Wedge Capital Management L L P NC acquired a new stake in Sensata Technologies Holding plc (NYSE:ST - Free Report) in the 1st quarter, according to the company in its most recent filing with the SEC. The fund acquired 108,117 shares of the scientific and technical instruments company's stock, valued at approximately $2,624,000. Wedge Capital Management L L P NC owned about 0.07% of Sensata Technologies as of its most recent filing with the SEC.

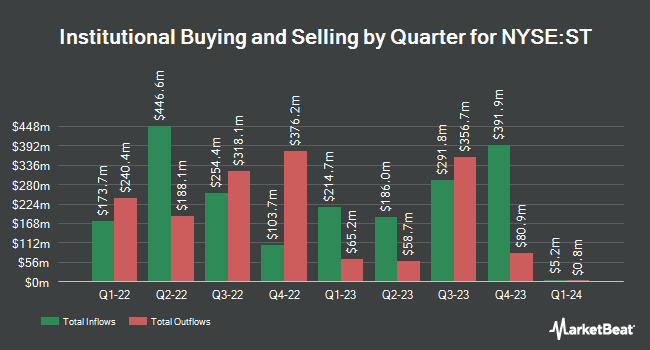

Other institutional investors have also recently bought and sold shares of the company. Blue Trust Inc. raised its position in Sensata Technologies by 738.7% in the 4th quarter. Blue Trust Inc. now owns 931 shares of the scientific and technical instruments company's stock valued at $26,000 after purchasing an additional 820 shares during the last quarter. Brown Brothers Harriman & Co. bought a new position in Sensata Technologies in the 4th quarter valued at $27,000. Parallel Advisors LLC raised its position in Sensata Technologies by 278.8% in the 1st quarter. Parallel Advisors LLC now owns 1,519 shares of the scientific and technical instruments company's stock valued at $37,000 after purchasing an additional 1,118 shares during the last quarter. UMB Bank n.a. raised its position in Sensata Technologies by 110.0% in the 1st quarter. UMB Bank n.a. now owns 1,873 shares of the scientific and technical instruments company's stock valued at $45,000 after purchasing an additional 981 shares during the last quarter. Finally, Venturi Wealth Management LLC raised its position in Sensata Technologies by 67.6% in the 4th quarter. Venturi Wealth Management LLC now owns 2,026 shares of the scientific and technical instruments company's stock valued at $56,000 after purchasing an additional 817 shares during the last quarter. Institutional investors own 99.42% of the company's stock.

Insider Transactions at Sensata Technologies

In related news, Director Andrew C. Teich purchased 9,925 shares of Sensata Technologies stock in a transaction that occurred on Friday, May 23rd. The stock was purchased at an average cost of $25.19 per share, with a total value of $250,010.75. Following the completion of the transaction, the director now owns 41,117 shares of the company's stock, valued at approximately $1,035,737.23. This trade represents a 31.82% increase in their position. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. 0.89% of the stock is owned by insiders.

Sensata Technologies Trading Down 4.4%

Shares of Sensata Technologies stock traded down $1.26 during trading hours on Friday, hitting $27.50. The company's stock had a trading volume of 1,885,982 shares, compared to its average volume of 1,694,894. Sensata Technologies Holding plc has a 12 month low of $17.32 and a 12 month high of $42.33. The stock has a 50 day moving average of $23.62 and a 200 day moving average of $26.47. The company has a market capitalization of $4.02 billion, a PE ratio of 32.74, a price-to-earnings-growth ratio of 1.25 and a beta of 1.10. The company has a debt-to-equity ratio of 1.11, a current ratio of 2.85 and a quick ratio of 1.99.

Sensata Technologies (NYSE:ST - Get Free Report) last announced its quarterly earnings results on Thursday, May 8th. The scientific and technical instruments company reported $0.78 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.72 by $0.06. Sensata Technologies had a return on equity of 17.54% and a net margin of 3.27%. The company had revenue of $911.26 million during the quarter, compared to the consensus estimate of $878.39 million. During the same period in the prior year, the company earned $0.89 earnings per share. The company's revenue for the quarter was down 9.5% compared to the same quarter last year. Analysts predict that Sensata Technologies Holding plc will post 3.21 earnings per share for the current year.

Sensata Technologies Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Wednesday, May 28th. Stockholders of record on Wednesday, May 14th were given a dividend of $0.12 per share. The ex-dividend date of this dividend was Wednesday, May 14th. This represents a $0.48 annualized dividend and a dividend yield of 1.75%. Sensata Technologies's dividend payout ratio is currently 59.26%.

Analysts Set New Price Targets

A number of equities research analysts have recently weighed in on the company. Oppenheimer dropped their target price on Sensata Technologies from $44.00 to $40.00 and set an "outperform" rating for the company in a research report on Thursday, February 13th. JPMorgan Chase & Co. dropped their target price on Sensata Technologies from $27.00 to $21.00 and set an "underweight" rating for the company in a research report on Thursday, April 17th. Wells Fargo & Company boosted their target price on Sensata Technologies from $23.00 to $26.00 and gave the stock an "equal weight" rating in a research report on Monday, May 19th. Robert W. Baird dropped their target price on Sensata Technologies from $24.00 to $23.00 and set a "neutral" rating for the company in a research report on Tuesday, April 15th. Finally, UBS Group dropped their target price on Sensata Technologies from $37.00 to $30.00 and set a "buy" rating for the company in a research report on Thursday, April 10th. One research analyst has rated the stock with a sell rating, seven have issued a hold rating and five have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus price target of $34.08.

View Our Latest Analysis on ST

Sensata Technologies Profile

(

Free Report)

Sensata Technologies Holding plc develops, manufactures, and sells sensors and sensor-rich solutions, electrical protection components and systems, and other products used in mission-critical systems and applications in the United States and internationally. It operates in two segments, Performance Sensing and Sensing Solutions.

Featured Stories

Before you consider Sensata Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sensata Technologies wasn't on the list.

While Sensata Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.