Charles Schwab Investment Management Inc. raised its stake in Welltower Inc. (NYSE:WELL - Free Report) by 14.4% in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 6,956,594 shares of the real estate investment trust's stock after acquiring an additional 877,856 shares during the quarter. Charles Schwab Investment Management Inc. owned approximately 1.06% of Welltower worth $1,065,820,000 as of its most recent SEC filing.

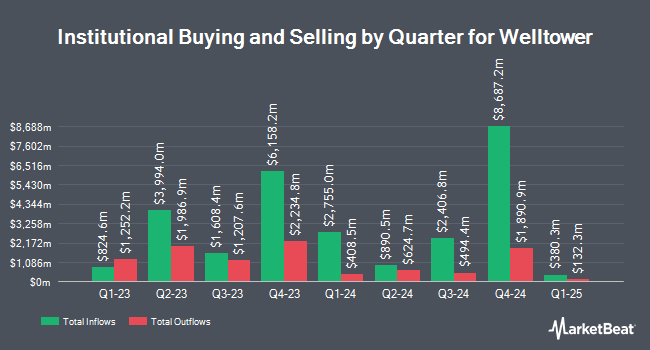

A number of other hedge funds also recently made changes to their positions in the stock. ASR Vermogensbeheer N.V. bought a new position in Welltower in the first quarter valued at about $7,203,000. Greykasell Wealth Strategies Inc. bought a new stake in shares of Welltower during the first quarter worth about $176,000. Primecap Management Co. CA acquired a new position in shares of Welltower in the first quarter valued at approximately $6,052,000. Strategy Asset Managers LLC acquired a new position in shares of Welltower in the first quarter valued at approximately $550,000. Finally, Goldman Sachs Group Inc. raised its holdings in Welltower by 27.9% in the 1st quarter. Goldman Sachs Group Inc. now owns 4,728,921 shares of the real estate investment trust's stock valued at $724,518,000 after buying an additional 1,030,599 shares during the last quarter. 94.80% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

A number of research firms have weighed in on WELL. Evercore ISI boosted their target price on shares of Welltower from $162.00 to $175.00 and gave the stock an "in-line" rating in a report on Wednesday, July 30th. Scotiabank reaffirmed an "outperform" rating on shares of Welltower in a research note on Monday, June 23rd. Wedbush reissued an "underperform" rating on shares of Welltower in a research note on Thursday, April 17th. Wells Fargo & Company increased their price objective on Welltower from $158.00 to $175.00 and gave the company an "overweight" rating in a report on Monday, June 2nd. Finally, Wall Street Zen lowered Welltower from a "hold" rating to a "sell" rating in a research report on Thursday, May 8th. Two equities research analysts have rated the stock with a sell rating, one has issued a hold rating, eight have assigned a buy rating and two have assigned a strong buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $169.82.

Check Out Our Latest Research Report on Welltower

Welltower Trading Down 0.8%

WELL stock traded down $1.42 during midday trading on Friday, hitting $168.27. The stock had a trading volume of 1,982,343 shares, compared to its average volume of 2,398,783. The company has a current ratio of 4.19, a quick ratio of 4.19 and a debt-to-equity ratio of 0.44. The firm has a market cap of $112.54 billion, a P/E ratio of 95.07, a price-to-earnings-growth ratio of 1.94 and a beta of 0.93. The business has a fifty day moving average price of $156.82 and a two-hundred day moving average price of $150.41. Welltower Inc. has a 1-year low of $115.18 and a 1-year high of $171.09.

Welltower (NYSE:WELL - Get Free Report) last announced its quarterly earnings data on Monday, July 28th. The real estate investment trust reported $1.28 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.22 by $0.06. Welltower had a return on equity of 3.38% and a net margin of 12.18%. The company had revenue of $2.55 billion for the quarter, compared to the consensus estimate of $2.49 billion. During the same period in the previous year, the business earned $1.05 EPS. The firm's revenue was up 39.6% compared to the same quarter last year. On average, sell-side analysts predict that Welltower Inc. will post 4.88 earnings per share for the current fiscal year.

Welltower Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, August 21st. Stockholders of record on Tuesday, August 12th will be given a dividend of $0.74 per share. This is a positive change from Welltower's previous quarterly dividend of $0.67. The ex-dividend date of this dividend is Tuesday, August 12th. This represents a $2.96 annualized dividend and a dividend yield of 1.8%. Welltower's payout ratio is 151.41%.

Insider Activity at Welltower

In related news, Director Andrew Gundlach purchased 20,000 shares of Welltower stock in a transaction on Monday, June 30th. The stock was acquired at an average cost of $151.46 per share, for a total transaction of $3,029,200.00. Following the completion of the acquisition, the director owned 20,000 shares of the company's stock, valued at $3,029,200. This trade represents a ∞ increase in their position. The purchase was disclosed in a legal filing with the SEC, which can be accessed through this link. 0.21% of the stock is currently owned by company insiders.

About Welltower

(

Free Report)

Welltower Inc NYSE: WELL, a real estate investment trust ("REIT") and S&P 500 company headquartered in Toledo, Ohio, is driving the transformation of health care infrastructure. Welltower invests with leading seniors housing operators, post-acute providers and health systems to fund the real estate infrastructure needed to scale innovative care delivery models and improve people's wellness and overall health care experience.

Read More

Before you consider Welltower, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Welltower wasn't on the list.

While Welltower currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.