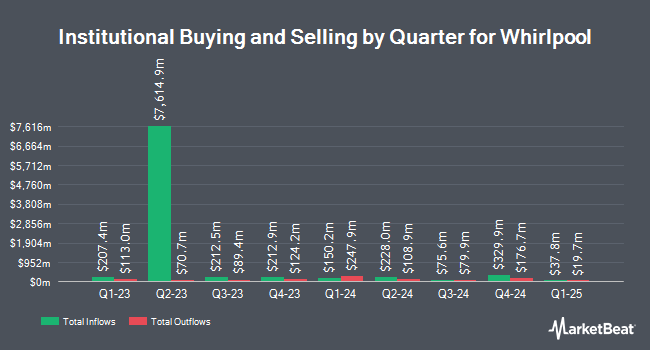

AE Wealth Management LLC lowered its stake in shares of Whirlpool Corporation (NYSE:WHR - Free Report) by 80.6% in the first quarter, according to its most recent 13F filing with the SEC. The fund owned 22,091 shares of the company's stock after selling 91,653 shares during the period. AE Wealth Management LLC's holdings in Whirlpool were worth $1,991,000 at the end of the most recent quarter.

Several other institutional investors also recently bought and sold shares of WHR. Vanguard Group Inc. raised its position in Whirlpool by 0.6% during the fourth quarter. Vanguard Group Inc. now owns 5,536,118 shares of the company's stock worth $633,775,000 after acquiring an additional 33,326 shares during the period. FMR LLC raised its position in shares of Whirlpool by 57.3% during the 4th quarter. FMR LLC now owns 1,808,744 shares of the company's stock worth $207,065,000 after purchasing an additional 659,014 shares during the last quarter. Dimensional Fund Advisors LP lifted its stake in Whirlpool by 19.6% in the 4th quarter. Dimensional Fund Advisors LP now owns 1,373,215 shares of the company's stock valued at $157,205,000 after buying an additional 224,990 shares in the last quarter. Nuveen Asset Management LLC boosted its holdings in Whirlpool by 19.8% in the 4th quarter. Nuveen Asset Management LLC now owns 1,208,741 shares of the company's stock worth $138,377,000 after buying an additional 199,663 shares during the last quarter. Finally, Geode Capital Management LLC boosted its holdings in Whirlpool by 3.8% in the 4th quarter. Geode Capital Management LLC now owns 937,637 shares of the company's stock worth $107,374,000 after buying an additional 34,471 shares during the last quarter. 90.78% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Several equities analysts have recently weighed in on WHR shares. Bank of America upgraded Whirlpool from an "underperform" rating to a "neutral" rating and raised their target price for the company from $68.00 to $94.00 in a research report on Friday, June 13th. Wall Street Zen cut shares of Whirlpool from a "hold" rating to a "sell" rating in a research note on Saturday. Royal Bank Of Canada reduced their target price on shares of Whirlpool from $81.00 to $65.00 and set an "underperform" rating for the company in a research report on Friday, April 25th. JPMorgan Chase & Co. decreased their price target on shares of Whirlpool from $109.00 to $89.00 and set a "neutral" rating on the stock in a research note on Monday, April 28th. Finally, Longbow Research raised shares of Whirlpool from a "neutral" rating to a "buy" rating and set a $145.00 price objective for the company in a research note on Monday, June 30th. Two analysts have rated the stock with a sell rating, two have assigned a hold rating and two have issued a buy rating to the company. According to data from MarketBeat.com, the stock currently has an average rating of "Hold" and a consensus price target of $108.40.

Read Our Latest Research Report on WHR

Whirlpool Stock Up 1.1%

Shares of WHR opened at $99.71 on Friday. Whirlpool Corporation has a 52-week low of $73.72 and a 52-week high of $135.49. The company has a quick ratio of 0.40, a current ratio of 0.72 and a debt-to-equity ratio of 1.71. The stock has a fifty day simple moving average of $92.58 and a two-hundred day simple moving average of $94.91. The company has a market capitalization of $5.54 billion, a PE ratio of 712.20 and a beta of 1.25.

Whirlpool (NYSE:WHR - Get Free Report) last released its quarterly earnings data on Wednesday, April 23rd. The company reported $1.70 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.67 by $0.03. The firm had revenue of $3.62 billion during the quarter, compared to analysts' expectations of $3.67 billion. Whirlpool had a net margin of 0.04% and a return on equity of 21.38%. Whirlpool's revenue was down 19.4% compared to the same quarter last year. During the same period last year, the business earned $1.78 earnings per share. As a group, equities analysts forecast that Whirlpool Corporation will post 9.52 EPS for the current year.

Whirlpool Company Profile

(

Free Report)

Whirlpool Corporation manufactures and markets home appliances and related products and services in the North America, Europe, the Middle East, Africa, Latin America, and Asia. The company's principal products include refrigerators, freezers, ice makers, and refrigerator water filters; laundry appliances, and commercial laundry products and related laundry accessories; cooking and other small domestic appliances; and dishwasher appliances and related accessories, as well as mixers.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Whirlpool, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Whirlpool wasn't on the list.

While Whirlpool currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.