Walleye Capital LLC increased its stake in shares of Globus Medical, Inc. (NYSE:GMED - Free Report) by 62.8% in the first quarter, according to its most recent Form 13F filing with the SEC. The fund owned 357,521 shares of the medical device company's stock after buying an additional 137,964 shares during the period. Walleye Capital LLC owned about 0.26% of Globus Medical worth $26,171,000 as of its most recent SEC filing.

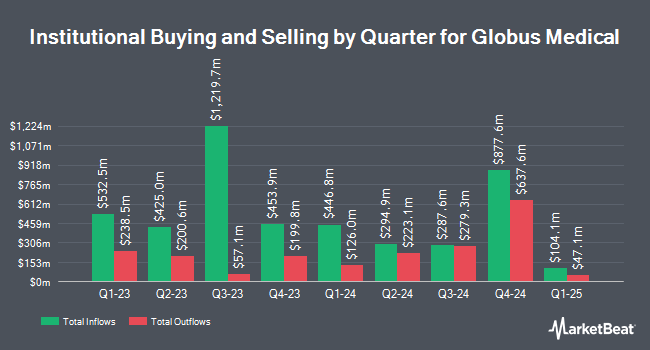

A number of other large investors have also added to or reduced their stakes in the stock. Vanguard Group Inc. increased its holdings in Globus Medical by 0.4% during the first quarter. Vanguard Group Inc. now owns 10,909,082 shares of the medical device company's stock worth $798,545,000 after buying an additional 45,248 shares during the last quarter. Burgundy Asset Management Ltd. increased its holdings in Globus Medical by 7.0% during the first quarter. Burgundy Asset Management Ltd. now owns 2,801,747 shares of the medical device company's stock worth $205,088,000 after buying an additional 183,639 shares during the last quarter. Invesco Ltd. increased its holdings in Globus Medical by 331.9% during the first quarter. Invesco Ltd. now owns 2,021,156 shares of the medical device company's stock worth $147,949,000 after buying an additional 1,553,154 shares during the last quarter. Geneva Capital Management LLC increased its holdings in Globus Medical by 1.0% during the first quarter. Geneva Capital Management LLC now owns 1,833,647 shares of the medical device company's stock worth $134,223,000 after buying an additional 17,810 shares during the last quarter. Finally, Price T Rowe Associates Inc. MD increased its holdings in Globus Medical by 2.2% during the first quarter. Price T Rowe Associates Inc. MD now owns 1,148,379 shares of the medical device company's stock worth $84,062,000 after buying an additional 25,247 shares during the last quarter. Hedge funds and other institutional investors own 95.16% of the company's stock.

Analyst Ratings Changes

Several equities analysts have recently weighed in on GMED shares. Truist Financial reduced their target price on shares of Globus Medical from $80.00 to $68.00 and set a "hold" rating for the company in a research note on Monday, May 12th. JMP Securities reiterated a "market perform" rating on shares of Globus Medical in a research note on Tuesday, May 27th. Morgan Stanley reduced their target price on shares of Globus Medical from $75.00 to $68.00 and set an "overweight" rating for the company in a research note on Tuesday, July 15th. BTIG Research reiterated a "neutral" rating on shares of Globus Medical in a research note on Tuesday, May 27th. Finally, Piper Sandler reduced their target price on shares of Globus Medical from $100.00 to $80.00 and set an "overweight" rating for the company in a research note on Friday, May 9th. Eight research analysts have rated the stock with a Buy rating and five have assigned a Hold rating to the company. Based on data from MarketBeat.com, Globus Medical currently has a consensus rating of "Moderate Buy" and an average price target of $87.64.

Check Out Our Latest Stock Analysis on Globus Medical

Globus Medical Trading Up 3.4%

Shares of NYSE:GMED opened at $62.5440 on Friday. The company has a 50 day moving average of $57.30 and a 200 day moving average of $66.24. The stock has a market cap of $8.45 billion, a P/E ratio of 24.06, a P/E/G ratio of 1.74 and a beta of 1.20. Globus Medical, Inc. has a 12 month low of $51.79 and a 12 month high of $94.93.

Globus Medical (NYSE:GMED - Get Free Report) last issued its quarterly earnings data on Thursday, August 7th. The medical device company reported $0.86 EPS for the quarter, beating the consensus estimate of $0.76 by $0.10. The company had revenue of $745.34 million during the quarter, compared to analysts' expectations of $738.91 million. Globus Medical had a net margin of 13.58% and a return on equity of 10.65%. Globus Medical's revenue for the quarter was up 18.4% on a year-over-year basis. During the same quarter in the previous year, the company earned $0.75 earnings per share. On average, equities analysts forecast that Globus Medical, Inc. will post 3.44 earnings per share for the current fiscal year.

Globus Medical declared that its Board of Directors has approved a stock repurchase plan on Thursday, May 15th that permits the company to buyback $500.00 million in shares. This buyback authorization permits the medical device company to reacquire up to 6.3% of its shares through open market purchases. Shares buyback plans are usually an indication that the company's management believes its shares are undervalued.

Globus Medical Profile

(

Free Report)

Globus Medical, Inc, a medical device company, develops and commercializes healthcare solutions for patients with musculoskeletal disorders in the United States and internationally. The company offers spine products, such as traditional fusion implants comprising pedicle screw and rod systems, plating systems, intervertebral spacers, and corpectomy devices for treating degenerative and congenital conditions, deformity, tumors, and trauma injuries; treatment options for motion preservation technologies that consist of dynamic stabilization, total disc replacement, and interspinous distraction devices; interventional solutions to treat vertebral compression fractures; and regenerative biologic products comprising of allografts and synthetic alternatives.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Globus Medical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Globus Medical wasn't on the list.

While Globus Medical currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.