Wolverine Asset Management LLC purchased a new stake in shares of MakeMyTrip Limited (NASDAQ:MMYT - Free Report) during the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm purchased 3,342 shares of the technology company's stock, valued at approximately $327,000.

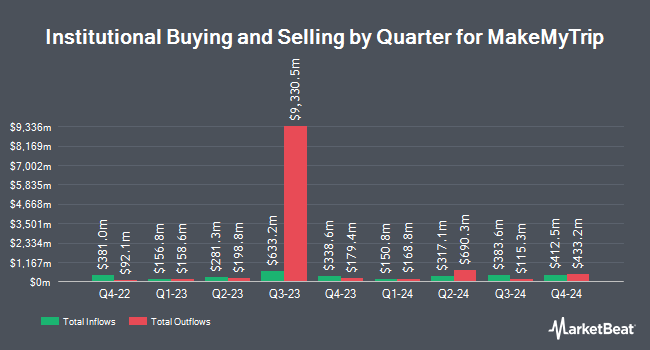

Several other institutional investors have also recently made changes to their positions in MMYT. Mirae Asset Global Investments Co. Ltd. increased its stake in shares of MakeMyTrip by 9,724.0% during the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 24,132,381 shares of the technology company's stock valued at $2,364,732,000 after buying an additional 23,886,735 shares during the period. Baillie Gifford & Co. boosted its position in MakeMyTrip by 40.0% during the first quarter. Baillie Gifford & Co. now owns 5,155,202 shares of the technology company's stock valued at $505,158,000 after purchasing an additional 1,471,660 shares in the last quarter. Ninety One UK Ltd boosted its position in MakeMyTrip by 1,586.6% during the first quarter. Ninety One UK Ltd now owns 772,853 shares of the technology company's stock valued at $75,732,000 after purchasing an additional 727,030 shares in the last quarter. Ninety One North America Inc. bought a new stake in MakeMyTrip during the first quarter valued at about $18,737,000. Finally, Carrhae Capital LLP boosted its position in MakeMyTrip by 88.6% during the first quarter. Carrhae Capital LLP now owns 397,945 shares of the technology company's stock valued at $38,995,000 after purchasing an additional 186,995 shares in the last quarter. Hedge funds and other institutional investors own 51.89% of the company's stock.

MakeMyTrip Stock Up 3.5%

MMYT stock traded up $3.34 during trading on Friday, reaching $97.67. 444,087 shares of the company traded hands, compared to its average volume of 1,038,251. The company has a debt-to-equity ratio of 18.35, a quick ratio of 1.15 and a current ratio of 1.15. The company has a market capitalization of $10.87 billion, a price-to-earnings ratio of 113.56 and a beta of 0.86. The business has a 50 day simple moving average of $95.94 and a 200 day simple moving average of $99.69. MakeMyTrip Limited has a 12 month low of $81.84 and a 12 month high of $123.00.

Analyst Upgrades and Downgrades

A number of equities research analysts recently weighed in on MMYT shares. Macquarie raised MakeMyTrip from a "neutral" rating to an "outperform" rating and set a $110.00 price objective on the stock in a research report on Tuesday, June 24th. Citigroup dropped their price objective on MakeMyTrip from $125.00 to $120.00 and set a "buy" rating on the stock in a research report on Wednesday, July 23rd. Finally, Wall Street Zen downgraded MakeMyTrip from a "hold" rating to a "sell" rating in a research report on Saturday, August 2nd.

View Our Latest Stock Report on MakeMyTrip

MakeMyTrip Company Profile

(

Free Report)

MakeMyTrip Limited, an online travel company, sells travel products and solutions in India, the United States, Singapore, Malaysia, Thailand, the United Arab Emirates, Peru, Colombia, Vietnam, and Indonesia. The company operates through three segments: Air Ticketing, Hotels and Packages, and Bus Ticketing.

Read More

Before you consider MakeMyTrip, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MakeMyTrip wasn't on the list.

While MakeMyTrip currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.