WealthPlan Investment Management LLC trimmed its stake in Hims & Hers Health, Inc. (NYSE:HIMS - Free Report) by 39.3% in the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 15,994 shares of the company's stock after selling 10,336 shares during the quarter. WealthPlan Investment Management LLC's holdings in Hims & Hers Health were worth $473,000 at the end of the most recent reporting period.

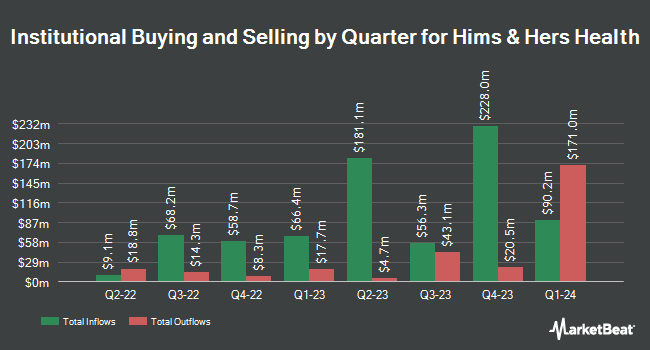

Other hedge funds have also recently bought and sold shares of the company. Signaturefd LLC grew its stake in Hims & Hers Health by 17.7% in the first quarter. Signaturefd LLC now owns 2,586 shares of the company's stock valued at $76,000 after purchasing an additional 388 shares in the last quarter. Raymond James Financial Inc. bought a new position in Hims & Hers Health in the fourth quarter valued at approximately $18,048,000. O Shaughnessy Asset Management LLC bought a new position in Hims & Hers Health in the fourth quarter valued at approximately $208,000. GAMMA Investing LLC grew its stake in Hims & Hers Health by 128.5% in the first quarter. GAMMA Investing LLC now owns 5,143 shares of the company's stock valued at $152,000 after purchasing an additional 2,892 shares in the last quarter. Finally, New York State Teachers Retirement System grew its stake in Hims & Hers Health by 95.2% in the first quarter. New York State Teachers Retirement System now owns 194,795 shares of the company's stock valued at $5,756,000 after purchasing an additional 94,983 shares in the last quarter. 63.52% of the stock is currently owned by institutional investors.

Hims & Hers Health Stock Performance

NYSE:HIMS opened at $51.05 on Friday. The stock has a market cap of $11.43 billion, a P/E ratio of 63.81, a PEG ratio of 2.16 and a beta of 2.08. The stock has a 50 day simple moving average of $53.76 and a 200 day simple moving average of $44.79. The company has a current ratio of 4.98, a quick ratio of 1.32 and a debt-to-equity ratio of 1.72. Hims & Hers Health, Inc. has a 1-year low of $13.47 and a 1-year high of $72.98.

Hims & Hers Health (NYSE:HIMS - Get Free Report) last released its quarterly earnings results on Monday, August 4th. The company reported $0.17 earnings per share for the quarter, missing the consensus estimate of $0.18 by ($0.01). The firm had revenue of $544.83 million for the quarter, compared to analyst estimates of $550.06 million. Hims & Hers Health had a return on equity of 26.26% and a net margin of 9.63%. The business's revenue for the quarter was up 72.6% on a year-over-year basis. During the same period in the previous year, the business posted $0.06 earnings per share. Research analysts anticipate that Hims & Hers Health, Inc. will post 0.29 earnings per share for the current year.

Insider Buying and Selling at Hims & Hers Health

In other news, insider Michael Chi sold 17,102 shares of the business's stock in a transaction on Tuesday, June 17th. The stock was sold at an average price of $59.75, for a total transaction of $1,021,844.50. Following the completion of the transaction, the insider owned 278,654 shares of the company's stock, valued at approximately $16,649,576.50. The trade was a 5.78% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CFO Oluyemi Okupe sold 23,107 shares of the business's stock in a transaction on Monday, June 23rd. The stock was sold at an average price of $47.25, for a total value of $1,091,805.75. Following the transaction, the chief financial officer directly owned 63,222 shares of the company's stock, valued at $2,987,239.50. This trade represents a 26.77% decrease in their position. The disclosure for this sale can be found here. Insiders sold 737,704 shares of company stock valued at $40,644,035 in the last three months. Corporate insiders own 13.71% of the company's stock.

Wall Street Analyst Weigh In

Several research analysts have recently commented on HIMS shares. Morgan Stanley reiterated an "equal weight" rating and set a $40.00 target price on shares of Hims & Hers Health in a research note on Wednesday, June 11th. Bank of America lifted their target price on Hims & Hers Health from $22.00 to $26.00 and gave the stock an "underperform" rating in a research note on Tuesday, April 29th. Needham & Company LLC reiterated a "hold" rating on shares of Hims & Hers Health in a research note on Tuesday. TD Cowen downgraded Hims & Hers Health from a "buy" rating to a "hold" rating and reduced their target price for the stock from $44.00 to $30.00 in a research note on Tuesday, April 29th. Finally, Wall Street Zen downgraded Hims & Hers Health from a "buy" rating to a "hold" rating in a research note on Monday, July 28th. Three investment analysts have rated the stock with a sell rating, nine have assigned a hold rating and two have assigned a buy rating to the stock. According to data from MarketBeat.com, the stock has a consensus rating of "Hold" and a consensus target price of $39.83.

Read Our Latest Stock Analysis on Hims & Hers Health

Hims & Hers Health Company Profile

(

Free Report)

Hims & Hers Health, Inc operates a telehealth consultation platform. It connects consumers to healthcare professionals, enabling them to access medical care for mental health, sexual health, dermatology and primary care. The company was founded in 2017 and is headquartered in San Francisco, CA.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Hims & Hers Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hims & Hers Health wasn't on the list.

While Hims & Hers Health currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.