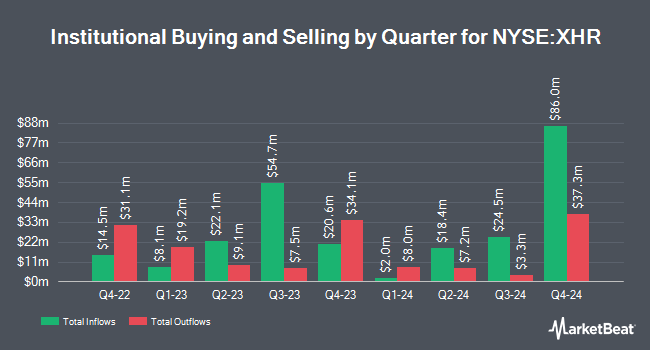

Millennium Management LLC raised its position in Xenia Hotels & Resorts, Inc. (NYSE:XHR - Free Report) by 17.8% in the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 2,126,198 shares of the real estate investment trust's stock after acquiring an additional 321,343 shares during the quarter. Millennium Management LLC owned 2.15% of Xenia Hotels & Resorts worth $25,004,000 at the end of the most recent quarter.

A number of other hedge funds have also made changes to their positions in the stock. Allspring Global Investments Holdings LLC grew its stake in Xenia Hotels & Resorts by 39.2% in the first quarter. Allspring Global Investments Holdings LLC now owns 320,979 shares of the real estate investment trust's stock worth $3,775,000 after purchasing an additional 90,405 shares in the last quarter. GSA Capital Partners LLP bought a new position in Xenia Hotels & Resorts in the 1st quarter worth about $789,000. Victory Capital Management Inc. grew its position in Xenia Hotels & Resorts by 223.7% in the 1st quarter. Victory Capital Management Inc. now owns 337,051 shares of the real estate investment trust's stock worth $3,964,000 after purchasing an additional 232,918 shares during the last quarter. Concurrent Investment Advisors LLC acquired a new position in shares of Xenia Hotels & Resorts during the first quarter worth approximately $214,000. Finally, American Century Companies Inc. boosted its position in shares of Xenia Hotels & Resorts by 235.7% during the first quarter. American Century Companies Inc. now owns 106,137 shares of the real estate investment trust's stock worth $1,248,000 after buying an additional 74,525 shares during the period. Institutional investors and hedge funds own 92.43% of the company's stock.

Xenia Hotels & Resorts Stock Up 0.3%

NYSE XHR traded up $0.05 during trading on Wednesday, hitting $14.71. 65,827 shares of the company traded hands, compared to its average volume of 947,821. Xenia Hotels & Resorts, Inc. has a 12 month low of $8.55 and a 12 month high of $16.50. The business has a fifty day simple moving average of $13.48 and a 200 day simple moving average of $12.37. The company has a market capitalization of $1.41 billion, a P/E ratio of 23.39 and a beta of 1.72. The company has a current ratio of 2.96, a quick ratio of 2.96 and a debt-to-equity ratio of 1.13.

Xenia Hotels & Resorts (NYSE:XHR - Get Free Report) last issued its quarterly earnings data on Friday, August 1st. The real estate investment trust reported $0.57 earnings per share for the quarter, beating analysts' consensus estimates of $0.43 by $0.14. Xenia Hotels & Resorts had a return on equity of 4.95% and a net margin of 5.86%.The business had revenue of $287.58 million for the quarter, compared to the consensus estimate of $273.43 million. During the same period last year, the business earned $0.52 EPS. The firm's revenue was up 5.4% compared to the same quarter last year. Xenia Hotels & Resorts has set its FY 2025 guidance at 1.660-1.800 EPS. As a group, sell-side analysts predict that Xenia Hotels & Resorts, Inc. will post 1.46 EPS for the current year.

Xenia Hotels & Resorts Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, October 15th. Stockholders of record on Tuesday, September 30th will be paid a $0.14 dividend. The ex-dividend date is Tuesday, September 30th. This represents a $0.56 dividend on an annualized basis and a dividend yield of 3.8%. Xenia Hotels & Resorts's payout ratio is presently 88.89%.

Analyst Upgrades and Downgrades

Several equities research analysts recently weighed in on XHR shares. Wells Fargo & Company upped their price objective on shares of Xenia Hotels & Resorts from $14.00 to $15.00 and gave the stock an "overweight" rating in a report on Wednesday, August 27th. BMO Capital Markets increased their price objective on Xenia Hotels & Resorts from $15.00 to $16.00 and gave the company an "outperform" rating in a research report on Tuesday, September 2nd. Finally, Wall Street Zen downgraded Xenia Hotels & Resorts from a "buy" rating to a "hold" rating in a report on Saturday, August 2nd. Three research analysts have rated the stock with a Buy rating, one has assigned a Hold rating and one has given a Sell rating to the stock. According to data from MarketBeat, the company currently has a consensus rating of "Hold" and an average price target of $13.20.

Check Out Our Latest Stock Report on Xenia Hotels & Resorts

About Xenia Hotels & Resorts

(

Free Report)

Xenia Hotels & Resorts, Inc is a real estate investment trust, which engages in the provision of investment in luxury and upper upscale hotels and resorts. It also owns a diversified portfolio of lodging properties operated by Marriott, Kimpton, Hyatt, Aston, Fairmong, and Loews. The company was founded in 2007 and is headquartered in Orlando, FL.

See Also

Before you consider Xenia Hotels & Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Xenia Hotels & Resorts wasn't on the list.

While Xenia Hotels & Resorts currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.