Voya Investment Management LLC trimmed its position in NexGen Energy (NYSE:NXE - Free Report) by 19.5% in the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 879,347 shares of the company's stock after selling 213,484 shares during the quarter. Voya Investment Management LLC owned 0.15% of NexGen Energy worth $3,948,000 at the end of the most recent reporting period.

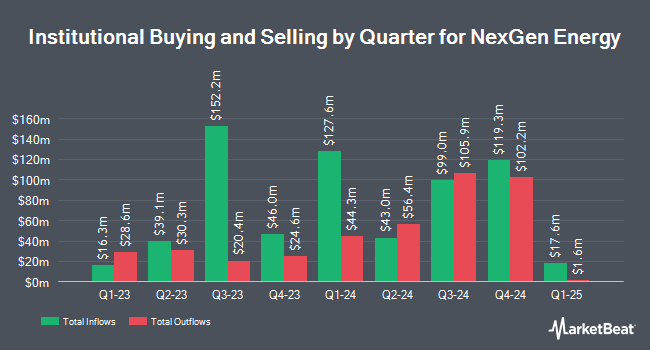

Several other hedge funds have also made changes to their positions in NXE. BNP Paribas Financial Markets purchased a new stake in shares of NexGen Energy in the 4th quarter worth $207,000. Cetera Investment Advisers lifted its stake in shares of NexGen Energy by 2.6% during the 4th quarter. Cetera Investment Advisers now owns 104,611 shares of the company's stock worth $690,000 after purchasing an additional 2,648 shares during the last quarter. Tidal Investments LLC lifted its stake in shares of NexGen Energy by 100.3% during the 4th quarter. Tidal Investments LLC now owns 62,617 shares of the company's stock worth $413,000 after purchasing an additional 31,362 shares during the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its stake in shares of NexGen Energy by 38.2% during the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 623,857 shares of the company's stock worth $4,117,000 after purchasing an additional 172,499 shares during the last quarter. Finally, Public Employees Retirement System of Ohio lifted its stake in shares of NexGen Energy by 3.2% during the 4th quarter. Public Employees Retirement System of Ohio now owns 134,655 shares of the company's stock worth $888,000 after purchasing an additional 4,176 shares during the last quarter. 42.43% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

A number of research analysts have recently issued reports on NXE shares. TD Securities reaffirmed a "buy" rating on shares of NexGen Energy in a research report on Friday, August 8th. Desjardins started coverage on shares of NexGen Energy in a research report on Tuesday, June 10th. They issued a "buy" rating on the stock. One equities research analyst has rated the stock with a Strong Buy rating and five have assigned a Buy rating to the stock. Based on data from MarketBeat, the stock presently has an average rating of "Buy".

View Our Latest Research Report on NexGen Energy

NexGen Energy Price Performance

NexGen Energy stock traded up $0.10 during midday trading on Tuesday, reaching $9.03. The company's stock had a trading volume of 1,769,060 shares, compared to its average volume of 9,082,009. NexGen Energy has a 52-week low of $3.91 and a 52-week high of $9.08. The stock has a market capitalization of $5.19 billion, a P/E ratio of -36.14 and a beta of 1.46. The stock's 50-day simple moving average is $7.32 and its 200-day simple moving average is $6.20.

NexGen Energy (NYSE:NXE - Get Free Report) last announced its quarterly earnings data on Tuesday, August 5th. The company reported ($0.10) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.02) by ($0.08). As a group, equities research analysts expect that NexGen Energy will post -0.05 earnings per share for the current fiscal year.

NexGen Energy Company Profile

(

Free Report)

NexGen Energy Ltd., an exploration and development stage company, engages in the acquisition, exploration, and evaluation and development of uranium properties in Canada. It holds a 100% interest in the Rook I project that consists of 32 contiguous mineral claims totaling an area of 35,065 hectares located in the southwestern Athabasca Basin of Saskatchewan.

See Also

Before you consider NexGen Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NexGen Energy wasn't on the list.

While NexGen Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.