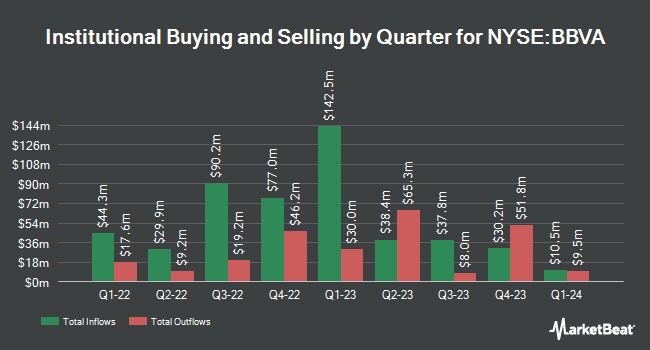

Virtu Financial LLC acquired a new stake in Banco Bilbao Viscaya Argentaria S.A. (NYSE:BBVA - Free Report) during the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 15,193 shares of the bank's stock, valued at approximately $207,000.

A number of other hedge funds have also modified their holdings of BBVA. Alpine Bank Wealth Management acquired a new position in shares of Banco Bilbao Viscaya Argentaria in the first quarter valued at about $29,000. Private Trust Co. NA increased its holdings in shares of Banco Bilbao Viscaya Argentaria by 224.7% in the first quarter. Private Trust Co. NA now owns 2,607 shares of the bank's stock valued at $36,000 after purchasing an additional 1,804 shares during the period. Cullen Frost Bankers Inc. acquired a new position in shares of Banco Bilbao Viscaya Argentaria in the first quarter valued at about $46,000. Bessemer Group Inc. increased its holdings in shares of Banco Bilbao Viscaya Argentaria by 25.3% in the first quarter. Bessemer Group Inc. now owns 3,901 shares of the bank's stock valued at $53,000 after purchasing an additional 787 shares during the period. Finally, Manchester Capital Management LLC increased its holdings in shares of Banco Bilbao Viscaya Argentaria by 19.2% in the first quarter. Manchester Capital Management LLC now owns 4,643 shares of the bank's stock valued at $63,000 after purchasing an additional 748 shares during the period. 2.96% of the stock is owned by institutional investors and hedge funds.

Banco Bilbao Viscaya Argentaria Stock Performance

Shares of BBVA stock opened at $19.23 on Friday. The company has a market capitalization of $112.26 billion, a P/E ratio of 10.12, a P/E/G ratio of 1.51 and a beta of 1.12. The business's 50 day moving average is $15.88 and its two-hundred day moving average is $14.45. The company has a current ratio of 1.01, a quick ratio of 1.01 and a debt-to-equity ratio of 1.18. Banco Bilbao Viscaya Argentaria S.A. has a 12-month low of $9.23 and a 12-month high of $19.39.

Banco Bilbao Viscaya Argentaria (NYSE:BBVA - Get Free Report) last issued its quarterly earnings results on Thursday, July 31st. The bank reported $0.52 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.47 by $0.05. The firm had revenue of $10.30 billion for the quarter, compared to analyst estimates of $10.24 billion. Banco Bilbao Viscaya Argentaria had a return on equity of 17.61% and a net margin of 29.17%. Analysts expect that Banco Bilbao Viscaya Argentaria S.A. will post 1.59 EPS for the current fiscal year.

Analyst Ratings Changes

A number of analysts have recently commented on BBVA shares. Wall Street Zen downgraded Banco Bilbao Viscaya Argentaria from a "buy" rating to a "hold" rating in a research note on Saturday, July 12th. Barclays upgraded Banco Bilbao Viscaya Argentaria from an "equal weight" rating to an "overweight" rating in a research note on Thursday, August 7th.

Check Out Our Latest Stock Analysis on Banco Bilbao Viscaya Argentaria

Banco Bilbao Viscaya Argentaria Profile

(

Free Report)

Banco Bilbao Vizcaya Argentaria, SA provides retail banking, wholesale banking, and asset management services in the United States, Spain, Mexico, Turkey, South America, and internationally. The company offers savings account, demand deposits, and time deposits; and loan products, such as residential mortgages, other households, credit card loans, loans to enterprises and public sector, as well as consumer finance.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Banco Bilbao Viscaya Argentaria, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Banco Bilbao Viscaya Argentaria wasn't on the list.

While Banco Bilbao Viscaya Argentaria currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.