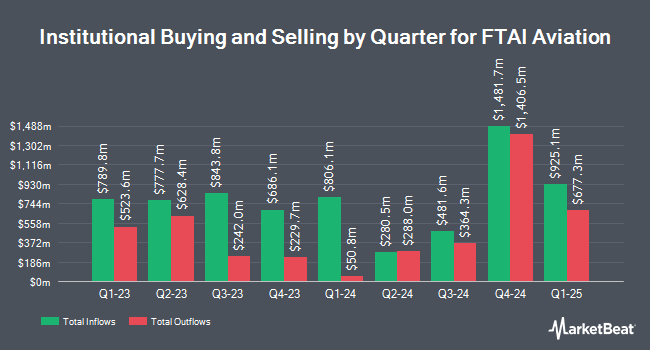

Wellington Management Group LLP raised its stake in FTAI Aviation Ltd. (NASDAQ:FTAI - Free Report) by 159.6% during the first quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 2,347,633 shares of the financial services provider's stock after buying an additional 1,443,440 shares during the period. Wellington Management Group LLP owned about 2.29% of FTAI Aviation worth $260,658,000 as of its most recent SEC filing.

A number of other institutional investors have also recently made changes to their positions in the stock. Envestnet Asset Management Inc. boosted its position in shares of FTAI Aviation by 3.2% during the 4th quarter. Envestnet Asset Management Inc. now owns 38,598 shares of the financial services provider's stock valued at $5,560,000 after purchasing an additional 1,207 shares in the last quarter. NewEdge Advisors LLC bought a new stake in shares of FTAI Aviation during the 4th quarter valued at about $145,000. Canada Pension Plan Investment Board bought a new stake in shares of FTAI Aviation during the 4th quarter valued at about $3,408,000. Dimensional Fund Advisors LP boosted its position in shares of FTAI Aviation by 182.1% during the 4th quarter. Dimensional Fund Advisors LP now owns 238,184 shares of the financial services provider's stock valued at $34,175,000 after purchasing an additional 153,738 shares in the last quarter. Finally, Curi RMB Capital LLC bought a new stake in shares of FTAI Aviation during the 4th quarter valued at about $370,000. Institutional investors own 88.96% of the company's stock.

Analyst Ratings Changes

Several equities research analysts recently commented on the company. Stifel Nicolaus upgraded FTAI Aviation from a "hold" rating to a "buy" rating and set a $123.00 target price on the stock in a research report on Friday, May 2nd. Wall Street Zen upgraded FTAI Aviation from a "hold" rating to a "buy" rating in a research report on Saturday, August 2nd. Morgan Stanley upped their target price on FTAI Aviation from $138.00 to $175.00 and gave the company an "overweight" rating in a research report on Wednesday, August 20th. Citigroup restated a "buy" rating on shares of FTAI Aviation in a research report on Thursday, July 10th. Finally, JMP Securities upped their target price on FTAI Aviation from $180.00 to $205.00 and gave the company a "market outperform" rating in a research report on Wednesday, August 6th. One analyst has rated the stock with a Strong Buy rating, twelve have issued a Buy rating and one has given a Hold rating to the company. According to data from MarketBeat.com, the company presently has a consensus rating of "Buy" and an average target price of $182.83.

Get Our Latest Report on FTAI Aviation

FTAI Aviation Stock Down 0.1%

NASDAQ:FTAI traded down $0.10 on Monday, hitting $147.61. The stock had a trading volume of 236,919 shares, compared to its average volume of 2,251,293. The business's fifty day moving average is $126.11 and its 200 day moving average is $116.50. The company has a market cap of $15.14 billion, a PE ratio of 36.54 and a beta of 1.61. FTAI Aviation Ltd. has a 52 week low of $75.06 and a 52 week high of $181.64.

FTAI Aviation (NASDAQ:FTAI - Get Free Report) last announced its quarterly earnings results on Tuesday, July 29th. The financial services provider reported $1.57 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.33 by $0.24. The business had revenue of $676.24 million for the quarter, compared to analyst estimates of $754.75 million. FTAI Aviation had a return on equity of 465.13% and a net margin of 21.31%.The company's quarterly revenue was up 52.4% on a year-over-year basis. During the same quarter in the prior year, the company earned ($2.26) earnings per share. Equities analysts predict that FTAI Aviation Ltd. will post 2.2 earnings per share for the current fiscal year.

FTAI Aviation Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, August 19th. Stockholders of record on Tuesday, August 12th were paid a $0.30 dividend. The ex-dividend date of this dividend was Tuesday, August 12th. This represents a $1.20 annualized dividend and a dividend yield of 0.8%. FTAI Aviation's dividend payout ratio is 29.70%.

FTAI Aviation Profile

(

Free Report)

FTAI Aviation Ltd. owns and acquires aviation and offshore energy equipment for the transportation of goods and people worldwide. It operates through two segments, Aviation Leasing and Aerospace Products. The Aviation Leasing segment owns and manages aviation assets, including aircraft and aircraft engines, which it leases and sells to customers.

See Also

Before you consider FTAI Aviation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FTAI Aviation wasn't on the list.

While FTAI Aviation currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.