Vontobel Holding Ltd. lifted its stake in Chemed Corporation (NYSE:CHE - Free Report) by 44.5% during the 2nd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 2,821 shares of the company's stock after buying an additional 869 shares during the quarter. Vontobel Holding Ltd.'s holdings in Chemed were worth $1,374,000 as of its most recent filing with the Securities & Exchange Commission.

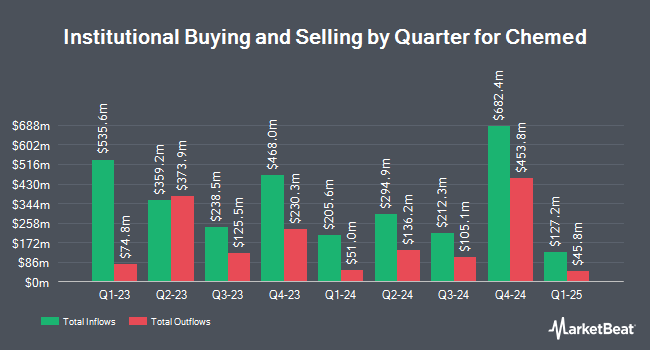

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Kayne Anderson Rudnick Investment Management LLC boosted its position in shares of Chemed by 2.6% in the first quarter. Kayne Anderson Rudnick Investment Management LLC now owns 597,175 shares of the company's stock worth $367,454,000 after purchasing an additional 15,041 shares during the period. Neuberger Berman Group LLC lifted its position in shares of Chemed by 3.9% in the first quarter. Neuberger Berman Group LLC now owns 521,212 shares of the company's stock valued at $320,712,000 after acquiring an additional 19,650 shares in the last quarter. Boston Trust Walden Corp boosted its stake in shares of Chemed by 1.7% in the first quarter. Boston Trust Walden Corp now owns 246,351 shares of the company's stock worth $151,585,000 after acquiring an additional 4,179 shares during the period. Dimensional Fund Advisors LP grew its position in shares of Chemed by 9.7% during the first quarter. Dimensional Fund Advisors LP now owns 218,675 shares of the company's stock worth $134,547,000 after purchasing an additional 19,421 shares in the last quarter. Finally, Northern Trust Corp raised its stake in Chemed by 3.4% during the 1st quarter. Northern Trust Corp now owns 215,523 shares of the company's stock valued at $132,616,000 after purchasing an additional 6,988 shares during the period. 95.85% of the stock is owned by hedge funds and other institutional investors.

Insider Activity at Chemed

In related news, EVP Nicholas Michael Westfall sold 10,012 shares of Chemed stock in a transaction dated Monday, August 4th. The shares were sold at an average price of $421.91, for a total transaction of $4,224,162.92. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, Director George J. Walsh III bought 200 shares of Chemed stock in a transaction dated Monday, August 4th. The shares were bought at an average cost of $417.10 per share, for a total transaction of $83,420.00. Following the completion of the transaction, the director owned 3,523 shares of the company's stock, valued at approximately $1,469,443.30. This trade represents a 6.02% increase in their position. The disclosure for this purchase can be found here. Over the last quarter, insiders sold 13,162 shares of company stock worth $5,677,511. 3.29% of the stock is currently owned by corporate insiders.

Analyst Upgrades and Downgrades

Several research analysts have weighed in on the company. Weiss Ratings restated a "hold (c-)" rating on shares of Chemed in a research note on Wednesday, October 8th. Bank of America cut their target price on shares of Chemed from $610.00 to $595.00 and set a "buy" rating for the company in a research note on Wednesday, September 10th. Royal Bank Of Canada decreased their price target on shares of Chemed from $640.00 to $589.00 and set an "outperform" rating on the stock in a research note on Thursday, July 31st. Wall Street Zen lowered Chemed from a "buy" rating to a "hold" rating in a research report on Saturday, July 5th. Finally, Jefferies Financial Group raised Chemed from a "hold" rating to a "buy" rating and lifted their target price for the stock from $490.00 to $550.00 in a report on Tuesday, September 2nd. Four analysts have rated the stock with a Buy rating and one has assigned a Hold rating to the stock. According to MarketBeat.com, Chemed has an average rating of "Moderate Buy" and a consensus target price of $578.50.

Read Our Latest Stock Report on Chemed

Chemed Stock Down 0.5%

Shares of CHE opened at $429.34 on Monday. The business has a fifty day moving average of $448.45 and a 200 day moving average of $509.15. The company has a market cap of $6.26 billion, a PE ratio of 22.07, a P/E/G ratio of 2.50 and a beta of 0.43. Chemed Corporation has a 52-week low of $408.42 and a 52-week high of $623.60.

Chemed (NYSE:CHE - Get Free Report) last issued its quarterly earnings results on Tuesday, July 29th. The company reported $4.27 EPS for the quarter, missing the consensus estimate of $6.02 by ($1.75). The firm had revenue of $618.80 million for the quarter, compared to the consensus estimate of $650.60 million. Chemed had a net margin of 11.56% and a return on equity of 25.83%. The business's revenue for the quarter was up 3.8% on a year-over-year basis. During the same quarter in the previous year, the company posted $5.47 earnings per share. Chemed has set its FY 2025 guidance at 22.000-22.300 EPS. As a group, research analysts anticipate that Chemed Corporation will post 21.43 earnings per share for the current fiscal year.

Chemed Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, August 29th. Stockholders of record on Monday, August 11th were issued a $0.60 dividend. The ex-dividend date was Monday, August 11th. This is a boost from Chemed's previous quarterly dividend of $0.50. This represents a $2.40 dividend on an annualized basis and a dividend yield of 0.6%. Chemed's dividend payout ratio (DPR) is currently 12.34%.

About Chemed

(

Free Report)

Chemed Corporation provides hospice and palliative care services to patients through a network of physicians, registered nurses, home health aides, social workers, clergy, and volunteers primarily in the United States. The company operates in VITAS and Roto-Rooter segments. It offers plumbing, drain cleaning, excavation, water restoration, and other related services to residential and commercial customers through company-owned branches, independent contractors, and franchisees.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Chemed, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chemed wasn't on the list.

While Chemed currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.