and Activities with the Market + Corporation. It offers current account; loans; credit and debit cards; investment and commercial banking services; real estate lending services; financing and investment services; economic, financial and brokerage advisory; and leasing and foreign exchange services.

Featured Stories

Before you consider Itau Unibanco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Itau Unibanco wasn't on the list.

While Itau Unibanco currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.