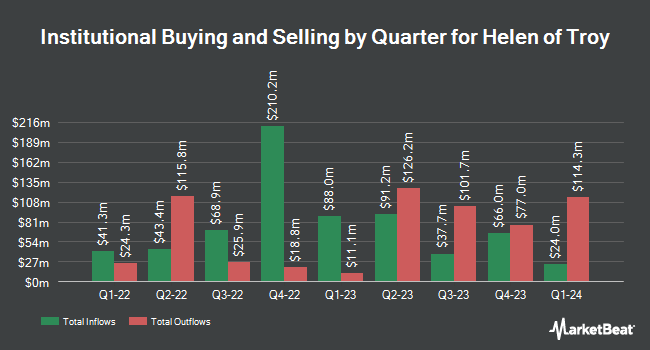

Wealth Enhancement Advisory Services LLC bought a new position in shares of Helen of Troy Limited (NASDAQ:HELE - Free Report) during the second quarter, according to its most recent filing with the SEC. The fund bought 11,062 shares of the company's stock, valued at approximately $314,000.

Several other institutional investors and hedge funds have also bought and sold shares of HELE. Envestnet Asset Management Inc. lifted its position in shares of Helen of Troy by 20.8% during the first quarter. Envestnet Asset Management Inc. now owns 149,625 shares of the company's stock worth $8,003,000 after acquiring an additional 25,713 shares in the last quarter. Federated Hermes Inc. lifted its position in shares of Helen of Troy by 3,325.3% during the first quarter. Federated Hermes Inc. now owns 185,616 shares of the company's stock worth $9,929,000 after acquiring an additional 180,197 shares in the last quarter. Public Sector Pension Investment Board lifted its position in shares of Helen of Troy by 27.3% during the first quarter. Public Sector Pension Investment Board now owns 72,526 shares of the company's stock worth $3,879,000 after acquiring an additional 15,573 shares in the last quarter. Jacobs Levy Equity Management Inc. lifted its position in shares of Helen of Troy by 1,985.6% during the first quarter. Jacobs Levy Equity Management Inc. now owns 332,708 shares of the company's stock worth $17,797,000 after acquiring an additional 316,755 shares in the last quarter. Finally, Cubist Systematic Strategies LLC lifted its position in shares of Helen of Troy by 1,392.7% during the first quarter. Cubist Systematic Strategies LLC now owns 97,148 shares of the company's stock worth $5,196,000 after acquiring an additional 90,640 shares in the last quarter.

Wall Street Analyst Weigh In

A number of brokerages recently issued reports on HELE. UBS Group lowered their price objective on Helen of Troy from $29.00 to $27.00 and set a "neutral" rating on the stock in a research report on Thursday, October 2nd. Canaccord Genuity Group reiterated a "hold" rating and issued a $26.00 price objective (down previously from $47.00) on shares of Helen of Troy in a research report on Friday, July 11th. Finally, Weiss Ratings reiterated a "sell (d-)" rating on shares of Helen of Troy in a research report on Saturday, September 27th. Three analysts have rated the stock with a Hold rating and one has assigned a Sell rating to the company. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Reduce" and an average price target of $43.67.

Get Our Latest Report on HELE

Helen of Troy Stock Up 2.2%

Shares of NASDAQ:HELE opened at $27.61 on Thursday. The stock has a market capitalization of $633.37 million, a P/E ratio of -1.90 and a beta of 0.84. The stock's 50-day moving average price is $24.05 and its 200-day moving average price is $28.61. The company has a current ratio of 1.70, a quick ratio of 0.74 and a debt-to-equity ratio of 0.69. Helen of Troy Limited has a 12-month low of $20.02 and a 12-month high of $77.95.

Helen of Troy (NASDAQ:HELE - Get Free Report) last released its quarterly earnings data on Thursday, July 10th. The company reported $0.41 EPS for the quarter, missing the consensus estimate of $0.91 by ($0.50). The company had revenue of $371.66 million during the quarter, compared to analysts' expectations of $400.69 million. Helen of Troy had a positive return on equity of 8.96% and a negative net margin of 17.89%.The firm's quarterly revenue was down 10.8% on a year-over-year basis. During the same quarter in the prior year, the firm posted $0.99 EPS. On average, equities analysts anticipate that Helen of Troy Limited will post 6.46 earnings per share for the current year.

Insider Activity

In related news, CFO Tracy Scheuerman acquired 10,000 shares of the firm's stock in a transaction dated Tuesday, July 15th. The shares were purchased at an average price of $20.13 per share, for a total transaction of $201,300.00. Following the completion of the acquisition, the chief financial officer owned 33,041 shares in the company, valued at approximately $665,115.33. This represents a 43.40% increase in their ownership of the stock. The purchase was disclosed in a filing with the SEC, which is available at this link. Also, CEO Brian Grass acquired 10,000 shares of the firm's stock in a transaction dated Tuesday, July 15th. The stock was bought at an average price of $21.47 per share, for a total transaction of $214,700.00. Following the acquisition, the chief executive officer owned 135,932 shares of the company's stock, valued at approximately $2,918,460.04. This trade represents a 7.94% increase in their position. The disclosure for this purchase can be found here. In the last quarter, insiders bought 20,435 shares of company stock worth $425,948. Company insiders own 0.45% of the company's stock.

Helen of Troy Profile

(

Free Report)

Helen of Troy Limited provides various consumer products in the United States, Canada, Europe, the Middle East, Africa, the Asia Pacific, and Latin America. The company operates in two segments: Home & Outdoor and Beauty & Wellness. The Home & Outdoor segment offers food storage containers, kitchen utensils for cooking and preparing salads, fruits, vegetables and meats, graters, slicers and choppers, baking essentials, kitchen organization, bath, cleaning, infant and toddler products, and coffee preparation tools and electronics; and insulated beverageware, including bottles, travel tumblers, drinkware, mugs, food and lunch containers, insulated totes, soft coolers, outdoor kitchenware, and accessories.

Further Reading

Want to see what other hedge funds are holding HELE? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Helen of Troy Limited (NASDAQ:HELE - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Helen of Troy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Helen of Troy wasn't on the list.

While Helen of Troy currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report