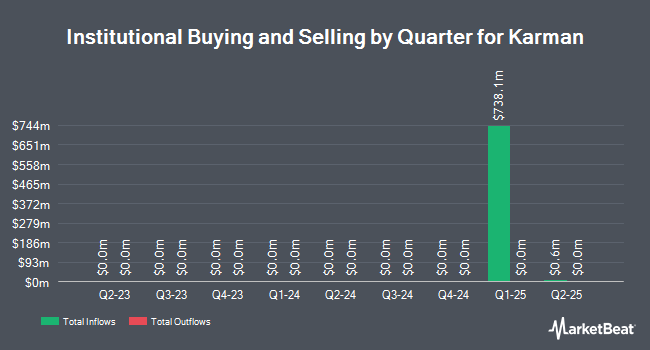

Woodline Partners LP acquired a new stake in Karman Holdings Inc. (NYSE:KRMN - Free Report) in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor acquired 170,569 shares of the company's stock, valued at approximately $5,700,000. Woodline Partners LP owned about 0.13% of Karman at the end of the most recent reporting period.

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Stephens Investment Management Group LLC purchased a new position in Karman in the 1st quarter valued at about $8,740,000. Baird Financial Group Inc. purchased a new position in Karman in the 1st quarter valued at about $1,632,000. Charles Schwab Investment Management Inc. bought a new position in shares of Karman during the first quarter worth about $4,293,000. T. Rowe Price Investment Management Inc. bought a new position in shares of Karman during the first quarter worth about $48,691,000. Finally, HBK Investments L P bought a new position in shares of Karman during the first quarter worth about $3,342,000.

Insider Activity

In other Karman news, major shareholder Spaceco Spv Lp Tcfiii sold 23,623,968 shares of the firm's stock in a transaction that occurred on Friday, July 25th. The shares were sold at an average price of $49.00, for a total value of $1,157,574,432.00. Following the sale, the insider owned 50,450,859 shares in the company, valued at approximately $2,472,092,091. This trade represents a 31.89% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, COO Jonathan Beaudoin sold 80,000 shares of the firm's stock in a transaction that occurred on Friday, July 25th. The shares were sold at an average price of $49.00, for a total transaction of $3,920,000.00. Following the completion of the sale, the chief operating officer owned 740,861 shares in the company, valued at $36,302,189. The trade was a 9.75% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 23,865,968 shares of company stock worth $1,169,432,432 over the last ninety days.

Wall Street Analysts Forecast Growth

KRMN has been the topic of several research analyst reports. Citigroup reaffirmed a "buy" rating and set a $58.00 price target (up previously from $46.50) on shares of Karman in a research report on Monday, June 9th. Raymond James Financial initiated coverage on shares of Karman in a research report on Friday, September 5th. They set a "strong-buy" rating and a $100.00 price target on the stock. Finally, Royal Bank Of Canada increased their price target on shares of Karman from $55.00 to $57.00 and gave the stock an "outperform" rating in a research report on Friday, August 8th. Two investment analysts have rated the stock with a Strong Buy rating and five have issued a Buy rating to the company's stock. According to data from MarketBeat.com, the company has a consensus rating of "Buy" and a consensus price target of $60.60.

View Our Latest Report on Karman

Karman Price Performance

KRMN traded up $1.09 on Thursday, hitting $65.20. 322,554 shares of the company's stock were exchanged, compared to its average volume of 1,213,586. Karman Holdings Inc. has a twelve month low of $25.02 and a twelve month high of $66.29. The stock has a fifty day moving average of $53.53 and a two-hundred day moving average of $43.94. The company has a debt-to-equity ratio of 1.30, a current ratio of 2.75 and a quick ratio of 2.58.

Karman (NYSE:KRMN - Get Free Report) last released its quarterly earnings data on Thursday, August 7th. The company reported $0.10 earnings per share for the quarter, missing the consensus estimate of $0.11 by ($0.01). The firm's revenue for the quarter was up 35.3% on a year-over-year basis. Karman has set its FY 2025 guidance at EPS.

About Karman

(

Free Report)

We specialize in the upfront design, testing, manufacturing, and sale of mission-critical systems for existing and emerging missile and defense, and space programs. Our integrated payload protection, propulsion, and interstage system solutions are deployed across a wide variety of existing and emerging programs supporting important Department of Defense (“DoD”) and space sector initiatives.

See Also

Before you consider Karman, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Karman wasn't on the list.

While Karman currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.