Voloridge Investment Management LLC boosted its stake in shares of Strategy Incorporated (NASDAQ:MSTR - Free Report) by 1,677.4% during the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 134,494 shares of the software maker's stock after buying an additional 126,927 shares during the quarter. Voloridge Investment Management LLC owned approximately 0.06% of Strategy worth $38,952,000 as of its most recent SEC filing.

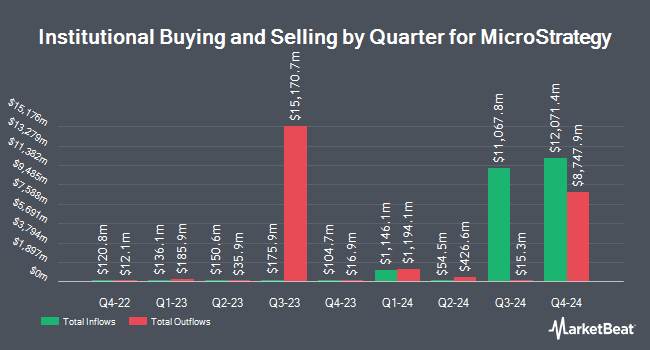

A number of other institutional investors have also recently made changes to their positions in MSTR. Proficio Capital Partners LLC acquired a new position in shares of Strategy in the fourth quarter worth approximately $81,783,000. Clarity Capital Partners LLC lifted its position in shares of Strategy by 122.3% in the 4th quarter. Clarity Capital Partners LLC now owns 25,115 shares of the software maker's stock worth $7,274,000 after purchasing an additional 13,817 shares during the period. Charles Schwab Investment Management Inc. lifted its position in shares of Strategy by 14.7% in the 4th quarter. Charles Schwab Investment Management Inc. now owns 761,776 shares of the software maker's stock worth $220,626,000 after purchasing an additional 97,515 shares during the period. Chung Wu Investment Group LLC bought a new stake in shares of Strategy in the 4th quarter valued at $850,000. Finally, Crew Capital Management Ltd. acquired a new stake in shares of Strategy during the fourth quarter worth $333,000. Institutional investors own 59.84% of the company's stock.

Insider Buying and Selling

In other news, CAO Jeanine Montgomery sold 481 shares of Strategy stock in a transaction on Monday, March 24th. The stock was sold at an average price of $329.27, for a total transaction of $158,378.87. Following the sale, the chief accounting officer now directly owns 7,805 shares in the company, valued at $2,569,952.35. The trade was a 5.80% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, Director Jarrod M. Patten sold 1,100 shares of the business's stock in a transaction dated Friday, May 9th. The stock was sold at an average price of $427.00, for a total transaction of $469,700.00. Following the completion of the transaction, the director now directly owns 9,170 shares in the company, valued at $3,915,590. This trade represents a 10.71% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have bought 8,000 shares of company stock worth $680,000 and have sold 41,198 shares worth $13,901,970. 9.16% of the stock is owned by corporate insiders.

Strategy Trading Up 0.8%

Shares of Strategy stock opened at $416.92 on Wednesday. The company has a market capitalization of $113.99 billion, a P/E ratio of -74.01 and a beta of 3.79. The stock has a fifty day simple moving average of $337.30 and a 200 day simple moving average of $337.39. Strategy Incorporated has a 12-month low of $102.40 and a 12-month high of $543.00. The company has a current ratio of 0.71, a quick ratio of 0.65 and a debt-to-equity ratio of 0.39.

Strategy (NASDAQ:MSTR - Get Free Report) last posted its earnings results on Thursday, May 1st. The software maker reported ($16.49) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.02) by ($16.47). The firm had revenue of $111.07 million during the quarter, compared to the consensus estimate of $116.66 million. Strategy had a negative return on equity of 19.01% and a negative net margin of 251.73%. The business's revenue was down 3.6% compared to the same quarter last year. During the same quarter in the previous year, the company earned ($0.83) EPS.

Wall Street Analyst Weigh In

A number of analysts have commented on the stock. Keefe, Bruyette & Woods initiated coverage on shares of Strategy in a research report on Friday, February 7th. They set an "outperform" rating and a $560.00 price target on the stock. HC Wainwright started coverage on Strategy in a research report on Tuesday, April 29th. They set a "buy" rating and a $480.00 target price on the stock. Cantor Fitzgerald reiterated a "hold" rating on shares of Strategy in a report on Monday. Compass Point upgraded Strategy to a "strong-buy" rating in a report on Wednesday, January 29th. Finally, UBS Group reiterated a "buy" rating on shares of Strategy in a research note on Friday. One investment analyst has rated the stock with a sell rating, two have assigned a hold rating, nine have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average target price of $514.42.

View Our Latest Stock Report on Strategy

About Strategy

(

Free Report)

Strategy Incorporated, formerly known as MicroStrategy, provides artificial intelligence-powered enterprise analytics software and services in the United States, Europe, the Middle East, Africa, and internationally. It offers Strategy ONE, a platform that allows non-technical users to access novel and actionable insights for decision-making, and Strategy Cloud for Government, which provides always-on threat monitoring designed to meet the strict technical and regulatory standards of governments and financial institutions.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Strategy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Strategy wasn't on the list.

While Strategy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.