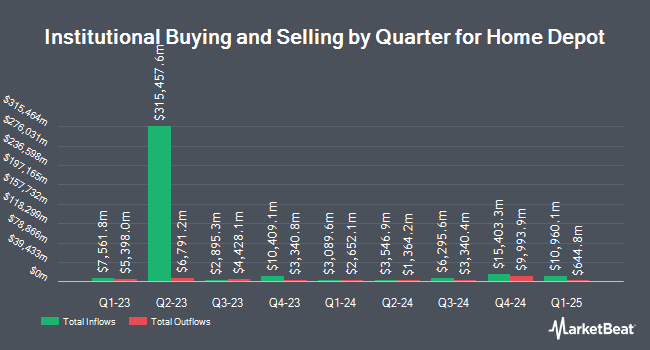

Western Financial Corp CA trimmed its stake in The Home Depot, Inc. (NYSE:HD - Free Report) by 53.3% in the first quarter, according to the company in its most recent disclosure with the SEC. The firm owned 2,515 shares of the home improvement retailer's stock after selling 2,866 shares during the quarter. Western Financial Corp CA's holdings in Home Depot were worth $922,000 as of its most recent filing with the SEC.

Other institutional investors have also recently bought and sold shares of the company. Wealth Group Ltd. raised its position in Home Depot by 5.0% in the fourth quarter. Wealth Group Ltd. now owns 563 shares of the home improvement retailer's stock valued at $219,000 after purchasing an additional 27 shares during the last quarter. Sollinda Capital Management LLC raised its position in Home Depot by 2.5% in the fourth quarter. Sollinda Capital Management LLC now owns 1,115 shares of the home improvement retailer's stock valued at $434,000 after purchasing an additional 27 shares during the last quarter. Hurlow Wealth Management Group Inc. raised its position in Home Depot by 1.3% in the fourth quarter. Hurlow Wealth Management Group Inc. now owns 2,137 shares of the home improvement retailer's stock valued at $831,000 after purchasing an additional 27 shares during the last quarter. Invst LLC raised its position in Home Depot by 0.4% in the fourth quarter. Invst LLC now owns 6,738 shares of the home improvement retailer's stock valued at $2,621,000 after purchasing an additional 28 shares during the last quarter. Finally, Fi3 FINANCIAL ADVISORS LLC raised its position in Home Depot by 2.0% in the fourth quarter. Fi3 FINANCIAL ADVISORS LLC now owns 1,484 shares of the home improvement retailer's stock valued at $577,000 after purchasing an additional 29 shares during the last quarter. 70.86% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several research firms have commented on HD. Morgan Stanley reiterated an "overweight" rating and issued a $415.00 target price (up from $410.00) on shares of Home Depot in a research report on Tuesday, May 20th. Robert W. Baird lowered their price objective on Home Depot from $430.00 to $425.00 and set an "outperform" rating for the company in a research report on Wednesday, May 21st. Mizuho lowered their price objective on Home Depot from $450.00 to $435.00 and set an "outperform" rating for the company in a research report on Wednesday, May 21st. TD Securities downgraded Home Depot to a "buy" rating in a research report on Monday, June 2nd. Finally, Evercore ISI set a $400.00 price objective on Home Depot and gave the stock an "outperform" rating in a research report on Thursday, May 22nd. Seven analysts have rated the stock with a hold rating, twenty-one have given a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, Home Depot has a consensus rating of "Moderate Buy" and a consensus target price of $426.77.

Get Our Latest Stock Analysis on HD

Home Depot Stock Up 1.3%

Shares of NYSE:HD traded up $4.86 during mid-day trading on Friday, hitting $368.36. 5,502,278 shares of the company traded hands, compared to its average volume of 3,419,944. The stock has a market cap of $366.49 billion, a P/E ratio of 24.99, a P/E/G ratio of 3.51 and a beta of 1.02. The company has a current ratio of 1.09, a quick ratio of 0.28 and a debt-to-equity ratio of 5.95. The Home Depot, Inc. has a 12-month low of $326.31 and a 12-month high of $439.37. The stock has a 50-day moving average price of $363.55 and a two-hundred day moving average price of $377.27.

Home Depot (NYSE:HD - Get Free Report) last announced its earnings results on Tuesday, May 20th. The home improvement retailer reported $3.56 earnings per share (EPS) for the quarter, missing the consensus estimate of $3.59 by ($0.03). Home Depot had a net margin of 8.98% and a return on equity of 242.51%. The company had revenue of $39.86 billion for the quarter, compared to analysts' expectations of $39.24 billion. During the same period in the previous year, the firm earned $3.63 EPS. The firm's quarterly revenue was up 9.4% on a year-over-year basis. On average, equities research analysts forecast that The Home Depot, Inc. will post 15.13 earnings per share for the current year.

Home Depot Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Wednesday, June 18th. Shareholders of record on Thursday, June 5th were given a $2.30 dividend. The ex-dividend date of this dividend was Thursday, June 5th. This represents a $9.20 annualized dividend and a yield of 2.50%. Home Depot's dividend payout ratio is currently 62.42%.

Insiders Place Their Bets

In other Home Depot news, EVP Teresa Wynn Roseborough sold 5,406 shares of the business's stock in a transaction on Wednesday, May 28th. The stock was sold at an average price of $369.28, for a total value of $1,996,327.68. Following the sale, the executive vice president now directly owns 17,367 shares in the company, valued at $6,413,285.76. The trade was a 23.74% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, EVP Fahim Siddiqui sold 2,600 shares of the business's stock in a transaction on Thursday, May 22nd. The shares were sold at an average price of $367.14, for a total value of $954,564.00. Following the completion of the sale, the executive vice president now owns 7,951 shares in the company, valued at approximately $2,919,130.14. The trade was a 24.64% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 0.10% of the company's stock.

About Home Depot

(

Free Report)

The Home Depot, Inc operates as a home improvement retailer in the United States and internationally. It sells various building materials, home improvement products, lawn and garden products, and décor products, as well as facilities maintenance, repair, and operations products. The company also offers installation services for flooring, water heaters, bath, garage doors, cabinets, cabinet makeovers, countertops, sheds, furnaces and central air systems, and windows.

Featured Articles

Before you consider Home Depot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Home Depot wasn't on the list.

While Home Depot currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report