Wellington Management Group LLP boosted its position in Air Lease Corporation (NYSE:AL - Free Report) by 1.3% in the first quarter, according to its most recent filing with the SEC. The institutional investor owned 5,453,859 shares of the transportation company's stock after purchasing an additional 69,629 shares during the period. Wellington Management Group LLP owned about 4.88% of Air Lease worth $263,476,000 as of its most recent SEC filing.

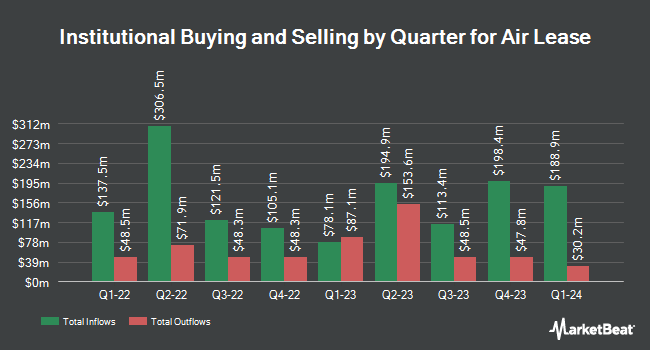

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Dimensional Fund Advisors LP boosted its stake in shares of Air Lease by 0.5% in the 1st quarter. Dimensional Fund Advisors LP now owns 6,592,510 shares of the transportation company's stock worth $318,479,000 after buying an additional 31,274 shares during the last quarter. JPMorgan Chase & Co. boosted its position in Air Lease by 1.2% in the first quarter. JPMorgan Chase & Co. now owns 5,025,421 shares of the transportation company's stock worth $242,778,000 after purchasing an additional 60,216 shares during the last quarter. American Century Companies Inc. boosted its position in Air Lease by 10.4% in the first quarter. American Century Companies Inc. now owns 3,563,297 shares of the transportation company's stock worth $172,143,000 after purchasing an additional 336,376 shares during the last quarter. Allspring Global Investments Holdings LLC grew its stake in Air Lease by 19.7% in the 1st quarter. Allspring Global Investments Holdings LLC now owns 3,353,803 shares of the transportation company's stock valued at $162,492,000 after purchasing an additional 553,080 shares during the period. Finally, Earnest Partners LLC increased its position in shares of Air Lease by 0.4% during the 4th quarter. Earnest Partners LLC now owns 2,577,931 shares of the transportation company's stock valued at $124,282,000 after purchasing an additional 9,809 shares during the last quarter. Hedge funds and other institutional investors own 94.59% of the company's stock.

Insiders Place Their Bets

In other Air Lease news, EVP David Beker sold 2,000 shares of the business's stock in a transaction on Thursday, August 7th. The shares were sold at an average price of $55.44, for a total transaction of $110,880.00. Following the sale, the executive vice president owned 19,770 shares of the company's stock, valued at $1,096,048.80. The trade was a 9.19% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Corporate insiders own 6.64% of the company's stock.

Air Lease Stock Performance

AL traded up $1.12 during trading hours on Friday, hitting $59.98. The stock had a trading volume of 565,718 shares, compared to its average volume of 855,421. Air Lease Corporation has a 1 year low of $38.25 and a 1 year high of $60.59. The company's fifty day simple moving average is $57.46 and its 200 day simple moving average is $52.13. The stock has a market cap of $6.70 billion, a PE ratio of 7.28, a price-to-earnings-growth ratio of 0.62 and a beta of 1.41. The company has a quick ratio of 0.42, a current ratio of 0.42 and a debt-to-equity ratio of 2.47.

Air Lease (NYSE:AL - Get Free Report) last released its quarterly earnings data on Monday, August 4th. The transportation company reported $1.40 EPS for the quarter, beating the consensus estimate of $1.33 by $0.07. The business had revenue of $731.70 million for the quarter, compared to the consensus estimate of $723.35 million. Air Lease had a net margin of 34.04% and a return on equity of 7.99%. The company's revenue was up 9.7% compared to the same quarter last year. During the same period in the prior year, the firm earned $1.23 earnings per share. Equities analysts anticipate that Air Lease Corporation will post 5.16 earnings per share for the current year.

Air Lease Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, October 8th. Investors of record on Wednesday, September 3rd will be issued a $0.22 dividend. The ex-dividend date of this dividend is Wednesday, September 3rd. This represents a $0.88 annualized dividend and a yield of 1.5%. Air Lease's dividend payout ratio (DPR) is 10.68%.

Analyst Ratings Changes

AL has been the topic of a number of research analyst reports. Wall Street Zen raised shares of Air Lease from a "hold" rating to a "buy" rating in a report on Wednesday, May 7th. Citigroup upgraded shares of Air Lease from a "neutral" rating to a "buy" rating and boosted their target price for the company from $45.00 to $68.00 in a research note on Tuesday, May 20th. Finally, Barclays reissued an "overweight" rating and set a $67.00 target price (up from $56.00) on shares of Air Lease in a research report on Thursday, July 10th. Four analysts have rated the stock with a Buy rating and one has assigned a Sell rating to the company. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $59.50.

View Our Latest Analysis on Air Lease

Air Lease Company Profile

(

Free Report)

Air Lease Corporation, an aircraft leasing company, engages in the purchase and leasing of commercial jet aircraft to airlines worldwide. It sells aircraft from its fleet to third parties, including other leasing companies, financial services companies, airlines, and other investors. The company provides fleet management services to investors and owners of aircraft portfolios.

Further Reading

Before you consider Air Lease, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Air Lease wasn't on the list.

While Air Lease currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.