Voya Investment Management LLC lifted its stake in Zurn Elkay Water Solutions Cor (NYSE:ZWS - Free Report) by 39.8% in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 105,039 shares of the company's stock after purchasing an additional 29,878 shares during the period. Voya Investment Management LLC owned about 0.06% of Zurn Elkay Water Solutions Cor worth $3,464,000 at the end of the most recent quarter.

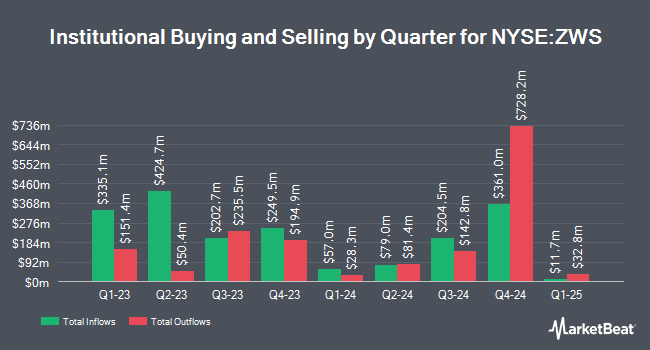

A number of other hedge funds and other institutional investors also recently bought and sold shares of ZWS. Zimmer Partners LP acquired a new stake in Zurn Elkay Water Solutions Cor during the 1st quarter worth $50,344,000. Ameriprise Financial Inc. raised its holdings in Zurn Elkay Water Solutions Cor by 74.1% during the first quarter. Ameriprise Financial Inc. now owns 1,715,496 shares of the company's stock worth $56,577,000 after purchasing an additional 729,920 shares in the last quarter. Nuveen LLC purchased a new stake in shares of Zurn Elkay Water Solutions Cor in the first quarter valued at approximately $21,273,000. Vanguard Group Inc. increased its holdings in shares of Zurn Elkay Water Solutions Cor by 2.4% in the 1st quarter. Vanguard Group Inc. now owns 15,860,934 shares of the company's stock valued at $523,094,000 after purchasing an additional 371,635 shares in the last quarter. Finally, Fort Washington Investment Advisors Inc. OH boosted its stake in shares of Zurn Elkay Water Solutions Cor by 45.2% during the 1st quarter. Fort Washington Investment Advisors Inc. OH now owns 533,849 shares of the company's stock worth $17,606,000 after acquiring an additional 166,080 shares in the last quarter. 83.33% of the stock is currently owned by institutional investors and hedge funds.

Zurn Elkay Water Solutions Cor Price Performance

Zurn Elkay Water Solutions Cor stock traded up $0.20 during mid-day trading on Tuesday, hitting $47.15. The company's stock had a trading volume of 44,728 shares, compared to its average volume of 1,007,035. Zurn Elkay Water Solutions Cor has a twelve month low of $27.74 and a twelve month high of $48.42. The stock has a market capitalization of $7.90 billion, a P/E ratio of 46.69, a P/E/G ratio of 2.51 and a beta of 1.07. The company has a quick ratio of 1.72, a current ratio of 2.71 and a debt-to-equity ratio of 0.32. The stock's fifty day moving average price is $43.82 and its two-hundred day moving average price is $37.73.

Zurn Elkay Water Solutions Cor (NYSE:ZWS - Get Free Report) last released its earnings results on Tuesday, July 29th. The company reported $0.42 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.36 by $0.06. Zurn Elkay Water Solutions Cor had a return on equity of 15.23% and a net margin of 10.78%.The company had revenue of $444.50 million during the quarter, compared to analyst estimates of $424.55 million. During the same quarter in the prior year, the company earned $0.33 earnings per share. The company's revenue for the quarter was up 7.9% on a year-over-year basis. Research analysts forecast that Zurn Elkay Water Solutions Cor will post 1.36 earnings per share for the current year.

Zurn Elkay Water Solutions Cor Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, September 5th. Shareholders of record on Wednesday, August 20th were given a dividend of $0.09 per share. The ex-dividend date of this dividend was Wednesday, August 20th. This represents a $0.36 dividend on an annualized basis and a yield of 0.8%. Zurn Elkay Water Solutions Cor's payout ratio is currently 35.64%.

Wall Street Analysts Forecast Growth

ZWS has been the topic of a number of analyst reports. Stifel Nicolaus increased their price objective on Zurn Elkay Water Solutions Cor from $50.00 to $53.00 and gave the company a "buy" rating in a research note on Friday, September 12th. Oppenheimer upped their price target on Zurn Elkay Water Solutions Cor from $48.00 to $52.00 and gave the stock an "outperform" rating in a research note on Wednesday, September 17th. Two investment analysts have rated the stock with a Buy rating and four have given a Hold rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Hold" and a consensus target price of $40.50.

Get Our Latest Stock Analysis on Zurn Elkay Water Solutions Cor

Insider Buying and Selling

In other news, Director Timothy J. Jahnke sold 2,156 shares of the stock in a transaction that occurred on Tuesday, September 16th. The stock was sold at an average price of $47.54, for a total value of $102,496.24. Following the completion of the transaction, the director directly owned 308,964 shares of the company's stock, valued at approximately $14,688,148.56. This represents a 0.69% decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, VP Sudhanshu Chhabra sold 108,930 shares of Zurn Elkay Water Solutions Cor stock in a transaction dated Thursday, July 31st. The shares were sold at an average price of $43.61, for a total transaction of $4,750,437.30. Following the transaction, the vice president directly owned 94,330 shares of the company's stock, valued at $4,113,731.30. This represents a 53.59% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 168,930 shares of company stock worth $7,452,507 in the last ninety days. Insiders own 2.60% of the company's stock.

Zurn Elkay Water Solutions Cor Profile

(

Free Report)

Zurn Elkay Water Solutions Corporation engages in design, procurement, manufacture, and marketing of water management solutions in the United States, Canada, and internationally. It offers water safety and control products, such as backflow preventers, fire system valves, pressure reducing valves, thermostatic mixing valves, PEX pipings, fittings, and installation tools under the Zurn and Wilkins brand names.

Read More

Before you consider Zurn Elkay Water Solutions Cor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zurn Elkay Water Solutions Cor wasn't on the list.

While Zurn Elkay Water Solutions Cor currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.