Wellington Management Group LLP increased its stake in AeroVironment, Inc. (NASDAQ:AVAV - Free Report) by 26.3% during the first quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 162,141 shares of the aerospace company's stock after purchasing an additional 33,768 shares during the quarter. Wellington Management Group LLP owned approximately 0.57% of AeroVironment worth $19,326,000 at the end of the most recent quarter.

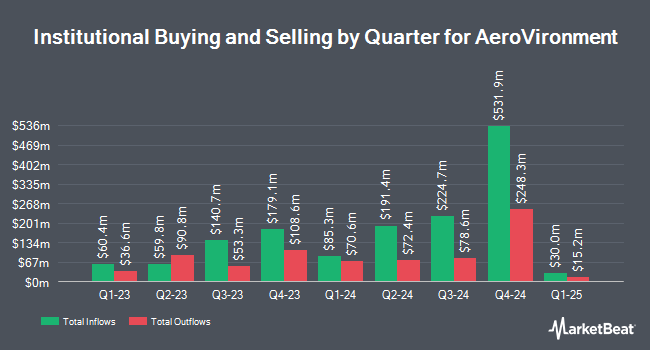

A number of other institutional investors also recently bought and sold shares of the stock. Corient IA LLC bought a new position in AeroVironment in the 1st quarter worth $298,000. Tocqueville Asset Management L.P. bought a new position in AeroVironment in the 1st quarter worth $16,802,000. Sit Investment Associates Inc. raised its holdings in AeroVironment by 13.1% during the first quarter. Sit Investment Associates Inc. now owns 26,260 shares of the aerospace company's stock valued at $3,130,000 after acquiring an additional 3,040 shares during the period. Russell Investments Group Ltd. raised its holdings in AeroVironment by 3.7% during the first quarter. Russell Investments Group Ltd. now owns 68,691 shares of the aerospace company's stock valued at $8,214,000 after acquiring an additional 2,433 shares during the period. Finally, HighTower Advisors LLC raised its holdings in AeroVironment by 11.4% during the first quarter. HighTower Advisors LLC now owns 8,699 shares of the aerospace company's stock valued at $1,037,000 after acquiring an additional 893 shares during the period. 86.38% of the stock is owned by institutional investors.

Insider Activity

In other AeroVironment news, CEO Wahid Nawabi sold 17,300 shares of the business's stock in a transaction that occurred on Wednesday, July 16th. The stock was sold at an average price of $263.05, for a total transaction of $4,550,765.00. Following the completion of the transaction, the chief executive officer owned 122,233 shares in the company, valued at $32,153,390.65. The trade was a 12.40% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. 0.81% of the stock is owned by company insiders.

Analyst Upgrades and Downgrades

A number of equities research analysts have commented on AVAV shares. The Goldman Sachs Group started coverage on AeroVironment in a report on Monday, June 30th. They set a "buy" rating and a $301.00 price target on the stock. Citigroup started coverage on AeroVironment in a report on Monday, August 4th. They set an "outperform" rating on the stock. KeyCorp started coverage on AeroVironment in a report on Sunday, June 29th. They set an "overweight" rating on the stock. Stifel Nicolaus started coverage on AeroVironment in a report on Tuesday, June 24th. They set a "buy" rating and a $240.00 price target on the stock. Finally, William Blair started coverage on AeroVironment in a report on Sunday, June 29th. They set an "outperform" rating on the stock. Three equities research analysts have rated the stock with a Strong Buy rating and sixteen have issued a Buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Buy" and a consensus target price of $286.46.

Get Our Latest Report on AeroVironment

AeroVironment Trading Up 0.5%

AVAV opened at $241.15 on Tuesday. The firm has a market cap of $12.04 billion, a P/E ratio of 155.58 and a beta of 0.99. AeroVironment, Inc. has a 12 month low of $102.25 and a 12 month high of $295.90. The company has a current ratio of 3.52, a quick ratio of 2.69 and a debt-to-equity ratio of 0.03. The stock has a 50-day moving average of $248.72 and a 200 day moving average of $185.72.

AeroVironment (NASDAQ:AVAV - Get Free Report) last released its quarterly earnings results on Tuesday, June 24th. The aerospace company reported $1.61 EPS for the quarter, topping the consensus estimate of $1.41 by $0.20. The company had revenue of $275.05 million during the quarter, compared to analyst estimates of $242.69 million. AeroVironment had a return on equity of 10.68% and a net margin of 5.32%.The firm's revenue was up 39.6% on a year-over-year basis. During the same quarter last year, the business posted $0.43 earnings per share. AeroVironment has set its FY 2026 guidance at 2.800-3.000 EPS. As a group, research analysts forecast that AeroVironment, Inc. will post 3.38 EPS for the current year.

AeroVironment Company Profile

(

Free Report)

AeroVironment, Inc designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally. It operates through Small Unmanned Aircraft Systems (SUAS), Tactical Missile System (TMS), Medium Unmanned Aircraft Systems (MUAS), and High Altitude Pseudo-Satellite Systems (HAPS) segments.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider AeroVironment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AeroVironment wasn't on the list.

While AeroVironment currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.