Westfield Capital Management Co. LP purchased a new stake in shares of Comerica Incorporated (NYSE:CMA - Free Report) during the 1st quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor purchased 8,560 shares of the financial services provider's stock, valued at approximately $506,000.

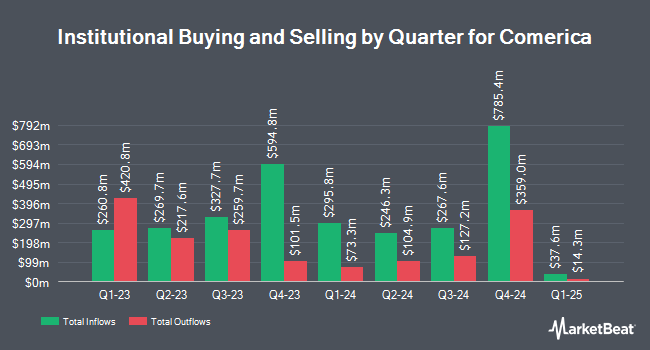

Several other hedge funds and other institutional investors also recently bought and sold shares of the stock. M&T Bank Corp increased its stake in Comerica by 11.2% in the first quarter. M&T Bank Corp now owns 13,215 shares of the financial services provider's stock worth $780,000 after purchasing an additional 1,326 shares during the period. Bank of Nova Scotia purchased a new stake in Comerica in the fourth quarter worth $1,320,000. Bessemer Group Inc. increased its stake in Comerica by 3.8% in the first quarter. Bessemer Group Inc. now owns 11,273 shares of the financial services provider's stock worth $666,000 after purchasing an additional 414 shares during the period. Mirae Asset Global Investments Co. Ltd. increased its stake in Comerica by 11.6% in the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 107,173 shares of the financial services provider's stock worth $6,293,000 after purchasing an additional 11,148 shares during the period. Finally, tru Independence LLC increased its stake in Comerica by 5.9% in the first quarter. tru Independence LLC now owns 85,075 shares of the financial services provider's stock worth $5,024,000 after purchasing an additional 4,772 shares during the period. Hedge funds and other institutional investors own 80.74% of the company's stock.

Comerica Stock Up 1.2%

CMA stock traded up $0.79 during trading on Friday, reaching $66.80. 1,249,938 shares of the company traded hands, compared to its average volume of 2,893,904. Comerica Incorporated has a 12 month low of $48.12 and a 12 month high of $73.45. The business has a 50 day simple moving average of $61.87 and a 200 day simple moving average of $59.96. The company has a market capitalization of $8.59 billion, a price-to-earnings ratio of 12.80, a price-to-earnings-growth ratio of 12.06 and a beta of 0.94. The company has a debt-to-equity ratio of 0.84, a quick ratio of 0.96 and a current ratio of 0.96.

Comerica (NYSE:CMA - Get Free Report) last issued its quarterly earnings results on Friday, July 18th. The financial services provider reported $1.42 earnings per share for the quarter, topping the consensus estimate of $1.23 by $0.19. The business had revenue of $849.00 million during the quarter, compared to the consensus estimate of $844.39 million. Comerica had a return on equity of 10.92% and a net margin of 14.92%. During the same quarter last year, the company earned $1.49 earnings per share. On average, equities research analysts anticipate that Comerica Incorporated will post 5.28 earnings per share for the current fiscal year.

Comerica Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, October 1st. Shareholders of record on Monday, September 15th will be issued a $0.71 dividend. This represents a $2.84 annualized dividend and a yield of 4.3%. The ex-dividend date of this dividend is Monday, September 15th. Comerica's dividend payout ratio (DPR) is currently 54.41%.

Analyst Upgrades and Downgrades

A number of analysts have weighed in on CMA shares. Jefferies Financial Group upgraded Comerica from an "underperform" rating to a "hold" rating and increased their target price for the stock from $50.00 to $70.00 in a research note on Wednesday. Evercore ISI downgraded Comerica from an "in-line" rating to an "underperform" rating and dropped their price target for the stock from $65.00 to $50.00 in a research report on Tuesday, April 22nd. Royal Bank Of Canada dropped their price target on Comerica from $75.00 to $65.00 and set an "outperform" rating on the stock in a research report on Tuesday, April 22nd. Piper Sandler increased their price target on Comerica from $60.00 to $65.00 and gave the stock a "neutral" rating in a research report on Monday, July 21st. Finally, The Goldman Sachs Group dropped their price target on Comerica from $66.00 to $57.00 and set a "neutral" rating on the stock in a research report on Tuesday, April 22nd. Five investment analysts have rated the stock with a sell rating, twelve have issued a hold rating and five have issued a buy rating to the company's stock. According to MarketBeat, the company has a consensus rating of "Hold" and a consensus price target of $64.40.

View Our Latest Stock Report on Comerica

Comerica Company Profile

(

Free Report)

Comerica Incorporated, through its subsidiaries, provides various financial products and services. The company operates through Commercial Bank, Retail Bank, Wealth Management, and Finance segments. The Commercial Bank segment offers various products and services, including commercial loans and lines of credit, deposits, cash management, payment solutions, card services, capital market products, international trade finance, letters of credit, foreign exchange management services, and loan syndication services for small and middle market businesses, multinational corporations, and governmental entities.

See Also

Before you consider Comerica, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Comerica wasn't on the list.

While Comerica currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.