Wealth Enhancement Advisory Services LLC cut its stake in GitLab Inc. (NASDAQ:GTLB - Free Report) by 5.1% in the 2nd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 164,004 shares of the company's stock after selling 8,862 shares during the period. Wealth Enhancement Advisory Services LLC owned approximately 0.10% of GitLab worth $7,605,000 at the end of the most recent quarter.

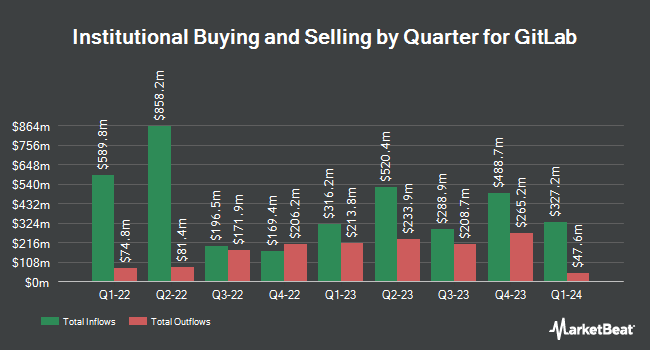

Several other hedge funds and other institutional investors have also recently added to or reduced their stakes in GTLB. 1832 Asset Management L.P. raised its holdings in shares of GitLab by 2,456.8% during the 1st quarter. 1832 Asset Management L.P. now owns 2,295,000 shares of the company's stock worth $107,865,000 after buying an additional 2,205,238 shares in the last quarter. Champlain Investment Partners LLC acquired a new position in shares of GitLab during the 1st quarter worth $60,371,000. ARK Investment Management LLC raised its holdings in shares of GitLab by 109.1% during the 1st quarter. ARK Investment Management LLC now owns 2,426,332 shares of the company's stock worth $114,038,000 after buying an additional 1,265,830 shares in the last quarter. Nikko Asset Management Americas Inc. raised its holdings in shares of GitLab by 175.1% during the 1st quarter. Nikko Asset Management Americas Inc. now owns 1,396,613 shares of the company's stock worth $65,529,000 after buying an additional 888,900 shares in the last quarter. Finally, Driehaus Capital Management LLC acquired a new position in shares of GitLab during the 1st quarter worth $39,976,000. 95.04% of the stock is owned by institutional investors and hedge funds.

Insider Activity at GitLab

In related news, Director Sytse Sijbrandij sold 108,600 shares of the company's stock in a transaction that occurred on Monday, September 15th. The stock was sold at an average price of $50.14, for a total transaction of $5,445,204.00. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. Also, Director Matthew Jacobson sold 233,382 shares of the company's stock in a transaction that occurred on Friday, September 19th. The stock was sold at an average price of $50.17, for a total value of $11,708,774.94. Following the transaction, the director directly owned 14,207 shares in the company, valued at approximately $712,765.19. This trade represents a 94.26% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 1,158,834 shares of company stock worth $56,452,170 in the last 90 days. Corporate insiders own 21.36% of the company's stock.

GitLab Price Performance

Shares of GitLab stock opened at $48.84 on Wednesday. GitLab Inc. has a one year low of $37.90 and a one year high of $74.18. The stock's 50-day moving average is $45.86 and its 200 day moving average is $46.24. The firm has a market cap of $8.14 billion, a price-to-earnings ratio of -1,221.00 and a beta of 0.74.

Analyst Ratings Changes

A number of equities analysts have issued reports on GTLB shares. Canaccord Genuity Group lowered their target price on GitLab from $76.00 to $70.00 and set a "buy" rating for the company in a report on Thursday, September 4th. Cowen reaffirmed a "buy" rating on shares of GitLab in a report on Friday, June 6th. Royal Bank Of Canada reaffirmed an "outperform" rating and issued a $62.00 target price on shares of GitLab in a report on Wednesday, June 25th. The Goldman Sachs Group reaffirmed a "neutral" rating and issued a $50.00 target price on shares of GitLab in a report on Tuesday, June 24th. Finally, Raymond James Financial reduced their price target on GitLab from $60.00 to $55.00 and set an "outperform" rating on the stock in a research report on Thursday, September 4th. One analyst has rated the stock with a Strong Buy rating, twenty have assigned a Buy rating and six have assigned a Hold rating to the stock. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $58.88.

View Our Latest Report on GTLB

About GitLab

(

Free Report)

GitLab Inc, through its subsidiaries, develops software for the software development lifecycle in the United States, Europe, and the Asia Pacific. It offers GitLab, a DevOps platform, which is a single application that leads to faster cycle time and allows visibility throughout and control over various stages of the DevOps lifecycle.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider GitLab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GitLab wasn't on the list.

While GitLab currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.