Wedge Capital Management L L P NC boosted its stake in Louisiana-Pacific Corporation (NYSE:LPX - Free Report) by 8.6% during the 2nd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 75,495 shares of the building manufacturing company's stock after acquiring an additional 5,951 shares during the period. Wedge Capital Management L L P NC owned 0.11% of Louisiana-Pacific worth $6,492,000 as of its most recent SEC filing.

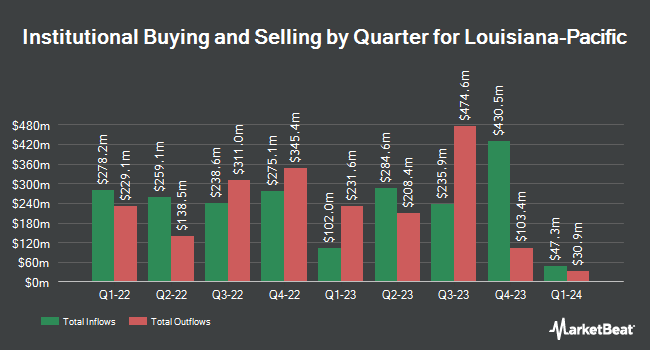

Several other institutional investors have also recently added to or reduced their stakes in the stock. 59 North Capital Management LP increased its position in Louisiana-Pacific by 32.1% in the 1st quarter. 59 North Capital Management LP now owns 2,618,643 shares of the building manufacturing company's stock valued at $240,863,000 after acquiring an additional 635,817 shares during the period. Eminence Capital LP increased its position in Louisiana-Pacific by 16.0% in the 1st quarter. Eminence Capital LP now owns 1,675,943 shares of the building manufacturing company's stock valued at $154,153,000 after acquiring an additional 230,837 shares during the period. Palestra Capital Management LLC increased its position in Louisiana-Pacific by 173.5% in the 1st quarter. Palestra Capital Management LLC now owns 911,621 shares of the building manufacturing company's stock valued at $83,851,000 after acquiring an additional 578,248 shares during the period. T. Rowe Price Investment Management Inc. increased its position in Louisiana-Pacific by 6.0% in the 1st quarter. T. Rowe Price Investment Management Inc. now owns 684,998 shares of the building manufacturing company's stock valued at $63,007,000 after acquiring an additional 38,801 shares during the period. Finally, Allianz Asset Management GmbH increased its position in Louisiana-Pacific by 252.2% in the 1st quarter. Allianz Asset Management GmbH now owns 682,164 shares of the building manufacturing company's stock valued at $62,746,000 after acquiring an additional 488,458 shares during the period. Institutional investors and hedge funds own 94.73% of the company's stock.

Insider Buying and Selling at Louisiana-Pacific

In other news, Director Ozey K. Horton, Jr. sold 500 shares of the firm's stock in a transaction that occurred on Thursday, August 14th. The stock was sold at an average price of $101.00, for a total value of $50,500.00. Following the transaction, the director owned 29,728 shares in the company, valued at $3,002,528. This trade represents a 1.65% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this link. 1.42% of the stock is currently owned by company insiders.

Louisiana-Pacific Trading Down 0.4%

Shares of NYSE LPX traded down $0.38 during trading hours on Tuesday, hitting $86.51. 225,351 shares of the company traded hands, compared to its average volume of 748,135. The company's 50 day moving average price is $93.32 and its 200 day moving average price is $90.96. The stock has a market capitalization of $6.02 billion, a price-to-earnings ratio of 20.38, a price-to-earnings-growth ratio of 1.97 and a beta of 1.84. The company has a current ratio of 2.84, a quick ratio of 1.67 and a debt-to-equity ratio of 0.20. Louisiana-Pacific Corporation has a 12 month low of $78.82 and a 12 month high of $122.87.

Louisiana-Pacific (NYSE:LPX - Get Free Report) last issued its earnings results on Wednesday, August 6th. The building manufacturing company reported $0.99 earnings per share for the quarter, topping the consensus estimate of $0.97 by $0.02. Louisiana-Pacific had a return on equity of 18.67% and a net margin of 10.34%.The business had revenue of $755.00 million during the quarter, compared to analysts' expectations of $751.15 million. During the same period in the prior year, the business earned $2.09 EPS. The business's revenue for the quarter was down 7.2% compared to the same quarter last year. On average, equities research analysts anticipate that Louisiana-Pacific Corporation will post 5.27 earnings per share for the current fiscal year.

Louisiana-Pacific Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Friday, August 29th. Shareholders of record on Friday, August 15th were issued a $0.28 dividend. This represents a $1.12 annualized dividend and a yield of 1.3%. The ex-dividend date of this dividend was Friday, August 15th. Louisiana-Pacific's dividend payout ratio (DPR) is presently 26.42%.

Analyst Ratings Changes

Several equities analysts have issued reports on LPX shares. Wall Street Zen cut Louisiana-Pacific from a "hold" rating to a "sell" rating in a research report on Sunday, August 3rd. Truist Financial lowered their price target on Louisiana-Pacific from $111.00 to $108.00 and set a "buy" rating on the stock in a report on Friday, July 11th. Finally, DA Davidson lowered their price target on Louisiana-Pacific from $123.00 to $117.00 and set a "buy" rating on the stock in a report on Wednesday, June 25th. Four analysts have rated the stock with a Buy rating, two have given a Hold rating and one has given a Sell rating to the company. Based on data from MarketBeat, Louisiana-Pacific has an average rating of "Hold" and an average target price of $110.57.

Check Out Our Latest Analysis on LPX

About Louisiana-Pacific

(

Free Report)

Louisiana-Pacific Corporation, together with its subsidiaries, provides building solutions primarily for use in new home construction, repair and remodeling, and outdoor structure markets. It operates through Siding, Oriented Strand Board, LP South America, and Other segments. The Siding segment offers LP SmartSide trim and siding products, LP SmartSide ExpertFinish trim and siding products, LP BuilderSeries lap siding products, and LP Outdoor Building Solutions; and engineered wood siding, trim, soffit, and fascia products.

Featured Articles

Before you consider Louisiana-Pacific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Louisiana-Pacific wasn't on the list.

While Louisiana-Pacific currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.