Wedge Capital Management L L P NC raised its holdings in shares of Worthington Steel, Inc. (NYSE:WS - Free Report) by 25.6% during the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 51,214 shares of the company's stock after purchasing an additional 10,428 shares during the period. Wedge Capital Management L L P NC owned 0.10% of Worthington Steel worth $1,297,000 at the end of the most recent quarter.

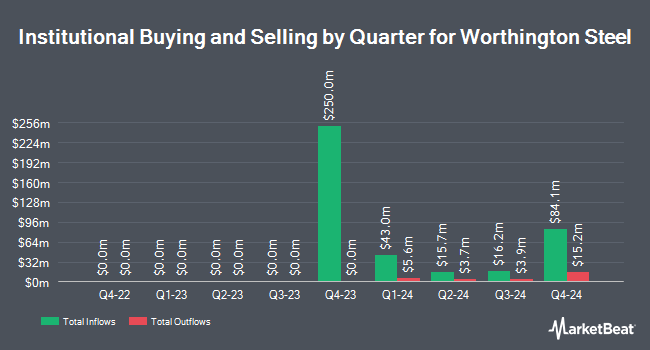

Other hedge funds and other institutional investors have also recently made changes to their positions in the company. Vanguard Group Inc. boosted its holdings in Worthington Steel by 14.0% in the fourth quarter. Vanguard Group Inc. now owns 4,467,428 shares of the company's stock valued at $142,154,000 after purchasing an additional 550,181 shares during the last quarter. Nuveen Asset Management LLC lifted its position in Worthington Steel by 3.6% during the fourth quarter. Nuveen Asset Management LLC now owns 445,698 shares of the company's stock worth $14,182,000 after buying an additional 15,684 shares in the last quarter. Northern Trust Corp boosted its holdings in Worthington Steel by 9.6% in the 4th quarter. Northern Trust Corp now owns 378,686 shares of the company's stock valued at $12,050,000 after purchasing an additional 33,272 shares during the last quarter. Bank of New York Mellon Corp grew its holdings in shares of Worthington Steel by 44.6% during the 4th quarter. Bank of New York Mellon Corp now owns 359,035 shares of the company's stock worth $11,424,000 after purchasing an additional 110,662 shares during the period. Finally, Charles Schwab Investment Management Inc. raised its position in Worthington Steel by 3.0% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 330,880 shares of the company's stock valued at $10,529,000 after purchasing an additional 9,584 shares during the period. Hedge funds and other institutional investors own 45.41% of the company's stock.

Worthington Steel Stock Down 3.8%

NYSE:WS traded down $0.96 on Friday, reaching $24.55. 197,001 shares of the company's stock were exchanged, compared to its average volume of 257,472. The firm has a market capitalization of $1.25 billion, a price-to-earnings ratio of 8.61 and a beta of 1.64. The business has a fifty day moving average of $25.57 and a 200-day moving average of $29.00. Worthington Steel, Inc. has a 52-week low of $21.30 and a 52-week high of $47.19.

Worthington Steel (NYSE:WS - Get Free Report) last posted its quarterly earnings results on Wednesday, March 19th. The company reported $0.35 EPS for the quarter, missing the consensus estimate of $0.67 by ($0.32). The firm had revenue of $687.40 million for the quarter, compared to analyst estimates of $732.00 million. Worthington Steel had a return on equity of 12.59% and a net margin of 4.36%. The company's revenue was down 14.7% on a year-over-year basis. During the same quarter last year, the firm earned $0.99 EPS. As a group, equities analysts anticipate that Worthington Steel, Inc. will post 2.26 earnings per share for the current year.

Worthington Steel Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, June 27th. Shareholders of record on Friday, June 13th will be paid a $0.16 dividend. The ex-dividend date is Friday, June 13th. This represents a $0.64 annualized dividend and a yield of 2.61%. Worthington Steel's dividend payout ratio is presently 29.91%.

Analyst Ratings Changes

Separately, KeyCorp lowered their price target on Worthington Steel from $41.00 to $34.00 and set an "overweight" rating for the company in a research report on Friday, March 7th.

Check Out Our Latest Stock Report on Worthington Steel

Worthington Steel Company Profile

(

Free Report)

Worthington Steel, Inc operates as a steel processor in North America. It offers carbon flat-rolled steel and tailor welded blanks, as well as electrical steel laminations; and aluminum tailor welded blanks. The company serves various end-markets, including automotive, heavy truck, agriculture, construction, and energy.

See Also

Before you consider Worthington Steel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Worthington Steel wasn't on the list.

While Worthington Steel currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.