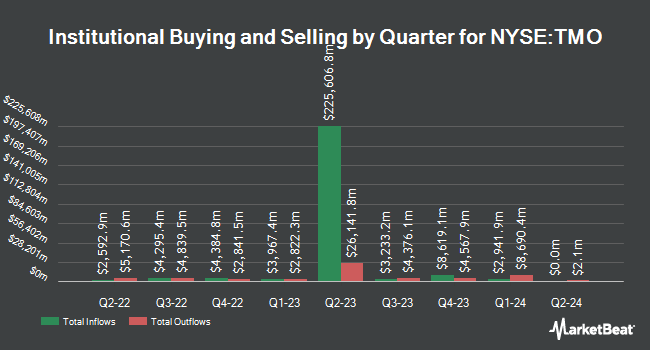

Vontobel Holding Ltd. lifted its position in Thermo Fisher Scientific Inc. (NYSE:TMO - Free Report) by 4.5% in the 2nd quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 1,089,103 shares of the medical research company's stock after acquiring an additional 46,743 shares during the period. Thermo Fisher Scientific accounts for about 1.4% of Vontobel Holding Ltd.'s investment portfolio, making the stock its 21st largest holding. Vontobel Holding Ltd. owned about 0.29% of Thermo Fisher Scientific worth $441,588,000 at the end of the most recent reporting period.

Several other institutional investors have also recently made changes to their positions in TMO. CBIZ Investment Advisory Services LLC increased its position in Thermo Fisher Scientific by 137.5% during the 1st quarter. CBIZ Investment Advisory Services LLC now owns 57 shares of the medical research company's stock valued at $28,000 after buying an additional 33 shares in the last quarter. Anderson Financial Strategies LLC bought a new position in Thermo Fisher Scientific during the 1st quarter valued at approximately $30,000. Keystone Global Partners LLC bought a new position in Thermo Fisher Scientific during the 1st quarter valued at approximately $31,000. IMA Advisory Services Inc. bought a new position in Thermo Fisher Scientific during the 1st quarter valued at approximately $35,000. Finally, Smallwood Wealth Investment Management LLC bought a new stake in shares of Thermo Fisher Scientific in the 1st quarter worth $37,000. Institutional investors own 89.23% of the company's stock.

Thermo Fisher Scientific Price Performance

NYSE TMO opened at $536.21 on Thursday. The company has a market capitalization of $202.48 billion, a PE ratio of 31.01, a price-to-earnings-growth ratio of 2.93 and a beta of 0.77. The company has a debt-to-equity ratio of 0.65, a quick ratio of 1.50 and a current ratio of 1.93. The business's fifty day moving average is $486.09 and its 200 day moving average is $448.21. Thermo Fisher Scientific Inc. has a fifty-two week low of $385.46 and a fifty-two week high of $610.97.

Thermo Fisher Scientific (NYSE:TMO - Get Free Report) last released its earnings results on Wednesday, July 23rd. The medical research company reported $5.36 earnings per share for the quarter, beating the consensus estimate of $5.22 by $0.14. Thermo Fisher Scientific had a return on equity of 16.82% and a net margin of 15.24%.The company had revenue of $10.86 billion for the quarter, compared to the consensus estimate of $10.68 billion. During the same period in the previous year, the business earned $5.37 earnings per share. Thermo Fisher Scientific's quarterly revenue was up 2.9% compared to the same quarter last year. Thermo Fisher Scientific has set its Q3 2025 guidance at 5.460-5.510 EPS. FY 2025 guidance at 22.220-22.840 EPS. Sell-side analysts predict that Thermo Fisher Scientific Inc. will post 23.28 earnings per share for the current year.

Wall Street Analysts Forecast Growth

A number of research firms have commented on TMO. Weiss Ratings reissued a "hold (c-)" rating on shares of Thermo Fisher Scientific in a report on Saturday, September 27th. HSBC reissued a "hold" rating and issued a $510.00 target price on shares of Thermo Fisher Scientific in a report on Thursday, July 24th. William Blair began coverage on Thermo Fisher Scientific in a report on Monday, August 18th. They issued an "outperform" rating for the company. Scotiabank raised Thermo Fisher Scientific from a "sector perform" rating to a "sector outperform" rating and set a $590.00 target price for the company in a report on Friday, July 11th. Finally, Raymond James Financial reaffirmed an "outperform" rating and issued a $535.00 price objective (up previously from $525.00) on shares of Thermo Fisher Scientific in a report on Thursday, July 24th. Fifteen equities research analysts have rated the stock with a Buy rating and six have assigned a Hold rating to the stock. According to MarketBeat.com, Thermo Fisher Scientific currently has an average rating of "Moderate Buy" and a consensus price target of $590.60.

Check Out Our Latest Report on Thermo Fisher Scientific

Insider Activity

In other news, CAO Joseph R. Holmes sold 385 shares of the business's stock in a transaction dated Friday, August 29th. The stock was sold at an average price of $492.63, for a total value of $189,662.55. Following the transaction, the chief accounting officer directly owned 2,319 shares in the company, valued at $1,142,408.97. The trade was a 14.24% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, CEO Marc N. Casper sold 10,000 shares of the business's stock in a transaction dated Friday, August 22nd. The shares were sold at an average price of $500.96, for a total value of $5,009,600.00. Following the completion of the transaction, the chief executive officer owned 115,174 shares in the company, valued at $57,697,567.04. The trade was a 7.99% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 30,066 shares of company stock worth $14,182,963 over the last ninety days. Corporate insiders own 0.33% of the company's stock.

About Thermo Fisher Scientific

(

Free Report)

Thermo Fisher Scientific Inc provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally. The company's Life Sciences Solutions segment offers reagents, instruments, and consumables for biological and medical research, discovery, and production of drugs and vaccines, as well as diagnosis of infections and diseases; and solutions include biosciences, genetic sciences, and bio production to pharmaceutical, biotechnology, agricultural, clinical, healthcare, academic, and government markets.

Featured Articles

Want to see what other hedge funds are holding TMO? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Thermo Fisher Scientific Inc. (NYSE:TMO - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Thermo Fisher Scientific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Thermo Fisher Scientific wasn't on the list.

While Thermo Fisher Scientific currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.