Virtu Financial LLC acquired a new position in shares of Sanofi (NASDAQ:SNY - Free Report) in the first quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund acquired 10,781 shares of the company's stock, valued at approximately $598,000.

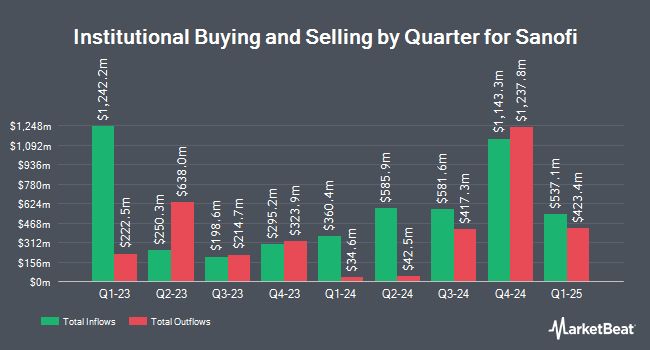

A number of other institutional investors also recently made changes to their positions in the company. Brighton Jones LLC raised its position in Sanofi by 52.6% during the fourth quarter. Brighton Jones LLC now owns 5,420 shares of the company's stock valued at $261,000 after purchasing an additional 1,869 shares in the last quarter. Geode Capital Management LLC raised its position in Sanofi by 1.1% during the fourth quarter. Geode Capital Management LLC now owns 257,655 shares of the company's stock valued at $12,427,000 after purchasing an additional 2,917 shares in the last quarter. Bessemer Group Inc. raised its position in Sanofi by 59.8% during the fourth quarter. Bessemer Group Inc. now owns 647 shares of the company's stock valued at $32,000 after purchasing an additional 242 shares in the last quarter. Sterling Capital Management LLC raised its position in Sanofi by 26.3% during the fourth quarter. Sterling Capital Management LLC now owns 16,004 shares of the company's stock valued at $772,000 after purchasing an additional 3,329 shares in the last quarter. Finally, Townsquare Capital LLC raised its position in Sanofi by 10.0% during the fourth quarter. Townsquare Capital LLC now owns 31,061 shares of the company's stock valued at $1,498,000 after purchasing an additional 2,813 shares in the last quarter. Institutional investors own 14.04% of the company's stock.

Sanofi Trading Up 1.5%

Shares of SNY traded up $0.73 during trading hours on Friday, reaching $49.77. 2,021,563 shares of the company traded hands, compared to its average volume of 2,641,391. The company's fifty day moving average price is $48.57 and its two-hundred day moving average price is $51.83. The company has a market capitalization of $122.21 billion, a price-to-earnings ratio of 11.96, a price-to-earnings-growth ratio of 1.17 and a beta of 0.48. The company has a quick ratio of 0.94, a current ratio of 1.27 and a debt-to-equity ratio of 0.19. Sanofi has a 12 month low of $44.73 and a 12 month high of $60.12.

Sanofi (NASDAQ:SNY - Get Free Report) last posted its quarterly earnings data on Thursday, July 31st. The company reported $0.90 EPS for the quarter, missing the consensus estimate of $0.96 by ($0.06). Sanofi had a return on equity of 16.86% and a net margin of 21.47%. The business had revenue of $11.34 billion for the quarter, compared to the consensus estimate of $9.91 billion. During the same period in the previous year, the firm earned $1.73 EPS. The company's revenue was down 7.0% on a year-over-year basis. Equities research analysts predict that Sanofi will post 4.36 earnings per share for the current fiscal year.

Analysts Set New Price Targets

Several analysts recently weighed in on SNY shares. Morgan Stanley set a $56.00 price objective on shares of Sanofi in a research note on Monday, June 2nd. Guggenheim reissued a "buy" rating on shares of Sanofi in a research note on Tuesday, June 3rd. Hsbc Global Res raised shares of Sanofi to a "strong-buy" rating in a research note on Monday, April 28th. JPMorgan Chase & Co. raised shares of Sanofi from a "neutral" rating to an "overweight" rating in a research note on Friday, August 8th. Finally, Deutsche Bank Aktiengesellschaft reissued a "hold" rating on shares of Sanofi in a research note on Tuesday, August 5th. Two investment analysts have rated the stock with a hold rating, five have given a buy rating and three have assigned a strong buy rating to the company. According to data from MarketBeat, Sanofi presently has an average rating of "Buy" and an average target price of $62.00.

View Our Latest Analysis on SNY

Sanofi Profile

(

Free Report)

Sanofi, a healthcare company, engages in the research, development, manufacture, and marketing of therapeutic solutions in the United States, Europe, Canada, and internationally. It operates through Pharmaceuticals, Vaccines, and Consumer Healthcare segments. The company provides specialty care, such as DUPIXENT, neurology and immunology, rare diseases, oncology, and rare blood disorders; medicines for diabetes and cardiovascular diseases; and established prescription products.

Read More

Before you consider Sanofi, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sanofi wasn't on the list.

While Sanofi currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.