William Blair Investment Management LLC trimmed its holdings in Vista Energy, S.A.B. de C.V. - Sponsored ADR (NYSE:VIST - Free Report) by 45.9% in the second quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 627,389 shares of the company's stock after selling 531,890 shares during the quarter. William Blair Investment Management LLC owned about 0.66% of Vista Energy worth $30,003,000 at the end of the most recent quarter.

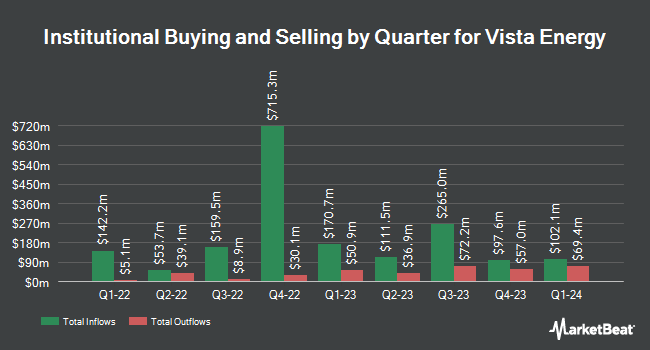

Several other institutional investors and hedge funds have also added to or reduced their stakes in the stock. WCM Investment Management LLC raised its stake in shares of Vista Energy by 102.2% in the second quarter. WCM Investment Management LLC now owns 766,219 shares of the company's stock worth $36,962,000 after acquiring an additional 387,257 shares during the last quarter. Vontobel Holding Ltd. raised its position in Vista Energy by 16.1% in the 2nd quarter. Vontobel Holding Ltd. now owns 1,017,790 shares of the company's stock worth $48,661,000 after purchasing an additional 141,066 shares during the last quarter. Ping Capital Management Inc. raised its position in Vista Energy by 12.3% in the 2nd quarter. Ping Capital Management Inc. now owns 33,800 shares of the company's stock worth $1,616,000 after purchasing an additional 3,700 shares during the last quarter. Ninety One North America Inc. lifted its holdings in Vista Energy by 35.4% during the 2nd quarter. Ninety One North America Inc. now owns 548,201 shares of the company's stock worth $26,209,000 after buying an additional 143,249 shares in the last quarter. Finally, Ninety One UK Ltd boosted its position in Vista Energy by 74.0% in the 2nd quarter. Ninety One UK Ltd now owns 1,337,817 shares of the company's stock valued at $63,961,000 after buying an additional 568,955 shares during the last quarter. Institutional investors and hedge funds own 63.81% of the company's stock.

Vista Energy Trading Down 0.2%

NYSE:VIST opened at $35.55 on Friday. The company has a current ratio of 0.41, a quick ratio of 0.41 and a debt-to-equity ratio of 0.89. Vista Energy, S.A.B. de C.V. - Sponsored ADR has a 1-year low of $31.63 and a 1-year high of $61.67. The firm has a market capitalization of $3.38 billion, a price-to-earnings ratio of 6.41 and a beta of 0.97. The business's 50-day moving average price is $37.60 and its two-hundred day moving average price is $43.46.

Wall Street Analyst Weigh In

A number of research firms have recently weighed in on VIST. Zacks Research downgraded Vista Energy from a "hold" rating to a "strong sell" rating in a research report on Monday, October 13th. Wall Street Zen lowered Vista Energy from a "hold" rating to a "sell" rating in a research report on Saturday, October 11th. Weiss Ratings reiterated a "hold (c)" rating on shares of Vista Energy in a research report on Tuesday, October 14th. Finally, JPMorgan Chase & Co. lowered their price target on shares of Vista Energy from $57.00 to $50.00 and set an "overweight" rating for the company in a research report on Friday. Two research analysts have rated the stock with a Strong Buy rating, three have given a Buy rating, one has assigned a Hold rating and one has assigned a Sell rating to the company. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus price target of $59.60.

Check Out Our Latest Stock Analysis on Vista Energy

Vista Energy Company Profile

(

Free Report)

Vista Energy, SAB. de C.V., through its subsidiaries, engages in the exploration and production of oil and gas in Latin America. The company's principal assets located in Neuquina basin, Argentina and Vaca Muerta. It owns producing assets in Argentina and Mexico. In addition, the company involved in drilling and workover activities located in Argentina.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Vista Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vista Energy wasn't on the list.

While Vista Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.