Wealthquest Corp acquired a new stake in Prosperity Bancshares, Inc. (NYSE:PB - Free Report) in the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor acquired 11,362 shares of the bank's stock, valued at approximately $811,000.

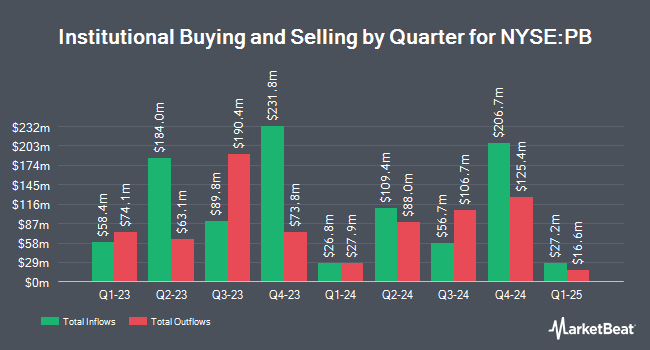

Other institutional investors and hedge funds have also bought and sold shares of the company. CIBC Private Wealth Group LLC grew its stake in shares of Prosperity Bancshares by 4.4% during the fourth quarter. CIBC Private Wealth Group LLC now owns 3,069 shares of the bank's stock worth $229,000 after purchasing an additional 128 shares during the period. U.S. Capital Wealth Advisors LLC grew its holdings in shares of Prosperity Bancshares by 4.9% during the first quarter. U.S. Capital Wealth Advisors LLC now owns 3,326 shares of the bank's stock worth $237,000 after buying an additional 156 shares in the last quarter. Tectonic Advisors LLC boosted its holdings in Prosperity Bancshares by 2.0% during the first quarter. Tectonic Advisors LLC now owns 8,319 shares of the bank's stock worth $594,000 after purchasing an additional 165 shares during the last quarter. State of Michigan Retirement System boosted its position in Prosperity Bancshares by 0.9% during the first quarter. State of Michigan Retirement System now owns 22,797 shares of the bank's stock valued at $1,627,000 after purchasing an additional 200 shares during the last quarter. Finally, Forum Financial Management LP grew its holdings in Prosperity Bancshares by 6.2% during the first quarter. Forum Financial Management LP now owns 3,407 shares of the bank's stock worth $243,000 after purchasing an additional 200 shares during the period. Institutional investors own 80.69% of the company's stock.

Insider Buying and Selling

In related news, Director Ned S. Holmes sold 600 shares of the firm's stock in a transaction dated Wednesday, May 21st. The stock was sold at an average price of $70.89, for a total transaction of $42,534.00. Following the completion of the sale, the director directly owned 45,700 shares of the company's stock, valued at approximately $3,239,673. This trade represents a 1.30% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Insiders sold a total of 13,100 shares of company stock worth $925,889 in the last quarter. Company insiders own 4.20% of the company's stock.

Analyst Ratings Changes

Several research analysts have recently commented on PB shares. Keefe, Bruyette & Woods lowered their target price on shares of Prosperity Bancshares from $95.00 to $90.00 and set an "outperform" rating on the stock in a report on Monday, May 5th. Wall Street Zen raised Prosperity Bancshares from a "sell" rating to a "hold" rating in a research report on Tuesday, May 13th. Hovde Group lowered their target price on shares of Prosperity Bancshares from $85.00 to $83.00 and set an "outperform" rating on the stock in a report on Thursday, July 24th. Piper Sandler reduced their price objective on Prosperity Bancshares from $86.00 to $84.00 and set an "overweight" rating on the stock in a research note on Thursday, July 24th. Finally, Royal Bank Of Canada decreased their price objective on Prosperity Bancshares from $85.00 to $78.00 and set a "sector perform" rating for the company in a report on Thursday, April 24th. Seven investment analysts have rated the stock with a hold rating and nine have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average price target of $84.57.

Get Our Latest Analysis on PB

Prosperity Bancshares Trading Down 0.1%

Shares of PB traded down $0.09 during trading hours on Tuesday, reaching $66.11. 207,976 shares of the stock traded hands, compared to its average volume of 670,031. Prosperity Bancshares, Inc. has a 52-week low of $61.57 and a 52-week high of $86.75. The company has a market cap of $6.30 billion, a P/E ratio of 12.01, a price-to-earnings-growth ratio of 0.99 and a beta of 0.71. The company's 50-day moving average price is $70.26 and its two-hundred day moving average price is $71.67.

Prosperity Bancshares (NYSE:PB - Get Free Report) last announced its quarterly earnings results on Wednesday, July 23rd. The bank reported $1.42 EPS for the quarter, topping the consensus estimate of $1.40 by $0.02. Prosperity Bancshares had a net margin of 29.37% and a return on equity of 6.99%. The business had revenue of $310.70 million for the quarter, compared to analysts' expectations of $315.66 million. During the same quarter in the previous year, the company earned $1.22 EPS. On average, research analysts forecast that Prosperity Bancshares, Inc. will post 5.83 EPS for the current year.

Prosperity Bancshares Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, October 1st. Investors of record on Monday, September 15th will be given a dividend of $0.58 per share. The ex-dividend date is Monday, September 15th. This represents a $2.32 dividend on an annualized basis and a yield of 3.5%. Prosperity Bancshares's dividend payout ratio (DPR) is presently 42.18%.

About Prosperity Bancshares

(

Free Report)

Prosperity Bancshares, Inc operates as bank holding company for the Prosperity Bank that provides financial products and services to businesses and consumers. It accepts various deposit products, such as demand, savings, money market, and time accounts, as well as and certificates of deposit. The company also offers 1-4 family residential mortgage, commercial real estate and multifamily residential, commercial and industrial, agricultural, and non-real estate agricultural loans, as well as construction, land development, and other land loans; consumer loans, including automobile, recreational vehicle, boat, home improvement, personal, and deposit account collateralized loans; term loans and lines of credit; and consumer durables and home equity loans, as well as loans for working capital, business expansion, and purchase of equipment and machinery.

Read More

Before you consider Prosperity Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prosperity Bancshares wasn't on the list.

While Prosperity Bancshares currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report