Westpac Banking Corp increased its position in Gilead Sciences, Inc. (NASDAQ:GILD - Free Report) by 5.1% in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 84,433 shares of the biopharmaceutical company's stock after buying an additional 4,135 shares during the quarter. Gilead Sciences accounts for approximately 0.7% of Westpac Banking Corp's investment portfolio, making the stock its 27th largest position. Westpac Banking Corp's holdings in Gilead Sciences were worth $9,461,000 at the end of the most recent quarter.

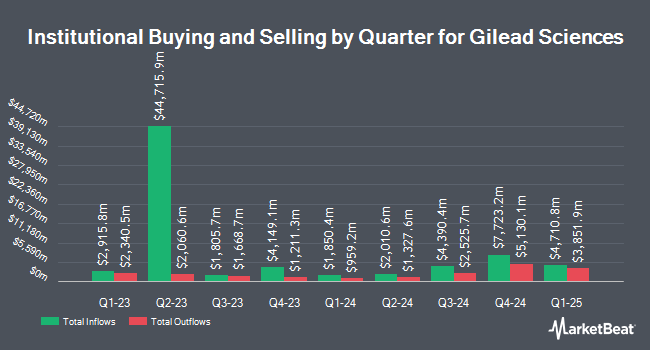

Other institutional investors and hedge funds also recently made changes to their positions in the company. Vanguard Group Inc. increased its position in Gilead Sciences by 1.7% during the 1st quarter. Vanguard Group Inc. now owns 117,470,825 shares of the biopharmaceutical company's stock valued at $13,162,606,000 after purchasing an additional 1,942,433 shares during the period. Northern Trust Corp increased its position in Gilead Sciences by 19.7% during the 4th quarter. Northern Trust Corp now owns 14,915,095 shares of the biopharmaceutical company's stock valued at $1,377,707,000 after purchasing an additional 2,458,954 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its position in Gilead Sciences by 15.1% during the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 12,234,672 shares of the biopharmaceutical company's stock valued at $1,130,117,000 after purchasing an additional 1,605,730 shares during the period. Royal Bank of Canada increased its position in Gilead Sciences by 30.1% during the 4th quarter. Royal Bank of Canada now owns 8,678,751 shares of the biopharmaceutical company's stock valued at $801,655,000 after purchasing an additional 2,005,863 shares during the period. Finally, Nuveen LLC bought a new stake in Gilead Sciences during the first quarter valued at $620,415,000. Institutional investors and hedge funds own 83.67% of the company's stock.

Insider Buying and Selling

In other Gilead Sciences news, CEO Daniel Patrick O'day sold 10,000 shares of the firm's stock in a transaction on Monday, July 28th. The stock was sold at an average price of $113.94, for a total transaction of $1,139,400.00. Following the transaction, the chief executive officer directly owned 605,725 shares in the company, valued at approximately $69,016,306.50. This trade represents a 1.62% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CFO Andrew D. Dickinson sold 2,500 shares of the firm's stock in a transaction on Tuesday, July 15th. The shares were sold at an average price of $111.03, for a total value of $277,575.00. Following the transaction, the chief financial officer owned 162,610 shares in the company, valued at approximately $18,054,588.30. This trade represents a 1.51% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 79,500 shares of company stock valued at $8,734,625 in the last 90 days. Insiders own 0.27% of the company's stock.

Wall Street Analysts Forecast Growth

GILD has been the subject of a number of recent analyst reports. UBS Group increased their price target on Gilead Sciences from $108.00 to $112.00 and gave the stock a "neutral" rating in a report on Friday, August 8th. Morgan Stanley upped their target price on Gilead Sciences from $130.00 to $135.00 and gave the company an "overweight" rating in a research report on Friday, April 25th. Needham & Company LLC upgraded Gilead Sciences from a "hold" rating to a "buy" rating and set a $133.00 target price for the company in a report on Friday, July 25th. Royal Bank Of Canada boosted their price target on Gilead Sciences from $96.00 to $98.00 and gave the company a "sector perform" rating in a research note on Friday, August 8th. Finally, Truist Financial upgraded Gilead Sciences from a "hold" rating to a "buy" rating and increased their price target for the stock from $108.00 to $127.00 in a report on Friday, August 8th. Seven research analysts have rated the stock with a hold rating, sixteen have given a buy rating and two have given a strong buy rating to the company. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average price target of $114.82.

Check Out Our Latest Analysis on GILD

Gilead Sciences Stock Down 0.9%

Shares of GILD traded down $1.12 during trading hours on Thursday, reaching $119.02. The stock had a trading volume of 5,461,007 shares, compared to its average volume of 8,364,447. Gilead Sciences, Inc. has a 12 month low of $72.89 and a 12 month high of $121.83. The firm has a 50-day simple moving average of $111.59 and a 200 day simple moving average of $108.00. The company has a current ratio of 1.32, a quick ratio of 1.15 and a debt-to-equity ratio of 1.13. The company has a market capitalization of $147.68 billion, a price-to-earnings ratio of 23.71, a P/E/G ratio of 0.75 and a beta of 0.33.

Gilead Sciences (NASDAQ:GILD - Get Free Report) last issued its earnings results on Thursday, August 7th. The biopharmaceutical company reported $2.01 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.96 by $0.05. Gilead Sciences had a return on equity of 50.99% and a net margin of 21.86%. The company had revenue of $7.08 billion for the quarter, compared to analysts' expectations of $6.95 billion. During the same period last year, the business earned $2.01 EPS. Gilead Sciences's quarterly revenue was up 1.4% compared to the same quarter last year. Equities research analysts predict that Gilead Sciences, Inc. will post 7.95 earnings per share for the current fiscal year.

Gilead Sciences Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, September 29th. Shareholders of record on Monday, September 15th will be paid a dividend of $0.79 per share. The ex-dividend date is Monday, September 15th. This represents a $3.16 annualized dividend and a yield of 2.7%. Gilead Sciences's dividend payout ratio (DPR) is 62.95%.

About Gilead Sciences

(

Free Report)

Gilead Sciences, Inc, a biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally. The company provides Biktarvy, Genvoya, Descovy, Odefsey, Truvada, Complera/ Eviplera, Stribild, Sunlencs, and Atripla products for the treatment of HIV/AIDS; Veklury, an injection for intravenous use, for the treatment of COVID-19; and Epclusa, Harvoni, Vemlidy, and Viread for the treatment of viral hepatitis.

Read More

Before you consider Gilead Sciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gilead Sciences wasn't on the list.

While Gilead Sciences currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report