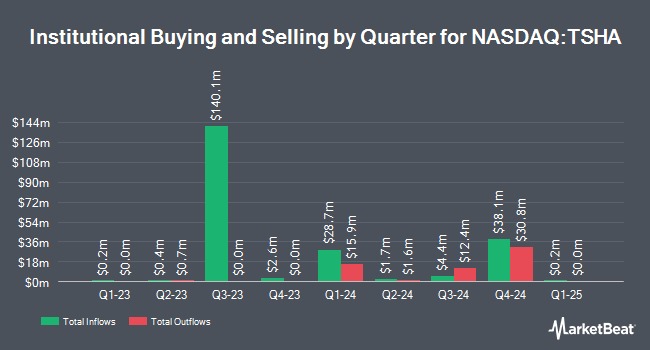

VR Adviser LLC lessened its holdings in shares of Taysha Gene Therapies, Inc. (NASDAQ:TSHA - Free Report) by 64.2% during the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 3,225,180 shares of the company's stock after selling 5,774,820 shares during the quarter. Taysha Gene Therapies makes up about 0.4% of VR Adviser LLC's portfolio, making the stock its 29th biggest holding. VR Adviser LLC owned approximately 1.57% of Taysha Gene Therapies worth $5,580,000 at the end of the most recent quarter.

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Octagon Capital Advisors LP raised its holdings in shares of Taysha Gene Therapies by 128.6% during the 4th quarter. Octagon Capital Advisors LP now owns 10,450,000 shares of the company's stock worth $18,078,000 after acquiring an additional 5,877,778 shares during the period. Adage Capital Partners GP L.L.C. acquired a new position in Taysha Gene Therapies in the fourth quarter valued at approximately $8,650,000. Bank of America Corp DE increased its stake in Taysha Gene Therapies by 1,178.9% during the fourth quarter. Bank of America Corp DE now owns 1,710,303 shares of the company's stock worth $2,959,000 after purchasing an additional 1,576,568 shares during the period. Norges Bank purchased a new stake in Taysha Gene Therapies during the fourth quarter worth about $2,528,000. Finally, Avoro Capital Advisors LLC increased its stake in Taysha Gene Therapies by 7.2% during the fourth quarter. Avoro Capital Advisors LLC now owns 19,999,999 shares of the company's stock worth $34,600,000 after purchasing an additional 1,349,999 shares during the period. Institutional investors and hedge funds own 77.70% of the company's stock.

Taysha Gene Therapies Stock Down 3.5%

Shares of TSHA stock traded down $0.10 during trading hours on Friday, reaching $2.75. 4,063,290 shares of the stock were exchanged, compared to its average volume of 2,908,833. The business's fifty day moving average is $1.83 and its two-hundred day moving average is $1.87. The company has a debt-to-equity ratio of 0.48, a current ratio of 5.51 and a quick ratio of 5.51. Taysha Gene Therapies, Inc. has a 12-month low of $1.05 and a 12-month high of $4.32. The firm has a market capitalization of $590.32 million, a P/E ratio of 4.37 and a beta of 0.90.

Taysha Gene Therapies (NASDAQ:TSHA - Get Free Report) last released its earnings results on Thursday, May 15th. The company reported ($0.08) earnings per share for the quarter, hitting analysts' consensus estimates of ($0.08). Taysha Gene Therapies had a negative net margin of 229.67% and a negative return on equity of 106.36%. The firm had revenue of $2.30 million for the quarter, compared to analyst estimates of $1.48 million. During the same period in the prior year, the firm earned ($0.10) earnings per share. As a group, research analysts expect that Taysha Gene Therapies, Inc. will post -0.35 EPS for the current fiscal year.

Analysts Set New Price Targets

A number of analysts have issued reports on TSHA shares. Canaccord Genuity Group boosted their price target on shares of Taysha Gene Therapies from $8.00 to $9.00 and gave the stock a "buy" rating in a research note on Friday, May 16th. Chardan Capital reiterated a "buy" rating and set a $7.00 price target on shares of Taysha Gene Therapies in a research note on Wednesday, February 26th. Cantor Fitzgerald reiterated an "overweight" rating and set a $7.00 price target on shares of Taysha Gene Therapies in a research note on Monday, April 28th. Needham & Company LLC reiterated a "buy" rating and set a $6.00 price target on shares of Taysha Gene Therapies in a research note on Thursday, April 10th. Finally, JMP Securities reiterated a "market outperform" rating and set a $5.00 price target on shares of Taysha Gene Therapies in a research note on Monday, April 28th. Seven analysts have rated the stock with a buy rating, Based on data from MarketBeat, the stock presently has an average rating of "Buy" and a consensus target price of $6.57.

Read Our Latest Analysis on TSHA

Taysha Gene Therapies Company Profile

(

Free Report)

Taysha Gene Therapies, Inc, a gene therapy company, focuses on developing and commercializing adeno-associated virus-based gene therapies for the treatment of monogenic diseases of the central nervous system. It primarily develops TSHA-120 for the treatment of giant axonal neuropathy; TSHA-102 for the treatment of Rett syndrome; TSHA-121 for the treatment of CLN7 disease; TSHA-118 for the treatment of CLN1 disease; TSHA-105 for the treatment of for SLC13A5 deficiency; TSHA-113 for the treatment of tauopathies; TSHA-106 for the treatment of angelman syndrome; TSHA-114 for the treatment of fragile X syndrome; and TSHA-101 for the treatment of GM2 gangliosidosis.

See Also

Before you consider Taysha Gene Therapies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Taysha Gene Therapies wasn't on the list.

While Taysha Gene Therapies currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.