Webster Bank N. A. decreased its position in shares of Lowe's Companies, Inc. (NYSE:LOW - Free Report) by 52.5% during the 2nd quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 2,909 shares of the home improvement retailer's stock after selling 3,218 shares during the period. Webster Bank N. A.'s holdings in Lowe's Companies were worth $645,000 as of its most recent filing with the Securities and Exchange Commission.

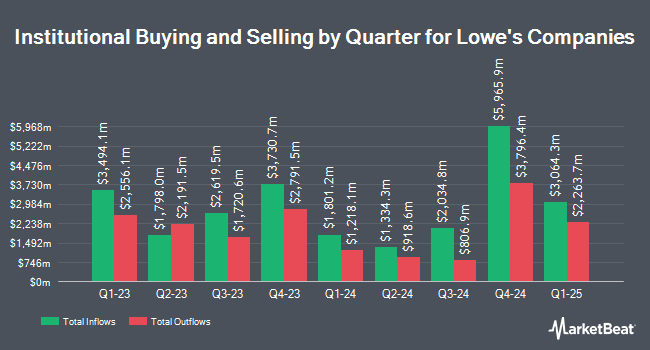

Other large investors have also made changes to their positions in the company. Wood Tarver Financial Group LLC acquired a new stake in shares of Lowe's Companies during the 4th quarter worth approximately $25,000. Fairway Wealth LLC acquired a new stake in shares of Lowe's Companies during the 1st quarter worth approximately $32,000. Orion Capital Management LLC acquired a new stake in shares of Lowe's Companies during the 4th quarter worth approximately $36,000. Inlight Wealth Management LLC acquired a new stake in shares of Lowe's Companies during the 1st quarter worth approximately $36,000. Finally, IFS Advisors LLC boosted its position in shares of Lowe's Companies by 60.0% during the 1st quarter. IFS Advisors LLC now owns 160 shares of the home improvement retailer's stock worth $37,000 after acquiring an additional 60 shares in the last quarter. Institutional investors and hedge funds own 74.06% of the company's stock.

Insider Buying and Selling at Lowe's Companies

In other news, EVP Brandon J. Sink sold 8,192 shares of the business's stock in a transaction dated Friday, September 5th. The shares were sold at an average price of $268.58, for a total transaction of $2,200,207.36. Following the completion of the sale, the executive vice president directly owned 21,603 shares of the company's stock, valued at $5,802,133.74. The trade was a 27.49% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, EVP Juliette Williams Pryor sold 929 shares of the business's stock in a transaction dated Tuesday, August 26th. The stock was sold at an average price of $257.20, for a total transaction of $238,938.80. Following the sale, the executive vice president directly owned 30,099 shares of the company's stock, valued at approximately $7,741,462.80. The trade was a 2.99% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 92,931 shares of company stock valued at $24,945,752. Insiders own 0.27% of the company's stock.

Analysts Set New Price Targets

Several analysts recently issued reports on the stock. JPMorgan Chase & Co. increased their price target on shares of Lowe's Companies from $280.00 to $283.00 and gave the stock an "overweight" rating in a research report on Thursday, August 21st. UBS Group raised their target price on shares of Lowe's Companies from $300.00 to $325.00 and gave the company a "buy" rating in a research report on Thursday, August 21st. Stifel Nicolaus raised their target price on shares of Lowe's Companies from $240.00 to $265.00 and gave the company a "hold" rating in a research report on Monday, August 18th. KeyCorp lifted their price target on shares of Lowe's Companies from $266.00 to $300.00 and gave the stock an "overweight" rating in a report on Thursday, August 21st. Finally, Telsey Advisory Group reiterated an "outperform" rating and set a $305.00 price target on shares of Lowe's Companies in a report on Thursday, August 21st. Sixteen analysts have rated the stock with a Buy rating, nine have issued a Hold rating and one has assigned a Sell rating to the company. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $284.13.

View Our Latest Research Report on Lowe's Companies

Lowe's Companies Trading Down 0.2%

LOW opened at $271.89 on Monday. Lowe's Companies, Inc. has a 1-year low of $206.38 and a 1-year high of $287.01. The company has a market cap of $152.48 billion, a P/E ratio of 22.34, a price-to-earnings-growth ratio of 2.52 and a beta of 0.87. The company has a fifty day moving average price of $243.26 and a two-hundred day moving average price of $231.63.

Lowe's Companies (NYSE:LOW - Get Free Report) last posted its quarterly earnings results on Wednesday, August 20th. The home improvement retailer reported $4.33 earnings per share for the quarter, beating the consensus estimate of $4.24 by $0.09. Lowe's Companies had a net margin of 8.20% and a negative return on equity of 52.02%. The firm had revenue of $23.96 billion during the quarter, compared to the consensus estimate of $23.99 billion. During the same period in the previous year, the firm posted $4.10 earnings per share. The business's revenue was up 1.6% compared to the same quarter last year. Lowe's Companies has set its FY 2025 guidance at 12.200-12.450 EPS. On average, research analysts forecast that Lowe's Companies, Inc. will post 11.9 EPS for the current fiscal year.

Lowe's Companies Cuts Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, November 5th. Stockholders of record on Wednesday, October 22nd will be given a dividend of $0.012 per share. The ex-dividend date of this dividend is Wednesday, October 22nd. This represents a $0.05 annualized dividend and a dividend yield of 0.0%. Lowe's Companies's payout ratio is presently 39.44%.

Lowe's Companies Company Profile

(

Free Report)

Lowe's Companies, Inc, together with its subsidiaries, operates as a home improvement retailer in the United States. The company offers a line of products for construction, maintenance, repair, remodeling, and decorating. It also provides home improvement products, such as appliances, seasonal and outdoor living, lawn and garden, lumber, kitchens and bath, tools, paint, millwork, hardware, flooring, rough plumbing, building materials, décor, and electrical.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lowe's Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lowe's Companies wasn't on the list.

While Lowe's Companies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report