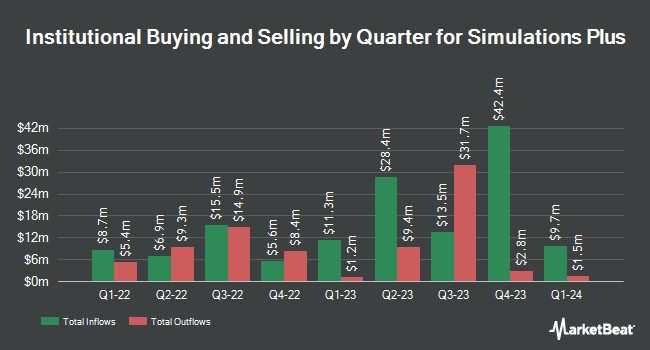

Wellington Management Group LLP purchased a new stake in Simulations Plus, Inc. (NASDAQ:SLP - Free Report) in the first quarter, according to its most recent Form 13F filing with the SEC. The institutional investor purchased 100,255 shares of the technology company's stock, valued at approximately $2,458,000. Wellington Management Group LLP owned about 0.50% of Simulations Plus at the end of the most recent quarter.

Several other hedge funds and other institutional investors also recently made changes to their positions in SLP. Conestoga Capital Advisors LLC lifted its position in shares of Simulations Plus by 17.2% in the first quarter. Conestoga Capital Advisors LLC now owns 2,609,388 shares of the technology company's stock worth $63,982,000 after purchasing an additional 383,126 shares in the last quarter. Ameriprise Financial Inc. raised its position in shares of Simulations Plus by 16.7% in the fourth quarter. Ameriprise Financial Inc. now owns 607,902 shares of the technology company's stock valued at $16,954,000 after purchasing an additional 86,868 shares during the period. Janus Henderson Group PLC grew its stake in shares of Simulations Plus by 7,753.3% in the fourth quarter. Janus Henderson Group PLC now owns 542,899 shares of the technology company's stock worth $15,141,000 after acquiring an additional 535,986 shares during the last quarter. Dimensional Fund Advisors LP grew its position in Simulations Plus by 6.1% in the 4th quarter. Dimensional Fund Advisors LP now owns 419,241 shares of the technology company's stock worth $11,693,000 after purchasing an additional 24,266 shares during the last quarter. Finally, Northern Trust Corp grew its position in Simulations Plus by 10.0% in the 4th quarter. Northern Trust Corp now owns 236,373 shares of the technology company's stock worth $6,592,000 after purchasing an additional 21,453 shares during the last quarter. 78.08% of the stock is currently owned by institutional investors and hedge funds.

Simulations Plus Stock Performance

Shares of Simulations Plus stock traded up $0.01 on Friday, hitting $14.13. The stock had a trading volume of 62,719 shares, compared to its average volume of 426,537. The stock has a 50 day moving average of $14.61 and a 200 day moving average of $23.48. Simulations Plus, Inc. has a twelve month low of $12.39 and a twelve month high of $37.67. The firm has a market capitalization of $284.42 million, a P/E ratio of -4.48 and a beta of 0.85.

Simulations Plus (NASDAQ:SLP - Get Free Report) last announced its quarterly earnings data on Monday, July 14th. The technology company reported $0.45 EPS for the quarter, topping the consensus estimate of $0.26 by $0.19. The company had revenue of $20.36 million during the quarter, compared to the consensus estimate of $22.83 million. Simulations Plus had a negative net margin of 78.63% and a positive return on equity of 11.62%. The company's quarterly revenue was up 9.8% on a year-over-year basis. During the same quarter last year, the firm posted $0.27 EPS. Equities analysts expect that Simulations Plus, Inc. will post 1.09 earnings per share for the current year.

Wall Street Analyst Weigh In

SLP has been the topic of a number of recent analyst reports. Stephens reduced their price target on shares of Simulations Plus from $28.00 to $20.00 and set an "overweight" rating on the stock in a research report on Tuesday, July 15th. JMP Securities reiterated a "market perform" rating on shares of Simulations Plus in a research report on Wednesday, June 18th. Craig Hallum cut their price target on shares of Simulations Plus from $45.00 to $36.00 and set a "buy" rating on the stock in a research report on Friday, June 13th. William Blair reiterated an "outperform" rating on shares of Simulations Plus in a report on Tuesday, July 15th. Finally, BTIG Research decreased their price target on shares of Simulations Plus from $41.00 to $25.00 and set a "buy" rating for the company in a research note on Monday, July 7th. Four investment analysts have rated the stock with a Buy rating and three have given a Hold rating to the company. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $26.50.

Get Our Latest Report on SLP

Simulations Plus Company Profile

(

Free Report)

Simulations Plus, Inc develops drug discovery and development software for modeling and simulation, and prediction of molecular properties utilizing artificial intelligence and machine learning based technology worldwide. The company operates through two segments, Software and Services. It offers GastroPlus, which simulates the absorption and drug interaction of compounds administered to humans and animals; and DDDPlus and MembranePlus simulation products.

Recommended Stories

Before you consider Simulations Plus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Simulations Plus wasn't on the list.

While Simulations Plus currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.