Wealth Architects LLC purchased a new stake in shares of Corning Incorporated (NYSE:GLW - Free Report) during the 2nd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund purchased 4,211 shares of the electronics maker's stock, valued at approximately $221,000.

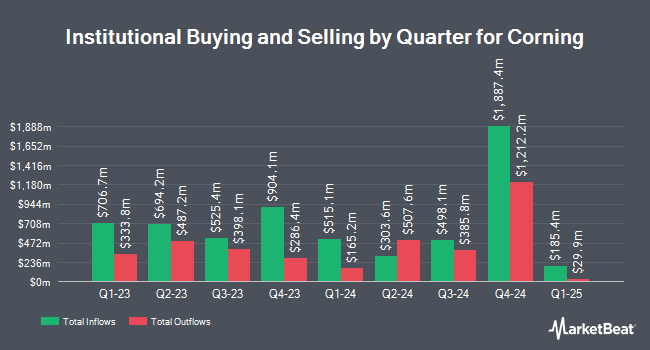

Several other institutional investors and hedge funds have also modified their holdings of GLW. Brighton Jones LLC grew its holdings in shares of Corning by 46.0% during the 4th quarter. Brighton Jones LLC now owns 6,705 shares of the electronics maker's stock valued at $319,000 after acquiring an additional 2,114 shares in the last quarter. GAMMA Investing LLC boosted its holdings in Corning by 29.2% in the first quarter. GAMMA Investing LLC now owns 11,358 shares of the electronics maker's stock worth $520,000 after purchasing an additional 2,567 shares in the last quarter. Wealth Enhancement Advisory Services LLC boosted its holdings in Corning by 1.9% in the first quarter. Wealth Enhancement Advisory Services LLC now owns 1,300,954 shares of the electronics maker's stock worth $59,558,000 after purchasing an additional 23,781 shares in the last quarter. Dynamic Advisor Solutions LLC boosted its holdings in Corning by 1.3% in the first quarter. Dynamic Advisor Solutions LLC now owns 22,379 shares of the electronics maker's stock worth $1,024,000 after purchasing an additional 297 shares in the last quarter. Finally, Hanson & Doremus Investment Management boosted its holdings in Corning by 7.5% in the first quarter. Hanson & Doremus Investment Management now owns 155,747 shares of the electronics maker's stock worth $7,130,000 after purchasing an additional 10,813 shares in the last quarter. 69.80% of the stock is currently owned by hedge funds and other institutional investors.

Corning Stock Down 4.8%

GLW stock opened at $83.00 on Monday. The company has a debt-to-equity ratio of 0.58, a current ratio of 1.50 and a quick ratio of 0.93. Corning Incorporated has a 52-week low of $37.31 and a 52-week high of $87.78. The company has a 50-day moving average of $73.19 and a two-hundred day moving average of $57.32. The stock has a market capitalization of $71.10 billion, a price-to-earnings ratio of 88.30, a price-to-earnings-growth ratio of 1.85 and a beta of 1.14.

Corning (NYSE:GLW - Get Free Report) last released its quarterly earnings results on Tuesday, July 29th. The electronics maker reported $0.60 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.57 by $0.03. Corning had a net margin of 5.77% and a return on equity of 17.27%. The company had revenue of $3.86 billion during the quarter, compared to analysts' expectations of $3.84 billion. During the same period in the prior year, the company earned $0.47 earnings per share. Corning has set its Q3 2025 guidance at 0.630-0.670 EPS. As a group, equities research analysts anticipate that Corning Incorporated will post 2.33 EPS for the current year.

Corning Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, December 12th. Investors of record on Friday, November 14th will be paid a $0.28 dividend. This represents a $1.12 annualized dividend and a dividend yield of 1.3%. The ex-dividend date is Friday, November 14th. Corning's dividend payout ratio (DPR) is presently 119.15%.

Insiders Place Their Bets

In related news, EVP Lewis A. Steverson sold 16,646 shares of the stock in a transaction dated Wednesday, July 30th. The shares were sold at an average price of $62.22, for a total value of $1,035,714.12. Following the completion of the sale, the executive vice president owned 39,759 shares in the company, valued at approximately $2,473,804.98. This trade represents a 29.51% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, SVP Michael Paul O'day sold 14,879 shares of the stock in a transaction dated Wednesday, July 30th. The shares were sold at an average price of $62.36, for a total transaction of $927,854.44. Following the completion of the sale, the senior vice president owned 35,743 shares of the company's stock, valued at approximately $2,228,933.48. The trade was a 29.39% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 181,671 shares of company stock valued at $11,816,899 in the last quarter. 0.40% of the stock is currently owned by insiders.

Analysts Set New Price Targets

A number of brokerages recently issued reports on GLW. Mizuho upped their price objective on shares of Corning from $74.00 to $90.00 and gave the stock an "outperform" rating in a report on Friday, October 3rd. Morgan Stanley upped their price objective on shares of Corning from $56.00 to $75.00 and gave the stock an "equal weight" rating in a report on Friday. Oppenheimer reiterated an "outperform" rating and issued a $72.00 price objective (up from $55.00) on shares of Corning in a report on Wednesday, July 30th. Wolfe Research began coverage on shares of Corning in a report on Tuesday, July 8th. They issued an "outperform" rating for the company. Finally, Barclays upped their price objective on shares of Corning from $52.00 to $65.00 and gave the stock an "equal weight" rating in a report on Wednesday, July 30th. One research analyst has rated the stock with a Strong Buy rating, eleven have issued a Buy rating and three have given a Hold rating to the company's stock. According to data from MarketBeat.com, Corning currently has an average rating of "Moderate Buy" and an average target price of $73.00.

View Our Latest Stock Analysis on Corning

Corning Company Profile

(

Free Report)

Corning Incorporated engages in the display technologies, optical communications, environmental technologies, specialty materials, and life sciences businesses in the United States and internationally. The company's Display Technologies segment offers glass substrates for flat panel displays, including liquid crystal displays and organic light-emitting diodes that are used in televisions, notebook computers, desktop monitors, tablets, and handheld devices.

Recommended Stories

Want to see what other hedge funds are holding GLW? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Corning Incorporated (NYSE:GLW - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Corning, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corning wasn't on the list.

While Corning currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report