Woodline Partners LP trimmed its stake in shares of Zai Lab Limited Unsponsored ADR (NASDAQ:ZLAB - Free Report) by 31.8% during the first quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 1,201,016 shares of the company's stock after selling 558,781 shares during the quarter. Woodline Partners LP owned 1.09% of Zai Lab worth $43,405,000 as of its most recent SEC filing.

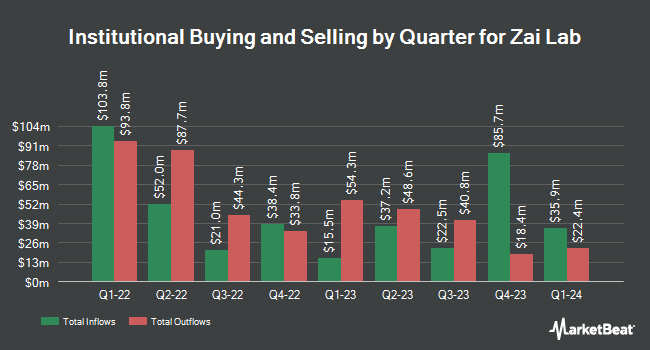

A number of other hedge funds and other institutional investors also recently made changes to their positions in the stock. RTW Investments LP purchased a new position in Zai Lab during the fourth quarter worth about $65,714,000. Mirae Asset Global Investments Co. Ltd. grew its position in Zai Lab by 46,222.0% during the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 2,132,201 shares of the company's stock worth $77,058,000 after buying an additional 2,127,598 shares in the last quarter. Principal Financial Group Inc. grew its position in Zai Lab by 63.6% during the first quarter. Principal Financial Group Inc. now owns 2,884,810 shares of the company's stock worth $104,257,000 after buying an additional 1,121,856 shares in the last quarter. MPM Bioimpact LLC purchased a new position in Zai Lab during the fourth quarter worth about $20,952,000. Finally, Jennison Associates LLC purchased a new position in Zai Lab during the first quarter worth about $25,743,000. 41.65% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In other Zai Lab news, insider Joshua L. Smiley purchased 10,000 shares of the stock in a transaction on Wednesday, September 10th. The stock was acquired at an average price of $28.91 per share, with a total value of $289,100.00. Following the transaction, the insider directly owned 86,604 shares of the company's stock, valued at approximately $2,503,721.64. This trade represents a 13.05% increase in their position. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this link. Also, CFO Yajing Chen sold 4,096 shares of the company's stock in a transaction that occurred on Friday, August 8th. The shares were sold at an average price of $34.01, for a total value of $139,304.96. Following the transaction, the chief financial officer directly owned 16,908 shares of the company's stock, valued at $575,041.08. The trade was a 19.50% decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 215,710 shares of company stock worth $7,589,684. 4.96% of the stock is currently owned by company insiders.

Wall Street Analysts Forecast Growth

Several research firms recently commented on ZLAB. Jefferies Financial Group began coverage on Zai Lab in a research report on Monday, August 25th. They set a "buy" rating and a $52.00 target price for the company. Wall Street Zen cut Zai Lab from a "buy" rating to a "hold" rating in a research report on Friday, June 27th. Citigroup restated a "buy" rating and set a $69.00 target price (up from $66.00) on shares of Zai Lab in a research report on Monday, August 11th. Finally, Leerink Partners set a $75.00 price objective on Zai Lab and gave the stock an "outperform" rating in a report on Monday, June 30th. Six analysts have rated the stock with a Buy rating and one has given a Hold rating to the company. According to data from MarketBeat.com, Zai Lab presently has an average rating of "Moderate Buy" and a consensus target price of $56.35.

View Our Latest Stock Report on Zai Lab

Zai Lab Stock Performance

ZLAB stock traded up $0.32 during trading on Friday, hitting $32.80. 956,964 shares of the company traded hands, compared to its average volume of 770,407. The company has a 50-day moving average of $34.78 and a 200-day moving average of $34.00. The firm has a market capitalization of $3.67 billion, a PE ratio of -16.08 and a beta of 1.04. Zai Lab Limited Unsponsored ADR has a 1 year low of $20.17 and a 1 year high of $44.34.

Zai Lab (NASDAQ:ZLAB - Get Free Report) last released its quarterly earnings results on Thursday, August 7th. The company reported ($0.37) EPS for the quarter, meeting analysts' consensus estimates of ($0.37). The business had revenue of $109.98 million during the quarter, compared to analyst estimates of $125.66 million. Zai Lab had a negative return on equity of 27.32% and a negative net margin of 49.68%. Zai Lab has set its FY 2025 guidance at EPS. Sell-side analysts expect that Zai Lab Limited Unsponsored ADR will post -2.58 EPS for the current year.

Zai Lab Profile

(

Free Report)

Zai Lab Limited develops and commercializes therapies to treat oncology, autoimmune disorders, infectious diseases, and neuroscience. Its commercial products include Zejula, an orally administered poly polymerase 1/2 inhibitor; Optune, a cancer therapy that uses electric fields tuned to specific frequencies to kill tumor cells; NUZYRA for acute bacterial skin and skin structure infections, and community acquired bacterial pneumonia; Qinlock to treat gastrointestinal stromal tumors, and VYVGART, a human IgG1 antibody fragment for myesthenia gravis.

See Also

Before you consider Zai Lab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zai Lab wasn't on the list.

While Zai Lab currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.