The Manufacturers Life Insurance Company grew its position in Xperi Inc. (NASDAQ:XPER - Free Report) by 15.6% during the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 2,151,343 shares of the semiconductor company's stock after purchasing an additional 289,685 shares during the period. The Manufacturers Life Insurance Company owned approximately 4.73% of Xperi worth $16,608,000 at the end of the most recent quarter.

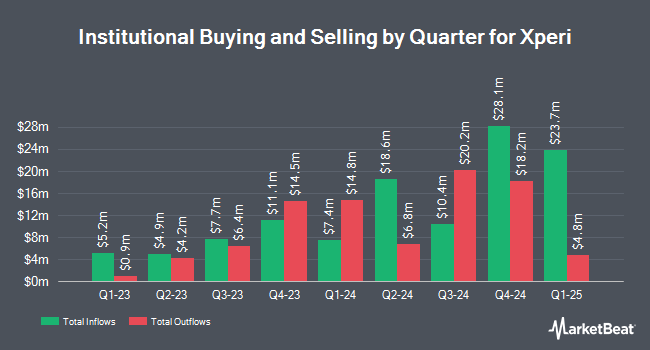

A number of other hedge funds and other institutional investors have also bought and sold shares of the company. Royce & Associates LP acquired a new stake in shares of Xperi in the first quarter valued at approximately $3,036,000. Connor Clark & Lunn Investment Management Ltd. boosted its holdings in Xperi by 35.0% during the first quarter. Connor Clark & Lunn Investment Management Ltd. now owns 804,956 shares of the semiconductor company's stock worth $6,214,000 after purchasing an additional 208,709 shares during the last quarter. Wellington Management Group LLP grew its position in Xperi by 11.0% in the first quarter. Wellington Management Group LLP now owns 2,091,742 shares of the semiconductor company's stock valued at $16,148,000 after purchasing an additional 207,810 shares in the last quarter. Cubist Systematic Strategies LLC bought a new position in Xperi in the fourth quarter valued at $1,577,000. Finally, Two Sigma Investments LP acquired a new stake in Xperi in the 4th quarter valued at $1,340,000. Institutional investors and hedge funds own 94.28% of the company's stock.

Analyst Ratings Changes

A number of research firms have recently commented on XPER. Rosenblatt Securities restated a "buy" rating and set a $15.00 price objective on shares of Xperi in a research note on Tuesday, July 29th. Wall Street Zen upgraded Xperi from a "hold" rating to a "buy" rating in a report on Saturday, May 17th. Finally, BWS Financial cut Xperi from a "strong-buy" rating to a "moderate buy" rating and reduced their price target for the company from $30.00 to $12.00 in a research report on Tuesday, July 29th. One analyst has rated the stock with a Buy rating, According to data from MarketBeat, the company currently has a consensus rating of "Buy" and a consensus price target of $13.50.

View Our Latest Analysis on Xperi

Xperi Stock Performance

XPER traded down $0.02 during trading hours on Monday, reaching $6.12. The company's stock had a trading volume of 57,943 shares, compared to its average volume of 361,572. The company's 50-day moving average is $6.77 and its 200-day moving average is $7.36. Xperi Inc. has a 52 week low of $5.68 and a 52 week high of $11.07. The firm has a market cap of $282.88 million, a PE ratio of -3.21 and a beta of 1.26.

Xperi Profile

(

Free Report)

Xperi Inc operates as a consumer and entertainment technology company worldwide. It offers Pay-TV solutions, including UX solutions that allows service providers to customize elements of the interactive program guide for their customers and to upgrade the programming features and services; IPTV, a cloud-based solution that supports various services and applications, such as TV programming, broadband OTT video content, digital music, photos, and other media experiences; managed IPTV service; video metadata and services; managed IPTV Service, a customizable, cloud-enabled, and end-to-end streaming video solution that enables operators to quickly launch a branded, fully compliant, full-featured Pay-TV service; metadata libraries comprising television, sports, movies, digital-first, celebrities, books, and video games; personalized content discovery, natural language voice, and insights; and TiVo DVR subscriptions, as well as technical support service.

Featured Articles

Before you consider Xperi, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Xperi wasn't on the list.

While Xperi currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.