Voloridge Investment Management LLC lifted its stake in On Holding AG (NYSE:ONON - Free Report) by 10.7% in the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 2,026,890 shares of the company's stock after purchasing an additional 196,270 shares during the period. Voloridge Investment Management LLC owned 0.32% of ON worth $111,013,000 as of its most recent SEC filing.

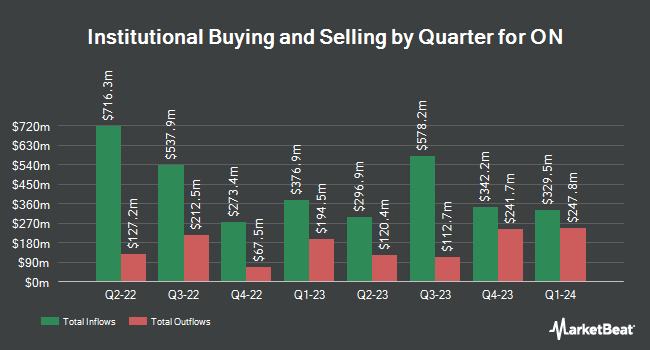

Several other institutional investors and hedge funds have also recently modified their holdings of ONON. Capital Advisors Inc. OK lifted its position in ON by 3.2% during the 4th quarter. Capital Advisors Inc. OK now owns 6,386 shares of the company's stock valued at $350,000 after acquiring an additional 200 shares during the period. Keystone Investors PTE Ltd. lifted its position in ON by 0.8% during the 4th quarter. Keystone Investors PTE Ltd. now owns 29,918 shares of the company's stock valued at $1,639,000 after acquiring an additional 228 shares during the period. Concurrent Investment Advisors LLC lifted its position in ON by 2.8% during the 4th quarter. Concurrent Investment Advisors LLC now owns 9,413 shares of the company's stock valued at $516,000 after acquiring an additional 259 shares during the period. CreativeOne Wealth LLC lifted its position in ON by 2.4% during the 4th quarter. CreativeOne Wealth LLC now owns 13,574 shares of the company's stock valued at $743,000 after acquiring an additional 323 shares during the period. Finally, Atria Investments Inc lifted its position in ON by 6.6% during the 4th quarter. Atria Investments Inc now owns 5,515 shares of the company's stock valued at $302,000 after acquiring an additional 341 shares during the period. 36.39% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

ONON has been the subject of a number of recent research reports. KeyCorp lifted their price target on shares of ON from $60.00 to $68.00 and gave the company an "overweight" rating in a research report on Wednesday, May 14th. Morgan Stanley lowered their price target on shares of ON from $66.00 to $62.00 and set an "overweight" rating for the company in a research report on Tuesday, May 6th. Telsey Advisory Group reissued an "outperform" rating and set a $65.00 price target on shares of ON in a research report on Tuesday, May 13th. Williams Trading lifted their price target on shares of ON from $60.00 to $62.00 and gave the company a "buy" rating in a research report on Tuesday, March 4th. Finally, HSBC upgraded shares of ON from a "hold" rating to a "buy" rating and set a $58.00 price objective for the company in a research note on Tuesday, March 11th. Two investment analysts have rated the stock with a hold rating, twenty have assigned a buy rating and two have assigned a strong buy rating to the stock. According to data from MarketBeat, the stock currently has a consensus rating of "Buy" and an average price target of $62.45.

Read Our Latest Analysis on ONON

ON Stock Performance

Shares of ONON stock traded down $0.38 during trading hours on Friday, reaching $58.44. The company had a trading volume of 4,394,621 shares, compared to its average volume of 4,621,257. The business has a fifty day moving average price of $47.40 and a 200-day moving average price of $52.13. On Holding AG has a one year low of $34.59 and a one year high of $64.05. The firm has a market cap of $36.80 billion, a PE ratio of 135.91, a price-to-earnings-growth ratio of 1.02 and a beta of 2.30.

ON Company Profile

(

Free Report)

On Holding AG engages in the development and distribution of sports products such as footwear, apparel, and accessories for high-performance running, outdoor, all-day activities, and tennis. It sells its products worldwide through independent retailers and global distributors, its own online presence, and its own stores.

Featured Articles

Before you consider ON, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ON wasn't on the list.

While ON currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.