Wormser Freres Gestion increased its stake in shares of Accenture PLC (NYSE:ACN - Free Report) by 5.3% during the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 29,484 shares of the information technology services provider's stock after buying an additional 1,471 shares during the quarter. Accenture comprises approximately 5.5% of Wormser Freres Gestion's investment portfolio, making the stock its 5th biggest position. Wormser Freres Gestion's holdings in Accenture were worth $9,008,000 as of its most recent SEC filing.

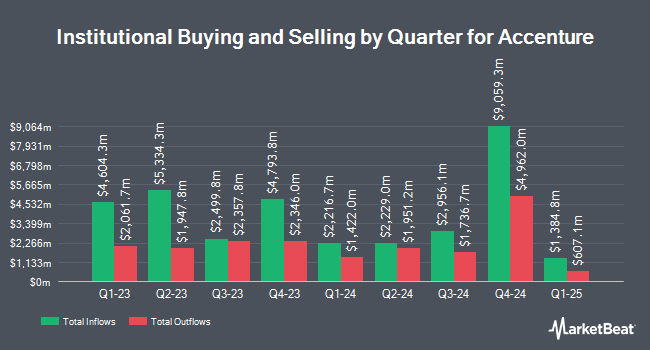

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in the business. Price T Rowe Associates Inc. MD lifted its stake in Accenture by 63.9% during the first quarter. Price T Rowe Associates Inc. MD now owns 8,953,621 shares of the information technology services provider's stock worth $2,793,889,000 after purchasing an additional 3,490,569 shares during the last quarter. TFB Advisors LLC lifted its stake in Accenture by 12.1% during the first quarter. TFB Advisors LLC now owns 814 shares of the information technology services provider's stock worth $254,000 after purchasing an additional 88 shares during the last quarter. Dorsey & Whitney Trust CO LLC lifted its stake in Accenture by 4.9% during the first quarter. Dorsey & Whitney Trust CO LLC now owns 8,589 shares of the information technology services provider's stock worth $2,680,000 after purchasing an additional 404 shares during the last quarter. T. Rowe Price Investment Management Inc. lifted its stake in Accenture by 12.6% during the first quarter. T. Rowe Price Investment Management Inc. now owns 920 shares of the information technology services provider's stock worth $288,000 after purchasing an additional 103 shares during the last quarter. Finally, Capital Analysts LLC lifted its stake in Accenture by 7.5% during the first quarter. Capital Analysts LLC now owns 13,970 shares of the information technology services provider's stock worth $4,359,000 after purchasing an additional 975 shares during the last quarter. 75.14% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

Several equities research analysts have weighed in on the company. HSBC assumed coverage on Accenture in a research note on Monday, July 28th. They set a "reduce" rating and a $240.00 target price for the company. Deutsche Bank Aktiengesellschaft assumed coverage on Accenture in a research note on Thursday, July 17th. They issued a "hold" rating and a $290.00 price target for the company. Benchmark reiterated a "mixed" rating on shares of Accenture in a research note on Friday, June 20th. Barclays dropped their price target on Accenture from $390.00 to $360.00 and set an "overweight" rating for the company in a research note on Monday, June 23rd. Finally, Hsbc Global Res upgraded Accenture to a "moderate sell" rating in a research note on Monday, July 28th. One equities research analyst has rated the stock with a Strong Buy rating, fifteen have assigned a Buy rating, seven have given a Hold rating and one has assigned a Sell rating to the company's stock. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average target price of $358.08.

Read Our Latest Report on Accenture

Accenture Trading Up 1.9%

NYSE ACN traded up $4.9040 on Friday, reaching $258.8940. The company had a trading volume of 3,102,553 shares, compared to its average volume of 4,885,374. The firm has a market cap of $162.15 billion, a price-to-earnings ratio of 20.61, a P/E/G ratio of 2.36 and a beta of 1.29. Accenture PLC has a fifty-two week low of $236.67 and a fifty-two week high of $398.35. The business has a 50 day moving average of $277.65 and a two-hundred day moving average of $306.53. The company has a debt-to-equity ratio of 0.16, a current ratio of 1.46 and a quick ratio of 1.46.

Accenture (NYSE:ACN - Get Free Report) last posted its quarterly earnings data on Friday, June 20th. The information technology services provider reported $3.49 earnings per share for the quarter, beating analysts' consensus estimates of $3.32 by $0.17. Accenture had a return on equity of 26.55% and a net margin of 11.61%.The business had revenue of $17.73 billion during the quarter, compared to the consensus estimate of $17.26 billion. During the same period in the prior year, the business posted $3.13 earnings per share. Accenture's quarterly revenue was up 7.7% on a year-over-year basis. Accenture has set its Q4 2025 guidance at EPS. FY 2025 guidance at 12.770-12.890 EPS. Analysts forecast that Accenture PLC will post 12.73 EPS for the current year.

Accenture Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Friday, August 15th. Shareholders of record on Thursday, July 10th were issued a dividend of $1.48 per share. This represents a $5.92 dividend on an annualized basis and a yield of 2.3%. The ex-dividend date was Thursday, July 10th. Accenture's dividend payout ratio (DPR) is presently 47.13%.

Insiders Place Their Bets

In other news, CEO Mauro Macchi sold 500 shares of the stock in a transaction dated Friday, July 11th. The shares were sold at an average price of $282.34, for a total transaction of $141,170.00. Following the transaction, the chief executive officer owned 2,283 shares of the company's stock, valued at $644,582.22. This represents a 17.97% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, CEO Julie Spellman Sweet sold 2,251 shares of the stock in a transaction dated Friday, July 11th. The stock was sold at an average price of $282.45, for a total transaction of $635,794.95. Following the transaction, the chief executive officer directly owned 8,109 shares in the company, valued at $2,290,387.05. This trade represents a 21.73% decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 2,954 shares of company stock worth $834,280. Company insiders own 0.02% of the company's stock.

About Accenture

(

Free Report)

Accenture plc, a professional services company, provides strategy and consulting, industry X, song, and technology and operation services worldwide. The company offers application services, including agile transformation, DevOps, application modernization, enterprise architecture, software and quality engineering, data management; intelligent automation comprising robotic process automation, natural language processing, and virtual agents; and application management services, as well as software engineering services; strategy and consulting services; data and analytics strategy, data discovery and augmentation, data management and beyond, data democratization, and industrialized solutions comprising turnkey analytics and artificial intelligence (AI) solutions; metaverse; and sustainability services.

Featured Stories

Before you consider Accenture, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Accenture wasn't on the list.

While Accenture currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report