Wedbush Securities Inc. raised its position in Quanta Services, Inc. (NYSE:PWR - Free Report) by 40.4% during the 1st quarter, according to its most recent filing with the SEC. The firm owned 3,017 shares of the construction company's stock after buying an additional 868 shares during the quarter. Wedbush Securities Inc.'s holdings in Quanta Services were worth $767,000 as of its most recent filing with the SEC.

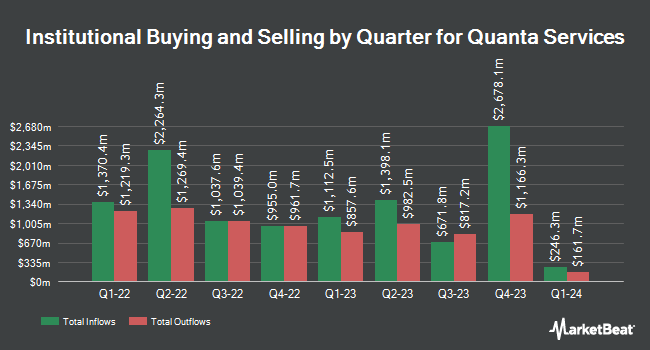

Several other institutional investors also recently bought and sold shares of PWR. Capital World Investors boosted its position in shares of Quanta Services by 14.1% during the 4th quarter. Capital World Investors now owns 7,223,471 shares of the construction company's stock worth $2,282,978,000 after purchasing an additional 891,977 shares in the last quarter. Geode Capital Management LLC boosted its position in shares of Quanta Services by 2.9% during the 4th quarter. Geode Capital Management LLC now owns 3,558,827 shares of the construction company's stock worth $1,121,830,000 after purchasing an additional 99,416 shares in the last quarter. Invesco Ltd. boosted its position in shares of Quanta Services by 3.7% during the 4th quarter. Invesco Ltd. now owns 1,913,847 shares of the construction company's stock worth $604,871,000 after purchasing an additional 68,565 shares in the last quarter. Norges Bank purchased a new stake in shares of Quanta Services during the 4th quarter worth $544,937,000. Finally, Bank of America Corp DE boosted its position in shares of Quanta Services by 42.8% during the 4th quarter. Bank of America Corp DE now owns 1,691,652 shares of the construction company's stock worth $534,647,000 after purchasing an additional 506,722 shares in the last quarter. 90.49% of the stock is owned by institutional investors and hedge funds.

Quanta Services Trading Down 2.2%

Shares of NYSE PWR traded down $9.44 during midday trading on Monday, hitting $412.24. The stock had a trading volume of 1,250,201 shares, compared to its average volume of 1,429,452. The company has a quick ratio of 1.26, a current ratio of 1.31 and a debt-to-equity ratio of 0.58. Quanta Services, Inc. has a 1-year low of $227.08 and a 1-year high of $424.94. The company has a market capitalization of $61.12 billion, a price-to-earnings ratio of 66.49, a PEG ratio of 2.90 and a beta of 1.08. The company has a fifty day moving average price of $368.62 and a 200 day moving average price of $315.86.

Quanta Services (NYSE:PWR - Get Free Report) last announced its quarterly earnings results on Thursday, May 1st. The construction company reported $1.78 earnings per share for the quarter, beating analysts' consensus estimates of $1.72 by $0.06. Quanta Services had a net margin of 3.74% and a return on equity of 18.06%. The firm had revenue of $6.23 billion for the quarter, compared to analysts' expectations of $5.88 billion. During the same period in the previous year, the company posted $1.41 earnings per share. Quanta Services's revenue was up 23.9% compared to the same quarter last year. On average, analysts predict that Quanta Services, Inc. will post 9.34 earnings per share for the current year.

Quanta Services Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, July 11th. Investors of record on Tuesday, July 1st were issued a dividend of $0.10 per share. The ex-dividend date of this dividend was Tuesday, July 1st. This represents a $0.40 annualized dividend and a dividend yield of 0.10%. Quanta Services's payout ratio is 6.45%.

Wall Street Analysts Forecast Growth

Several equities research analysts recently commented on PWR shares. Seaport Res Ptn upgraded shares of Quanta Services to a "hold" rating in a research report on Thursday, July 10th. JPMorgan Chase & Co. upped their price target on shares of Quanta Services from $345.00 to $392.00 and gave the company a "neutral" rating in a report on Tuesday, July 22nd. Piper Sandler reissued an "overweight" rating and set a $370.00 price objective (up from $360.00) on shares of Quanta Services in a research note on Tuesday, May 27th. The Goldman Sachs Group reaffirmed a "buy" rating and issued a $414.00 target price (up previously from $364.00) on shares of Quanta Services in a research note on Wednesday, June 4th. Finally, TD Cowen raised their price target on Quanta Services from $335.00 to $355.00 and gave the stock a "buy" rating in a research report on Wednesday, May 7th. Eleven analysts have rated the stock with a hold rating, thirteen have given a buy rating and two have issued a strong buy rating to the company. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus target price of $364.52.

Check Out Our Latest Research Report on PWR

Quanta Services Profile

(

Free Report)

Quanta Services, Inc provides infrastructure solutions for the electric and gas utility, renewable energy, communications, and pipeline and energy industries in the United States, Canada, Australia, and internationally. The company's Electric Power Infrastructure Solutions segment engages in the design, procurement, construction, upgrade, repair, and maintenance of electric power transmission and distribution infrastructure and substation facilities; installation, maintenance, and upgrade of electric power infrastructure projects; installation of smart grid technologies on electric power networks; and design, installation, maintenance, and repair of commercial and industrial wirings.

See Also

Before you consider Quanta Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Quanta Services wasn't on the list.

While Quanta Services currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.